Research Methodology on Air Bearings Market

Introduction

Air bearings are widely used in industries such as aerospace, automotive, metrology, and semiconductor due to their ability to levitate a load with a cushion of air. Air bearings have no mechanical contact and no friction, resulting in a smooth and accurate motion. The market for air bearings is expected to grow rapidly in the next few years, mainly due to the increased demand for automation and improved efficiency in the manufacturing industry.

This research project is designed to analyze the market and industry trends in the air bearings market. The scope of the research includes assessing the overall market size and growth, analyzing the various market players, analyzing geographical and market segments, identifying the current and emerging trends in the market, and understanding the industry’s value chain. Furthermore, this research also involves extensive secondary and primary research to get an in-depth understanding of the market and its dynamics.

Research objectives

This research project aims to identify and analyze the prevailing factors, trends, and dynamics that have a direct or indirect influence on the air bearings market. The objectives of this research are outlined below:

- To assess the overall size of the air bearings market, based on type, application, and geography, for the forecast period 2023-2030.

- To analyze the various market segments and sub-segments in terms of market share, growth rate, penetration rate, market opportunity, and pricing structure.

- To identify and analyze the key market players in the air bearings market, their strategies, and their competitive landscape.

- To analyze the prevailing trends, opportunities, challenges, and drivers in the air bearings market, and their impact on the market.

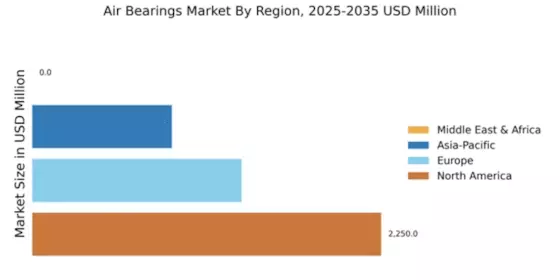

- To analyze the geographical segments in the market, and assess the market share and growth rate of the different regions.

Research Methodology

For this research project, we will make use of both primary and secondary research methods. The objective of the primary research is to gain in-depth insights into the current and future market dynamics and understand the customer’s needs. The data source for our primary research is industry experts, such as business executives, product managers, technology heads, etc., who have strong insights into the air bearings market.

Meanwhile, the objective of the secondary research will be to analyze the current market trends and the competitive landscape. The data for our secondary research will be sourced from company websites, reports, industry associations, journals, and annual reports. Moreover, financial information related to the market and its players will be obtained from reliable financial databases, such as Bloomberg and Capital IQ.

Data Analysis

For this project, we will use both qualitative and quantitative analysis techniques. This will include Porter’s Five Forces analysis, market attractiveness analysis, and SWOT analysis. Furthermore, we will use a mix of graphical and statistical models to analyze and interpret the data obtained from the primary and secondary research. This will include pie charts, bar graphs, and tables, as well as measures of central tendency and regression analysis.

Conclusion

This research project will provide an in-depth analysis of the market for air bearings, along with the segmentation, opportunities, and region-wise market trends. It will also provide insight into the competitive landscape of the air bearings market and the current and emerging trends in the industry. The findings of the research will help industry players, stakeholders, and investors make informed decisions when it comes to their products and investments.