Growth of the Construction Industry

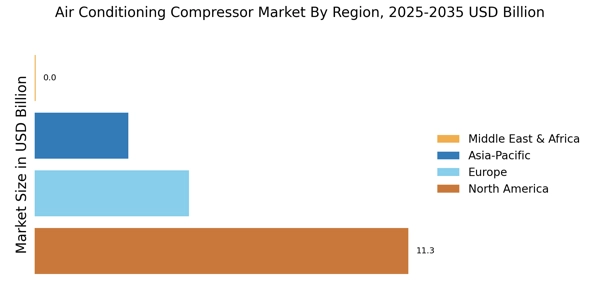

The growth of the construction industry is a significant driver for the Air Conditioning Compressor Market. As new residential and commercial projects emerge, the demand for air conditioning systems, and consequently compressors, is expected to rise. Data indicates that the construction sector is experiencing a resurgence, with investments in infrastructure and housing projects increasing. This trend is particularly evident in developing regions where urbanization is rapidly advancing. The integration of modern air conditioning systems in new buildings is becoming standard practice, further propelling the need for high-quality compressors. As construction activities continue to expand, the air conditioning compressor market is likely to benefit from this upward trajectory.

Rising Demand for Air Conditioning Systems

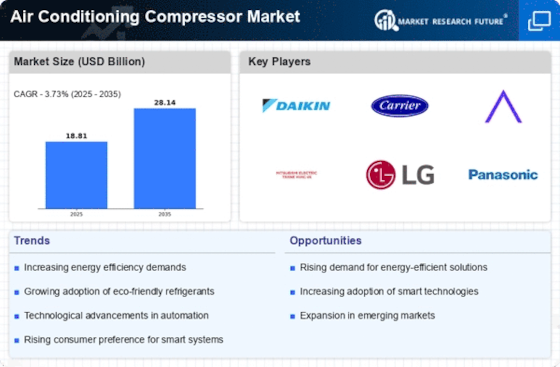

The increasing demand for air conditioning systems is a primary driver for the Air Conditioning Compressor Market. As urbanization accelerates, more residential and commercial buildings require effective cooling solutions. According to recent data, the air conditioning market is projected to grow at a compound annual growth rate of approximately 5.5% over the next several years. This surge in demand directly influences the compressor segment, as these components are essential for the efficient operation of air conditioning units. Furthermore, the rising temperatures in various regions due to climate change are likely to exacerbate this demand, leading to a robust market for air conditioning compressors. Manufacturers are thus focusing on enhancing compressor efficiency to meet the growing needs of consumers, which could further stimulate market growth.

Regulatory Standards and Environmental Concerns

Regulatory standards and environmental concerns are driving changes in the Air Conditioning Compressor Market. Governments worldwide are implementing stricter regulations regarding energy efficiency and emissions, pushing manufacturers to innovate and comply with these standards. The introduction of regulations such as the Energy Efficiency Ratio (EER) and Seasonal Energy Efficiency Ratio (SEER) has compelled companies to enhance their compressor technologies. Additionally, the shift towards eco-friendly refrigerants, prompted by environmental policies, is influencing compressor design and functionality. Market analysis indicates that compliance with these regulations not only helps in reducing environmental impact but also opens up new market opportunities for manufacturers who can provide compliant and efficient products.

Technological Advancements in Compressor Design

Technological advancements in compressor design are significantly impacting the Air Conditioning Compressor Market. Innovations such as variable speed compressors and inverter technology are enhancing the efficiency and performance of air conditioning systems. These advancements allow for better energy management, which is increasingly important in a world focused on sustainability. The introduction of smart compressors that can adapt to varying load conditions is also gaining traction. Market data suggests that the adoption of these advanced technologies could lead to a reduction in energy consumption by up to 30%. As manufacturers continue to invest in research and development, the market for advanced compressors is expected to expand, catering to the evolving needs of consumers and regulatory standards.

Consumer Awareness and Preferences for Energy Efficiency

Consumer awareness and preferences for energy efficiency are shaping the Air Conditioning Compressor Market. As individuals become more informed about energy consumption and its impact on utility bills, there is a growing preference for energy-efficient air conditioning systems. This shift in consumer behavior is prompting manufacturers to prioritize the development of compressors that offer superior energy performance. Market data suggests that energy-efficient models are increasingly favored, with sales of such units rising significantly. This trend not only reflects a change in consumer preferences but also aligns with broader sustainability goals. As awareness continues to grow, the demand for energy-efficient compressors is expected to rise, driving innovation and competition within the market.