Market Growth Projections

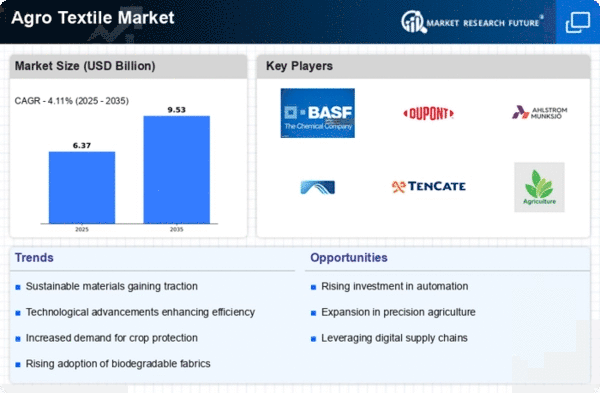

The Global Agro Textile Market Industry is poised for substantial growth, with projections indicating a market value of 6.12 USD Billion in 2024 and an anticipated increase to 9.53 USD Billion by 2035. This growth trajectory reflects a compound annual growth rate (CAGR) of 4.1% from 2025 to 2035. The increasing adoption of agro textiles in various agricultural applications, coupled with rising awareness of sustainable practices, is likely to drive this expansion. As the industry evolves, it may witness the emergence of new products and technologies, further enhancing its market potential.

Expansion of Agricultural Land

The expansion of agricultural land globally contributes to the growth of the Global Agro Textile Market Industry. As more land is converted for agricultural use, the demand for efficient farming solutions increases. Agro textiles, such as geotextiles and crop covers, are essential for optimizing land use and improving crop productivity. This trend is expected to support a robust market growth trajectory, with projections indicating a market value of 9.53 USD Billion by 2035. The integration of agro textiles into expanding agricultural practices may enhance soil health and promote sustainable farming, addressing the challenges of food production in a growing population.

Government Initiatives and Support

Government policies and initiatives significantly influence the Global Agro Textile Market Industry. Various countries are implementing programs to promote the use of agro textiles in agriculture, recognizing their potential to improve crop production and sustainability. Financial incentives, subsidies, and research grants are being offered to encourage farmers to adopt these innovative materials. This support is likely to enhance market growth, as evidenced by the projected CAGR of 4.1% from 2025 to 2035. Such initiatives not only foster innovation but also contribute to the overall development of the agricultural sector, ensuring food security and environmental sustainability.

Increasing Awareness of Crop Protection

The Global Agro Textile Market Industry is witnessing a surge in awareness regarding crop protection measures. Farmers are increasingly recognizing the benefits of agro textiles in safeguarding crops from adverse weather conditions and pests. Products like insect nets and frost protection covers are gaining traction as effective solutions to enhance crop resilience. This growing awareness is likely to drive market growth, with the industry projected to reach 6.12 USD Billion in 2024. As agricultural practices evolve, the emphasis on protective measures will continue to shape the demand for agro textiles, ensuring better yields and food quality.

Rising Demand for Sustainable Agriculture

The Global Agro Textile Market Industry experiences a notable increase in demand for sustainable agricultural practices. Farmers are increasingly adopting agro textiles to enhance crop yield while minimizing environmental impact. This shift is driven by the need for eco-friendly solutions that align with global sustainability goals. In 2024, the market is projected to reach 6.12 USD Billion, reflecting a growing awareness of sustainable farming methods. Agro textiles, such as biodegradable mulch films and shade nets, are becoming essential tools for modern agriculture, indicating a significant transformation in farming practices worldwide.

Technological Advancements in Agro Textiles

Technological innovations play a crucial role in shaping the Global Agro Textile Market Industry. The introduction of advanced materials, such as nanofibers and smart textiles, enhances the functionality of agro textiles. These innovations improve water retention, pest control, and crop protection, leading to increased agricultural productivity. As the market evolves, the integration of technology is expected to drive growth, with projections indicating a market value of 9.53 USD Billion by 2035. The adoption of these advanced agro textiles may potentially revolutionize traditional farming methods, making them more efficient and sustainable.