Rising Organic Farming Practices

The Agriculture Biological Control Agents Market is being propelled by the increasing adoption of organic farming practices. As consumers demand more organic produce, farmers are seeking effective pest management solutions that comply with organic standards. Biological control agents are inherently compatible with organic farming, as they provide a means to manage pests without synthetic chemicals. Recent statistics indicate that organic farming has seen a growth rate of approximately 10% annually, leading to a heightened demand for biological control solutions. This trend suggests that the Agriculture Biological Control Agents Market is likely to benefit from the expansion of organic agriculture, as more farmers turn to biological methods to meet consumer preferences and regulatory requirements.

Increasing Awareness of Environmental Impact

The Agriculture Biological Control Agents Market is experiencing a surge in awareness regarding the environmental consequences of chemical pesticides. As consumers and farmers alike become more informed about the detrimental effects of synthetic chemicals on ecosystems, there is a growing inclination towards biological control agents. This shift is not merely anecdotal; market data indicates that the demand for eco-friendly pest management solutions has increased by approximately 25% over the past few years. This trend suggests that stakeholders in the agriculture sector are increasingly prioritizing sustainability, thereby driving the growth of the Agriculture Biological Control Agents Market. Furthermore, educational initiatives and outreach programs are likely to enhance this awareness, leading to a more significant adoption of biological control methods.

Supportive Government Policies and Incentives

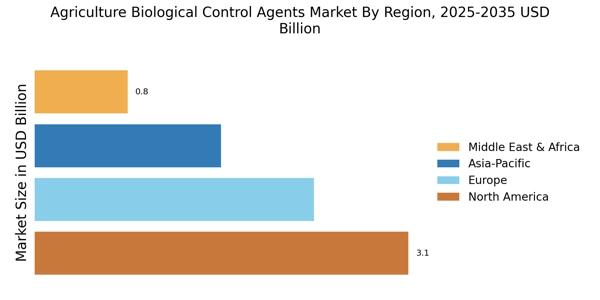

The Agriculture Biological Control Agents Market is positively impacted by supportive government policies and incentives aimed at promoting sustainable agricultural practices. Various governments are implementing regulations that encourage the use of biological control methods as part of their agricultural strategies. For example, subsidies and grants for farmers adopting biological pest control solutions are becoming more common. Market Research Future indicate that regions with strong governmental support for biological control are witnessing faster growth in the Agriculture Biological Control Agents Market. This trend suggests that as governments continue to prioritize sustainability and environmental health, the market for biological control agents is likely to expand, fostering innovation and adoption among agricultural producers.

Technological Innovations in Biological Control Agents

The Agriculture Biological Control Agents Market is significantly influenced by ongoing technological innovations. Advances in biotechnology, such as genetic engineering and microbial formulations, are enhancing the efficacy and specificity of biological control agents. For instance, the development of targeted microbial pesticides has shown promise in controlling specific pests without harming beneficial organisms. Market data suggests that the segment of microbial biopesticides is projected to grow at a compound annual growth rate of 15% over the next five years. This technological progress not only improves the performance of biological agents but also expands their applicability across various crops and pest scenarios, thereby propelling the Agriculture Biological Control Agents Market forward.

Integration of Biological Control in Integrated Pest Management

The Agriculture Biological Control Agents Market is witnessing a notable integration of biological control methods within Integrated Pest Management (IPM) frameworks. This approach combines various pest control strategies, including cultural, mechanical, and biological methods, to create a more holistic pest management system. Market analysis reveals that the adoption of IPM practices has grown, with approximately 40% of farmers now incorporating biological agents into their pest management strategies. This integration not only enhances the effectiveness of pest control but also aligns with sustainable agricultural practices. As the Agriculture Biological Control Agents Market continues to evolve, the synergy between biological control and IPM is likely to foster further growth and innovation in pest management solutions.