Rising Global Population

The continuous rise in The Global Agriculture Crop Service industry. As the population is projected to reach approximately 9.7 billion by 2050, the demand for food is expected to increase substantially. This necessitates enhanced agricultural productivity and efficiency. The Food and Agriculture Organization estimates that food production must increase by 70% to meet future demands. Consequently, agriculture crop services that focus on improving yield and resource management are likely to see increased investment and growth. This demographic trend underscores the urgency for innovative solutions within the agriculture crop service market.

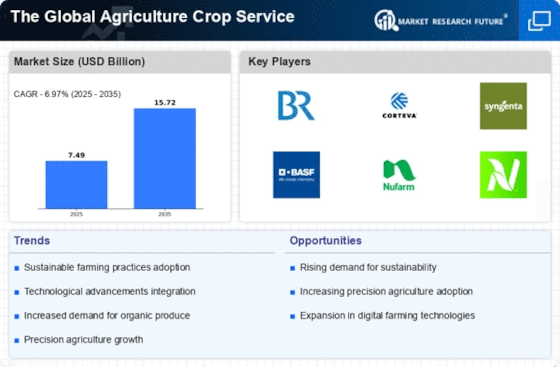

Sustainability Initiatives

Sustainability has emerged as a crucial driver in the agriculture crop service market. With increasing awareness of environmental issues, there is a growing demand for sustainable farming practices. This includes the adoption of organic farming, crop rotation, and integrated pest management. According to recent data, the organic food market is expected to grow at a CAGR of 10% through 2025, reflecting a shift towards eco-friendly practices. Additionally, regulatory frameworks are increasingly favoring sustainable agriculture, which may further propel the adoption of sustainable practices in the agriculture crop service market. This trend not only addresses environmental concerns but also meets consumer demand for sustainably sourced products.

Technological Advancements

The integration of advanced technologies in the agriculture crop service market appears to be a pivotal driver. Innovations such as precision agriculture, drones, and IoT devices are transforming traditional farming practices. These technologies enable farmers to monitor crop health, optimize resource usage, and increase yields. For instance, the use of drones for aerial imaging can enhance crop management by providing real-time data on plant health. The market for precision agriculture is projected to reach USD 12 billion by 2025, indicating a robust growth trajectory. This technological evolution is likely to enhance efficiency and productivity in the agriculture crop service market.

Government Support and Policies

Government initiatives and policies play a vital role in shaping the agriculture crop service market. Many governments are implementing policies that support agricultural innovation, research, and development. Subsidies for adopting new technologies and practices are becoming more common, encouraging farmers to invest in modern agricultural solutions. For instance, various countries have introduced grants and funding programs aimed at enhancing agricultural productivity. This support not only aids farmers in improving their operations but also stimulates growth within the agriculture crop service market. The alignment of government policies with agricultural needs is likely to foster a more resilient and productive agricultural sector.

Increased Investment in Research and Development

Investment in research and development (R&D) is emerging as a crucial driver for the agriculture crop service market. As the need for innovative agricultural solutions grows, stakeholders are increasingly allocating resources towards R&D initiatives. This investment is aimed at developing new crop varieties, improving pest management strategies, and enhancing soil health. Recent data indicates that global agricultural R&D spending has been on the rise, with an estimated increase of 5% annually. Such investments are likely to yield breakthroughs that can significantly enhance productivity and sustainability in the agriculture crop service market. The focus on R&D underscores the importance of innovation in addressing the challenges faced by the agricultural sector.