Rising Cybersecurity Threats

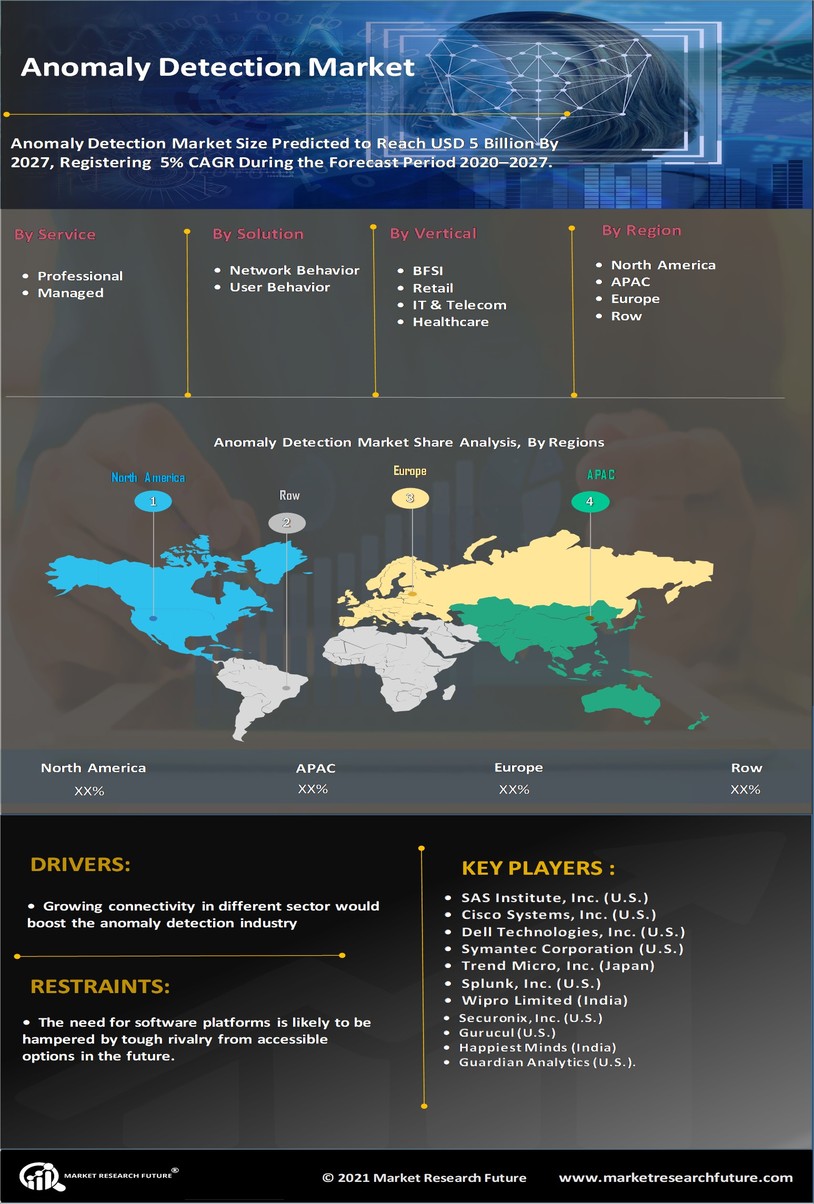

The Anomaly Detection Market is experiencing a surge in demand due to the increasing frequency and sophistication of cyber threats. Organizations are recognizing the necessity of implementing advanced anomaly detection systems to safeguard sensitive data and maintain operational integrity. According to recent statistics, cybercrime is projected to cost businesses trillions annually, prompting a shift towards proactive security measures. Anomaly detection technologies, which can identify unusual patterns and behaviors in network traffic, are becoming essential tools for cybersecurity professionals. This trend is likely to drive significant growth in the Anomaly Detection Market as companies seek to mitigate risks associated with data breaches and cyberattacks.

Increased Adoption of IoT Devices

The proliferation of Internet of Things (IoT) devices is a key driver for the Anomaly Detection Market. As more devices become interconnected, the volume of data generated increases exponentially, creating challenges in monitoring and managing this data effectively. Anomaly detection systems are crucial for identifying irregularities in data streams from IoT devices, which can indicate potential failures or security breaches. The market for IoT devices is anticipated to reach billions in the coming years, further emphasizing the need for robust anomaly detection solutions. This trend suggests that the Anomaly Detection Market will continue to expand as organizations seek to harness the benefits of IoT while ensuring security and reliability.

Regulatory Compliance Requirements

The Anomaly Detection Market is significantly influenced by stringent regulatory compliance requirements across various sectors. Industries such as finance, healthcare, and telecommunications are subject to regulations that mandate the monitoring of transactions and activities to prevent fraud and ensure data integrity. For instance, the implementation of the General Data Protection Regulation (GDPR) in Europe has compelled organizations to adopt advanced anomaly detection solutions to comply with data protection laws. As regulatory frameworks continue to evolve, the demand for anomaly detection systems that can provide real-time monitoring and reporting is expected to rise, thereby propelling growth in the Anomaly Detection Market.

Growing Demand for Predictive Analytics

The Anomaly Detection Market is witnessing a growing demand for predictive analytics, which relies heavily on the identification of anomalies within datasets. Businesses are increasingly leveraging predictive analytics to forecast trends, optimize operations, and enhance decision-making processes. Anomaly detection plays a pivotal role in this context by enabling organizations to identify outliers that may skew analytical results. As companies strive to become more data-driven, the integration of anomaly detection into predictive analytics frameworks is likely to gain traction. This shift is expected to contribute to the expansion of the Anomaly Detection Market, as organizations seek to improve their analytical capabilities and gain competitive advantages.

Advancements in Machine Learning Algorithms

The Anomaly Detection Market is being propelled by advancements in machine learning algorithms, which enhance the accuracy and efficiency of anomaly detection systems. Recent developments in artificial intelligence have led to the creation of sophisticated algorithms capable of learning from vast datasets and identifying complex patterns. These advancements enable organizations to detect anomalies with greater precision, reducing false positives and improving response times. As machine learning continues to evolve, its integration into anomaly detection solutions is likely to become more prevalent. This trend indicates a promising future for the Anomaly Detection Market, as businesses increasingly adopt these advanced technologies to bolster their security and operational capabilities.