Government Initiatives and Subsidies

Government initiatives aimed at promoting sustainable agricultural practices are playing a crucial role in the Agricultural Sprayer Market. Various countries are implementing policies that encourage the adoption of modern spraying technologies. These initiatives often include financial incentives, subsidies, and grants for farmers who invest in advanced sprayers. For instance, programs that support the transition to eco-friendly spraying methods are gaining traction. This support not only enhances the efficiency of agricultural operations but also aligns with global sustainability goals. As a result, the Agricultural Sprayer Market is likely to benefit from increased investments in innovative spraying solutions.

Growing Awareness of Crop Protection

The Agricultural Sprayer Market is witnessing a surge in awareness regarding the importance of crop protection. Farmers are becoming increasingly cognizant of the threats posed by pests and diseases, which can significantly impact crop yields. This awareness is driving the demand for effective spraying solutions that can safeguard crops. Recent statistics indicate that the crop protection market is expected to reach substantial figures, with a significant portion attributed to the use of advanced sprayers. Consequently, the Agricultural Sprayer Market is likely to expand as farmers seek reliable and efficient sprayers to protect their investments and ensure food security.

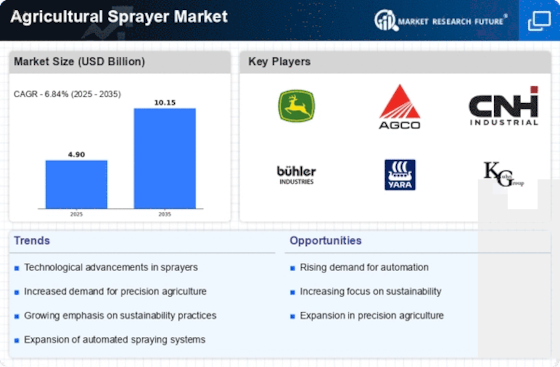

Rising Demand for Precision Agriculture

The Agricultural Sprayer Market is experiencing a notable increase in demand for precision agriculture techniques. Farmers are increasingly adopting precision farming practices to enhance crop yields and optimize resource use. This trend is driven by the need for efficient pest and nutrient management, which sprayers facilitate through targeted application. According to recent data, the precision agriculture market is projected to grow significantly, with a compound annual growth rate of over 12% in the coming years. This growth is likely to propel the Agricultural Sprayer Market as farmers seek advanced sprayers that can deliver precise amounts of chemicals, thereby reducing waste and environmental impact.

Increasing Focus on Sustainable Practices

The Agricultural Sprayer Market is increasingly influenced by a focus on sustainable agricultural practices. Farmers are recognizing the importance of minimizing chemical usage and reducing environmental impact. This shift is prompting the adoption of sprayers that utilize eco-friendly formulations and precision application techniques. Data suggests that the market for sustainable agricultural products is expanding, with consumers demanding more environmentally responsible practices. Consequently, the Agricultural Sprayer Market is likely to see a rise in the development and adoption of sprayers that align with these sustainability goals, thereby fostering a more responsible approach to agriculture.

Technological Innovations in Spraying Equipment

Technological innovations are transforming the Agricultural Sprayer Market, leading to the development of more efficient and user-friendly equipment. Advancements such as drone technology, automated sprayers, and smart sensors are enhancing the capabilities of agricultural sprayers. These innovations allow for real-time monitoring and precise application of chemicals, which can improve crop health and reduce environmental impact. The integration of technology is expected to drive market growth, as farmers increasingly seek out modern solutions that offer enhanced performance and ease of use. As a result, the Agricultural Sprayer Market is poised for significant advancements in the coming years.