Advancements in 5G Technology

The AI in Telecommunication Market is profoundly impacted by the advancements in 5G technology. The rollout of 5G networks is creating new opportunities for AI applications, enabling faster data transmission and lower latency. This technological evolution allows telecommunications companies to implement AI solutions that enhance user experiences, such as improved video streaming and augmented reality applications. As 5G networks become more prevalent, the demand for AI-driven services is expected to increase, with projections indicating a substantial rise in AI applications tailored for 5G environments. Telecommunications providers are likely to invest in AI technologies that can optimize network performance and manage the increased data traffic associated with 5G. This synergy between AI and 5G is anticipated to redefine the telecommunications landscape, offering innovative services and solutions.

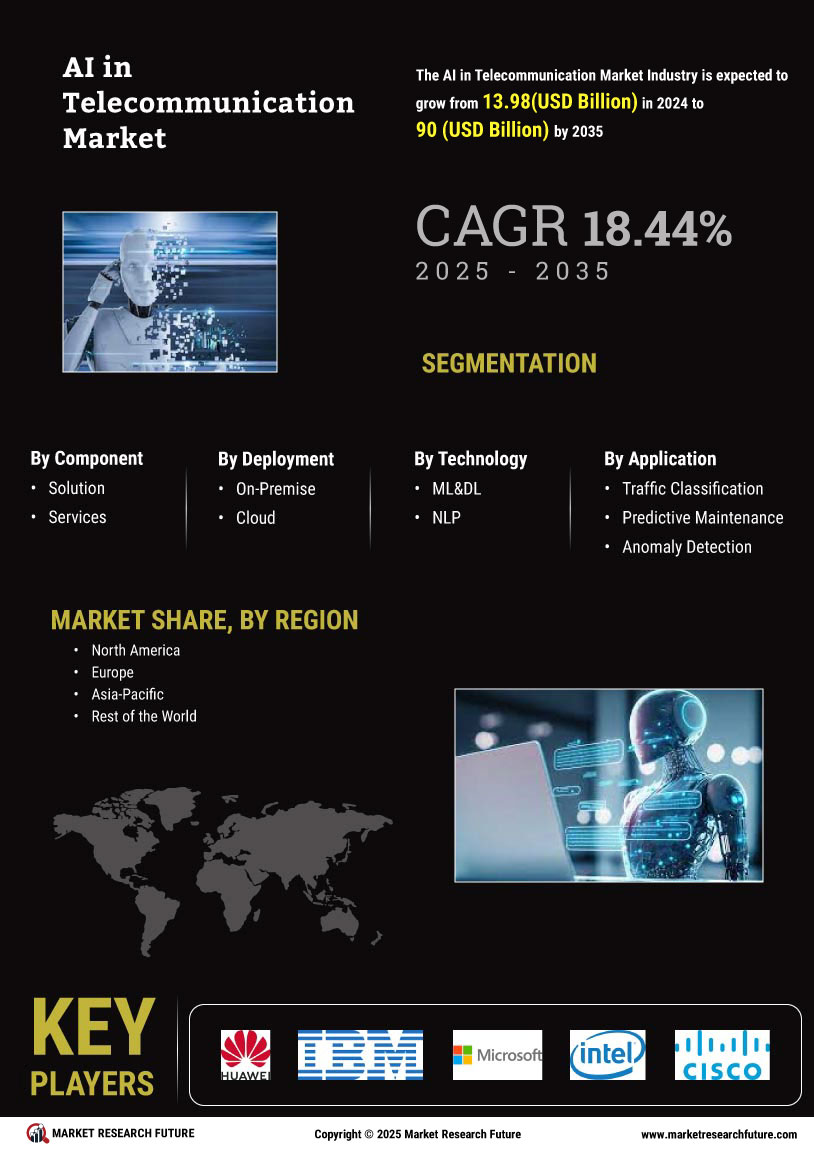

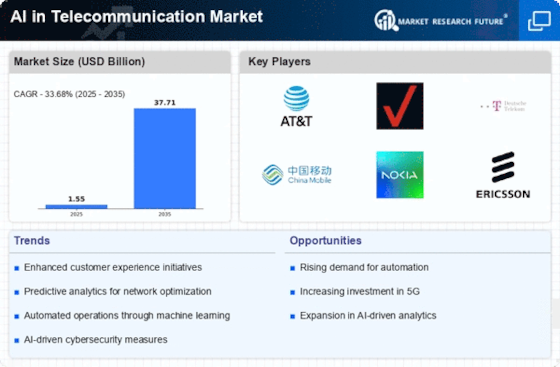

Increased Demand for Automation

The AI in Telecommunication Market experiences a notable surge in demand for automation solutions. Telecommunications companies are increasingly adopting AI technologies to streamline operations, reduce costs, and enhance service delivery. Automation through AI enables real-time data analysis, which is crucial for managing vast networks efficiently. According to recent data, the market for AI-driven automation in telecommunications is projected to grow at a compound annual growth rate of over 25% in the coming years. This growth is driven by the need for improved operational efficiency and the ability to respond swiftly to customer needs. As a result, telecommunications providers are investing heavily in AI technologies to automate routine tasks, thereby allowing human resources to focus on more complex issues. This trend indicates a significant shift towards a more automated and efficient telecommunications landscape.

Growing Focus on Network Security

The AI in Telecommunication Market is increasingly shaped by the growing emphasis on network security. As cyber threats become more sophisticated, telecommunications companies are turning to AI solutions to bolster their security measures. AI technologies can detect anomalies in network traffic, identify potential threats, and respond to security incidents in real-time. This proactive approach to security is essential in maintaining customer trust and ensuring compliance with regulatory standards. Recent reports indicate that investments in AI for cybersecurity within telecommunications are expected to rise significantly, reflecting the industry's commitment to safeguarding sensitive data. By integrating AI into their security frameworks, telecommunications providers can enhance their resilience against cyber threats, thereby ensuring a more secure environment for their customers.

Enhanced Data Analytics Capabilities

The AI in Telecommunication Market is significantly influenced by advancements in data analytics capabilities. Telecommunications companies are leveraging AI to analyze vast amounts of data generated from user interactions and network operations. This capability allows for more informed decision-making and the identification of trends that can enhance service offerings. For instance, AI-driven analytics can predict network congestion and optimize resource allocation accordingly. Recent statistics suggest that the AI analytics market within telecommunications is expected to reach several billion dollars by 2026, reflecting a growing recognition of the value of data-driven insights. Enhanced analytics not only improves operational efficiency but also fosters a deeper understanding of customer preferences, enabling providers to tailor their services more effectively.

Personalization of Customer Services

The AI in Telecommunication Market is significantly influenced by the trend towards personalization of customer services. Telecommunications companies are increasingly utilizing AI to analyze customer data and preferences, enabling them to offer tailored services that meet individual needs. This personalization enhances customer satisfaction and loyalty, as users receive services that align closely with their expectations. Recent studies indicate that companies employing AI for customer personalization can see a marked increase in customer retention rates. By leveraging AI technologies, telecommunications providers can create more engaging customer experiences, from personalized marketing campaigns to customized service plans. This focus on personalization not only drives customer engagement but also positions telecommunications companies to compete more effectively in a crowded market.