Sustainable Agriculture Practices

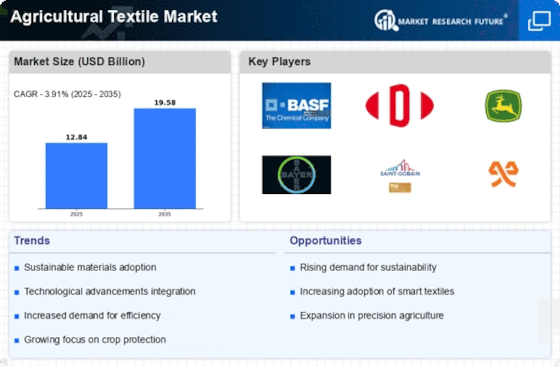

The increasing emphasis on sustainable agriculture practices is a pivotal driver for the Agricultural Textile Market. Farmers are increasingly adopting eco-friendly materials and methods to enhance crop yield while minimizing environmental impact. This shift is reflected in the rising demand for biodegradable and recyclable agricultural textiles, which are designed to reduce waste and promote sustainability. According to recent data, the market for sustainable agricultural textiles is projected to grow at a compound annual growth rate of approximately 8% over the next five years. This trend not only aligns with global sustainability goals but also encourages innovation in textile manufacturing, leading to the development of advanced materials that meet the needs of modern agriculture.

Government Initiatives and Support

Government initiatives and support play a significant role in shaping the Agricultural Textile Market. Various countries are implementing policies aimed at promoting sustainable agricultural practices and the use of advanced textiles. These initiatives often include subsidies for farmers who adopt eco-friendly materials and technologies, thereby encouraging the adoption of agricultural textiles. Recent data indicates that government funding for agricultural innovation has increased by approximately 20% in the last year, reflecting a commitment to enhancing agricultural productivity and sustainability. Such support not only boosts the market for agricultural textiles but also fosters collaboration between manufacturers and agricultural stakeholders, leading to the development of tailored solutions that meet specific regional needs.

Increasing Awareness of Climate Change

The increasing awareness of climate change and its impact on agriculture is driving the Agricultural Textile Market. As farmers face the challenges posed by changing weather patterns, there is a growing recognition of the need for adaptive agricultural practices. Agricultural textiles, such as shade nets and frost covers, are becoming essential tools for mitigating the effects of climate change on crop production. The market for climate-resilient agricultural textiles is projected to expand, with estimates suggesting a growth rate of around 12% over the next few years. This trend indicates a shift towards more resilient agricultural practices, where textiles play a crucial role in ensuring food security and sustainability in the face of environmental challenges.

Rising Demand for Crop Protection Solutions

The rising demand for effective crop protection solutions is a crucial driver for the Agricultural Textile Market. As agricultural practices evolve, the need for protective covers, nets, and fabrics that shield crops from pests and adverse weather conditions is becoming increasingly apparent. The market for agricultural protective textiles is anticipated to grow, with estimates suggesting a value increase of over 10% in the next few years. This growth is fueled by the need for enhanced crop yield and quality, as well as the desire to reduce chemical pesticide usage. Consequently, manufacturers are focusing on developing innovative protective textiles that offer both functionality and sustainability, thereby catering to the evolving needs of the agricultural sector.

Technological Advancements in Textile Manufacturing

Technological advancements in textile manufacturing are significantly influencing the Agricultural Textile Market. Innovations such as nanotechnology and smart textiles are enhancing the functionality of agricultural fabrics, making them more durable and efficient. For instance, the integration of sensors into textiles allows for real-time monitoring of soil conditions and crop health, thereby optimizing resource use. The market for smart textiles is expected to witness substantial growth, with projections indicating a potential increase of 15% annually. These advancements not only improve agricultural productivity but also provide farmers with tools to make informed decisions, thereby driving the demand for technologically advanced agricultural textiles.