Air Bearings Size

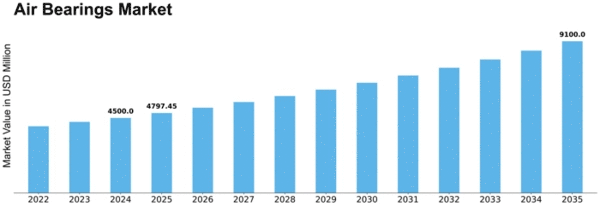

Air Bearings Market Growth Projections and Opportunities

The global air bearings market is poised to witness a Compound Annual Growth Rate (CAGR) of 6.82% during the forecast period from 2018 to 2023. As of 2017, Asia Pacific led the market with a commanding share of 56.59%, followed by Europe and North America with shares of 18.07% and 14.39%, respectively. The driving factors behind the market's growth include the increased applications in precision machine tools, the notable durability of air bearings, and the growing potential of air bearings within various industries.

The segmentation of the global air bearings market takes into account yarn type, application, industry, and region. Among the various types, the Hydrostatic/Aerostatic segment claimed the largest share, representing 58.72% of the global air bearings market. Following closely, the Hydrodynamic/Aerodynamic segment secured the second-largest share with 41.28% in the same period. Regarding application, precision machinery tools dominated the market, holding a significant share of 48.78% in the global air bearings market. Similarly, the high-speed machines segment accounted for 35.66% share in the same year. In terms of end-users, the aviation segment emerged as the leader, commanding the largest share at 22.94% in the global air bearings market. In parallel, the medical segment secured a substantial share of 19.56% in the same year.

The primary growth drivers for the global air bearings market stem from their increased adoption in precision machinery tools, where their unique characteristics, such as zero friction and smooth operation, prove advantageous. The high durability of air bearings further contributes to their widespread use in various applications. Moreover, the growing recognition of the potential of air bearings across different industries adds momentum to the market's expansion.

The prevalence of the Hydrostatic/Aerostatic type in the air bearings market underscores its dominance, highlighting its suitability for a broad range of applications. Precision machinery tools, with their diverse uses across industries, emerge as the leading application segment, showcasing the versatility of air bearings in enhancing precision in machinery operations. High-speed machines also benefit from the advantages offered by air bearings, contributing to their significant share in the market.

In terms of end-users, the aviation segment takes the lead, emphasizing the critical role air bearings play in aerospace applications. The medical segment follows closely, reflecting the importance of precision and smooth operation in medical equipment and devices.

In conclusion, the global air bearings market is on a growth trajectory, with a projected CAGR of 6.82% during the forecast period. The dominance of Asia Pacific, coupled with the increasing adoption of air bearings in precision machinery tools and their durability, positions them as key components in various industries. The market's segmentation highlights the significance of specific types, applications, and end-users, emphasizing the diverse applications and widespread adoption of air bearings across the globe. The continued advancements in technology and the increasing recognition of their potential in different sectors are anticipated to further fuel the growth of the air bearings market.

Leave a Comment