Government Support and Subsidies

Government initiatives play a crucial role in the Agricultural Sprayer Equipment Market. Many governments are implementing policies that support the adoption of modern agricultural practices, including the provision of subsidies for purchasing advanced sprayer equipment. These initiatives aim to enhance food security and promote sustainable farming. For instance, various countries have allocated significant budgets to support farmers in acquiring efficient sprayers, which is expected to stimulate market growth. The Agricultural Sprayer Equipment Market stands to gain from these supportive measures, as they encourage farmers to invest in new technologies that improve productivity and sustainability.

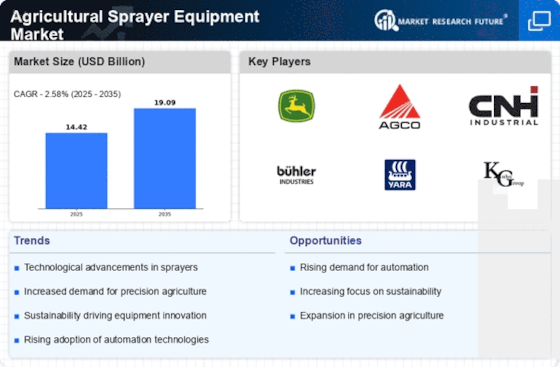

Advancements in Sprayer Technology

Technological advancements are significantly shaping the Agricultural Sprayer Equipment Market. Innovations such as drone-assisted spraying and automated systems are revolutionizing how farmers apply chemicals. These technologies not only enhance efficiency but also improve accuracy, reducing waste management and potential harm to non-target areas. The integration of smart technology, including IoT devices, allows for real-time monitoring and data collection, further optimizing spraying operations. As these technologies become more accessible, the Agricultural Sprayer Equipment Market is poised for growth, with an anticipated increase in adoption rates among farmers seeking to modernize their operations.

Growing Global Population and Food Demand

The increasing The Agricultural Sprayer Equipment Industry to enhance food production. As the world population is projected to reach nearly 9.7 billion by 2050, the demand for food is expected to rise substantially. This necessitates the adoption of advanced agricultural practices, including the use of efficient sprayer equipment. Farmers are likely to invest in technologies that enable higher crop yields and better pest management. Consequently, the Agricultural Sprayer Equipment Market is anticipated to expand as stakeholders seek solutions that address the challenges posed by rising food demand, ensuring food security for future generations.

Increasing Demand for Precision Agriculture

The Agricultural Sprayer Equipment Market is experiencing a notable surge in demand for precision agriculture techniques. Farmers are increasingly adopting advanced sprayer technologies that enable targeted application of pesticides and fertilizers. This shift is driven by the need to enhance crop yields while minimizing chemical usage. According to recent data, the precision agriculture market is projected to grow at a compound annual growth rate of approximately 12% over the next five years. This growth is likely to propel the Agricultural Sprayer Equipment Market as farmers seek to invest in equipment that supports precision application methods, thereby optimizing resource use and improving overall farm efficiency.

Rising Awareness of Sustainable Farming Practices

Sustainability has become a pivotal focus within the Agricultural Sprayer Equipment Market. As environmental concerns escalate, farmers are increasingly aware of the need to adopt sustainable practices. This awareness is driving the demand for sprayers that utilize eco-friendly technologies, such as low-drift nozzles and electric sprayers. The market for sustainable agricultural equipment is expected to witness a growth rate of around 10% annually, reflecting a shift towards practices that reduce environmental impact. Consequently, the Agricultural Sprayer Equipment Market is likely to benefit from innovations that align with sustainable farming, as stakeholders prioritize eco-conscious solutions.

.png)