Technological Advancements

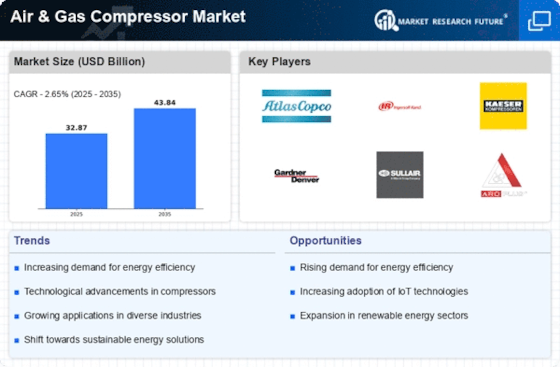

Technological advancements play a crucial role in shaping the Air & Gas Compressor Market. Innovations in compressor design, such as the development of variable speed drives and energy-efficient models, are enhancing performance and reducing energy consumption. In 2025, the market is witnessing a shift towards smart compressors equipped with IoT capabilities, allowing for real-time monitoring and predictive maintenance. These advancements not only improve operational efficiency but also contribute to sustainability efforts by minimizing energy waste. The increasing focus on reducing carbon footprints is likely to drive the adoption of these advanced technologies within the Air & Gas Compressor Market. As manufacturers continue to invest in research and development, the market is expected to evolve, offering more sophisticated and environmentally friendly solutions to meet the diverse needs of various industries.

Growth in Oil and Gas Sector

The Air & Gas Compressor Market is significantly influenced by the growth in the oil and gas sector. As exploration and production activities expand, the demand for reliable and efficient compressors is on the rise. In 2025, the oil and gas industry is projected to be a major contributor to the market, driven by increasing investments in upstream and downstream operations. Compressors are essential for various applications, including gas processing, transportation, and storage, making them indispensable in this sector. The ongoing development of unconventional oil and gas resources is likely to further boost the demand for specialized compressors designed to handle high pressures and varying gas compositions. This trend underscores the critical role of the Air & Gas Compressor Market in supporting the energy sector's operational needs and ensuring efficient resource management.

Increasing Focus on Energy Efficiency

The increasing focus on energy efficiency is a significant driver for the Air & Gas Compressor Market. As energy costs continue to rise, industries are seeking ways to optimize their operations and reduce energy consumption. In 2025, energy-efficient compressors are expected to gain traction, as they offer substantial cost savings and lower environmental impact. The demand for compressors that utilize advanced technologies, such as variable speed drives and heat recovery systems, is likely to grow as companies aim to enhance their sustainability profiles. This trend reflects a broader commitment to reducing carbon emissions and improving overall operational efficiency. Consequently, the Air & Gas Compressor Market is poised to benefit from this shift towards energy-efficient solutions, as manufacturers respond to the evolving needs of their customers and the regulatory landscape.

Rising Demand in Manufacturing Sector

The Air & Gas Compressor Market is experiencing a notable surge in demand, particularly from the manufacturing sector. As industries increasingly automate processes, the need for reliable compressed air systems becomes paramount. In 2025, the manufacturing sector is projected to account for a substantial share of the market, driven by the expansion of production facilities and the adoption of advanced technologies. This trend indicates a robust growth trajectory for the Air & Gas Compressor Market, as manufacturers seek efficient solutions to enhance productivity and reduce operational costs. Furthermore, the integration of smart technologies in manufacturing processes necessitates the use of high-performance compressors, further propelling market growth. The ongoing investments in infrastructure and industrial development are likely to sustain this demand, positioning the Air & Gas Compressor Market favorably in the coming years.

Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards are becoming increasingly stringent across various industries, impacting the Air & Gas Compressor Market. In 2025, companies are compelled to adhere to environmental regulations and safety protocols, driving the demand for compressors that meet these requirements. The need for equipment that minimizes emissions and operates safely is paramount, particularly in sectors such as manufacturing, oil and gas, and pharmaceuticals. As organizations strive to comply with these regulations, they are likely to invest in advanced compressor technologies that not only fulfill legal obligations but also enhance operational efficiency. This trend indicates a growing market for environmentally friendly and safe compressor solutions, positioning the Air & Gas Compressor Market as a key player in promoting sustainable practices across diverse sectors.