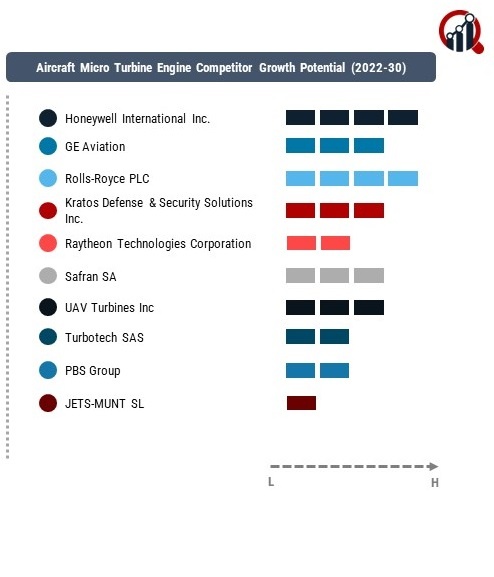

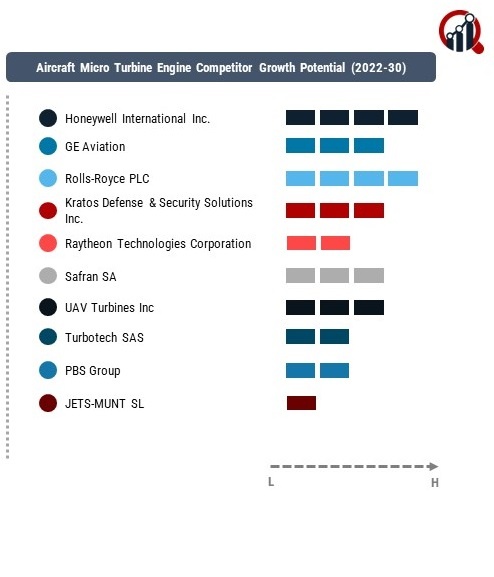

Top Industry Leaders in the Aircraft Micro Turbine Engines Market

Strategies Adopted:

Product Innovation: Key players focus on developing advanced passenger security screening technologies, such as millimeter-wave scanners, explosives trace detectors, and biometric systems, to enhance detection accuracy, throughput, and passenger experience.

Strategic Partnerships: Collaboration with airports, airlines, government agencies, and security integrators enables companies to customize solutions, integrate technologies, and provide end-to-end security solutions tailored to customer requirements.

Global Expansion: Companies expand their geographic presence through acquisitions, partnerships, and establishing regional offices and service centers to capitalize on growing passenger traffic and security demands across emerging markets.

Regulatory Compliance: Compliance with stringent aviation security regulations, standards, and certifications, such as TSA (Transportation Security Administration) and ECAC (European Civil Aviation Conference), is essential for market competitiveness and customer trust.

Key players

Honeywell International Inc.

GE Aviation

Rolls-Royce PLC

Kratos Defense & Security Solutions Inc.

Raytheon Technologies Corporation

Safran SA

UAV Turbines Inc.

Turbotech SAS

PBS Group, a.s.

JETS-MUNT SL

Williams International

Sierra Turbines Inc.

AMT NetherlandS B.V.

Hawk Turbine AB

Ingenieurbüro CAT, M. Zipperer GmbH.

Factors for Market Share Analysis:

Technology Leadership: Market share analysis considers the technological capabilities and performance of passenger security screening systems, with companies offering cutting-edge detection technologies and integration capabilities commanding a larger market share.

Installed Base: The number of installed systems, contracts with airports, and deployment at high-traffic hubs influence market share, reflecting customer trust, reliability, and performance in real-world airport environments.

Customer Relationships: Strong relationships with airports, airlines, and government agencies, built on reliability, service quality, and after-sales support, contribute to market share by fostering loyalty and repeat business.

Industry Standards: Compliance with industry standards, such as TSA's Advanced Imaging Technology (AIT) requirements and ECAC Common Evaluation Process (CEP), is crucial for market share, ensuring interoperability and regulatory compliance across airports and regions.

Industry News:

Adoption of AI and Machine Learning: Industry news highlights the adoption of artificial intelligence (AI) and machine learning (ML) algorithms in passenger security screening systems to improve threat detection accuracy, reduce false alarms, and enhance operational efficiency.

Integration of Biometrics: Increasing integration of biometric technologies, such as facial recognition and fingerprint scanning, into passenger security processes aims to enhance identity verification, streamline passenger flow, and improve security effectiveness.

Emphasis on Privacy Protection: With growing concerns over passenger privacy, industry news focuses on the development of privacy-preserving technologies and adherence to data protection regulations, ensuring the secure handling of passenger information during security screening.

Investments in Automation: Investments in automation technologies, including robotic security screening systems and automated threat detection algorithms, aim to increase throughput, reduce manual intervention, and improve overall passenger screening efficiency.

Current Company Investment Trends:

R&D Investments: Key players continue to invest in research and development to develop next-generation passenger security screening technologies, focusing on improving detection capabilities, reducing false alarms, and enhancing user experience.

Acquisitions and Partnerships: Strategic acquisitions and partnerships enable companies to access complementary technologies, expand product portfolios, and strengthen market presence, driving consolidation and innovation in the passenger security market.

Customer-centric Solutions: Companies prioritize customer-centric solutions tailored to specific airport requirements, investing in customization, integration, and service offerings to address evolving security challenges and enhance customer satisfaction.

Sustainability Initiatives: Increasing focus on sustainability initiatives, including energy-efficient systems, eco-friendly materials, and waste reduction programs, aligns with customer demands for environmentally responsible solutions and regulatory requirements, driving market differentiation and brand value.