Adoption of Precision Agriculture

The integration of precision agriculture techniques is reshaping the crop protection-chemicals market. Farmers are increasingly utilizing data-driven approaches to optimize their use of inputs, including crop protection chemicals. This trend not only enhances efficiency but also minimizes environmental impact. The market is witnessing a shift towards targeted applications, which can reduce chemical usage by up to 30%. As precision agriculture continues to gain traction, it is likely to drive demand for innovative crop protection solutions that align with these practices, thereby fostering growth in the crop protection-chemicals market.

Increasing Demand for Food Security

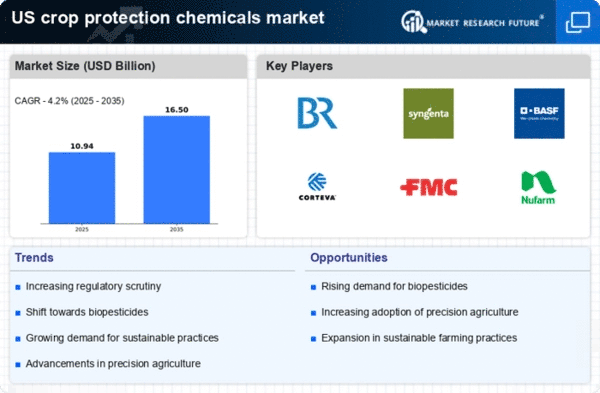

The rising global population and changing dietary preferences are driving the need for enhanced agricultural productivity. In the crop protection-chemicals market, this demand translates into a greater reliance on effective pest and disease management solutions. As farmers strive to maximize yields, the market for crop protection chemicals is projected to grow significantly. According to recent estimates, the market is expected to reach approximately $15 billion by 2026, reflecting a compound annual growth rate (CAGR) of around 5%. This growth is indicative of the critical role that crop protection-chemicals play in ensuring food security and sustaining agricultural output in the face of increasing challenges.

Rising Awareness of Sustainable Practices

There is a growing awareness among consumers and farmers regarding sustainable agricultural practices. This shift is influencing the crop protection-chemicals market as stakeholders seek environmentally friendly alternatives. The demand for biopesticides and organic crop protection solutions is on the rise, with the market for biopesticides projected to reach $4 billion by 2025. This trend suggests that the crop protection-chemicals market is evolving to meet the needs of a more environmentally conscious consumer base, potentially leading to increased investment in research and development of sustainable products.

Regulatory Landscape and Compliance Challenges

The regulatory environment surrounding the crop protection-chemicals market is becoming increasingly complex. Stricter regulations regarding chemical usage and safety standards are prompting manufacturers to adapt their product offerings. Compliance with these regulations is essential for market players to maintain their competitive edge. The market is witnessing a shift towards products that meet stringent safety and environmental criteria, which may lead to increased costs for manufacturers. However, this also presents opportunities for innovation and the development of safer, more effective crop protection solutions.

Technological Innovations in Chemical Formulations

Advancements in chemical formulations are playing a pivotal role in the evolution of the crop protection-chemicals market. Innovations such as slow-release formulations and nano-encapsulation are enhancing the efficacy and safety of crop protection products. These technologies not only improve the performance of active ingredients but also reduce the overall quantity of chemicals required for effective pest control. As a result, the market is likely to see a surge in demand for these advanced formulations, which can lead to improved crop yields and reduced environmental impact.