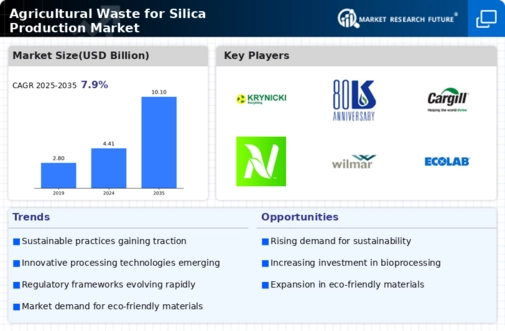

Rising Demand for Silica in Various Industries

The Agricultural Waste for Silica Production Market is experiencing a surge in demand for silica, which is utilized in numerous applications such as glass manufacturing, electronics, and construction materials. This increasing demand is driven by the growth of these sectors, which are projected to expand significantly in the coming years. For instance, the construction industry alone is expected to witness a compound annual growth rate of over 5%, thereby propelling the need for silica. As industries seek sustainable sources of silica, agricultural waste emerges as a viable alternative, potentially reducing reliance on traditional mining practices. This shift not only supports environmental sustainability but also enhances the economic viability of agricultural waste utilization, positioning the Agricultural Waste for Silica Production Market favorably in the broader silica market.

Technological Innovations in Silica Extraction

Technological advancements play a crucial role in enhancing the efficiency of silica extraction from agricultural waste, thereby benefiting the Agricultural Waste for Silica Production Market. Innovations such as advanced pyrolysis and chemical treatment methods have been developed to optimize the extraction process, resulting in higher yields and better quality silica. These technologies not only improve the economic feasibility of using agricultural waste but also reduce the environmental impact associated with silica production. As research and development continue to progress, the Agricultural Waste for Silica Production Market is likely to witness increased adoption of these technologies, further solidifying its position in the silica market.

Growing Awareness of Circular Economy Principles

The Agricultural Waste for Silica Production Market is gaining traction due to the increasing awareness of circular economy principles among consumers and businesses. The concept of a circular economy emphasizes the importance of reusing and recycling materials to minimize waste and environmental impact. As stakeholders become more conscious of their ecological footprint, there is a growing preference for products derived from sustainable sources, such as agricultural waste. This shift in consumer behavior is prompting manufacturers to explore agricultural waste as a viable feedstock for silica production. Consequently, the Agricultural Waste for Silica Production Market is likely to experience growth as it aligns with the principles of sustainability and resource efficiency.

Cost-Effectiveness of Agricultural Waste Utilization

The Agricultural Waste for Silica Production Market benefits from the cost-effectiveness associated with utilizing agricultural waste as a raw material. Agricultural residues, such as rice husks and corn stalks, are often considered waste products, leading to low procurement costs. This economic advantage is particularly appealing to manufacturers looking to reduce production costs while maintaining quality. Moreover, the processing of agricultural waste into silica can be less expensive compared to traditional silica extraction methods, which often involve extensive mining and processing. As companies increasingly prioritize cost efficiency, the Agricultural Waste for Silica Production Market is likely to see heightened interest from businesses aiming to optimize their supply chains and reduce operational expenses.

Environmental Regulations Favoring Sustainable Practices

The Agricultural Waste for Silica Production Market is positively influenced by stringent environmental regulations that encourage sustainable practices. Governments worldwide are implementing policies aimed at reducing waste and promoting recycling, which aligns with the utilization of agricultural waste for silica production. These regulations not only incentivize the use of renewable resources but also impose penalties on traditional silica extraction methods that are deemed environmentally harmful. As a result, companies are increasingly turning to agricultural waste as a sustainable alternative, thereby driving growth in the Agricultural Waste for Silica Production Market. This regulatory landscape creates a favorable environment for innovation and investment in sustainable silica production technologies.