Rising Demand for Food Security

The Agricultural Micronutrients Market is experiencing a surge in demand driven by the increasing global population and the corresponding need for enhanced food security. As populations grow, the pressure on agricultural systems intensifies, necessitating the use of micronutrients to improve crop yields and nutritional quality. Reports indicate that by 2025, the demand for food is expected to rise by approximately 60%, prompting farmers to adopt micronutrient solutions to meet these challenges. This trend is particularly evident in regions where soil deficiencies are prevalent, as micronutrients play a crucial role in plant health and productivity. Consequently, the Agricultural Micronutrients Market is poised for growth as stakeholders seek to ensure sustainable food production in the face of escalating demand.

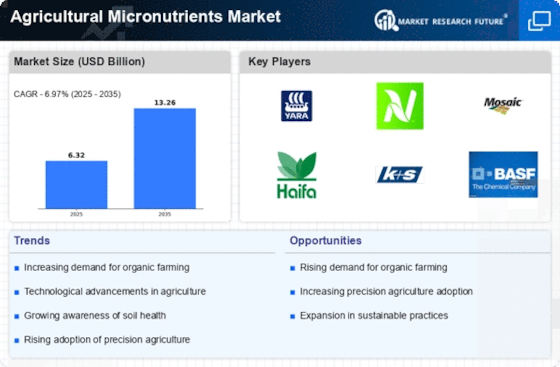

Growing Organic Farming Practices

The Agricultural Micronutrients Market is experiencing growth due to the rising trend of organic farming practices. As consumers increasingly demand organic produce, farmers are seeking ways to enhance soil fertility and crop health without synthetic fertilizers. Micronutrients play a vital role in organic farming, as they are essential for plant growth and development. The shift towards organic agriculture is prompting farmers to explore natural sources of micronutrients, such as compost and organic fertilizers. This trend is expected to drive the Agricultural Micronutrients Market, as the demand for organic produce continues to rise, necessitating the use of micronutrient solutions that align with organic farming principles.

Government Initiatives and Support

The Agricultural Micronutrients Market is bolstered by various government initiatives aimed at promoting sustainable agricultural practices. Governments are increasingly recognizing the importance of micronutrients in enhancing crop productivity and soil health. Initiatives such as subsidies for micronutrient fertilizers and educational programs for farmers are being implemented to encourage the adoption of these essential inputs. For instance, several countries have launched campaigns to raise awareness about soil health and the role of micronutrients in achieving food security. These efforts are likely to stimulate growth in the Agricultural Micronutrients Market, as more farmers are incentivized to integrate micronutrient solutions into their farming practices.

Increased Awareness of Nutritional Deficiencies

The Agricultural Micronutrients Market is significantly influenced by the growing awareness of nutritional deficiencies in both crops and human diets. As consumers become more informed about the importance of micronutrients, there is a corresponding increase in demand for fortified agricultural products. Studies have shown that deficiencies in essential micronutrients such as zinc, iron, and manganese can lead to reduced crop yields and poor human health outcomes. This awareness is driving farmers to incorporate micronutrient solutions into their agricultural practices, thereby enhancing the nutritional profile of their produce. The Agricultural Micronutrients Market is likely to benefit from this trend, as more stakeholders recognize the critical role of micronutrients in achieving both agricultural productivity and public health objectives.

Technological Innovations in Micronutrient Application

The Agricultural Micronutrients Market is witnessing a transformation due to technological innovations in the application of micronutrients. Advances in precision agriculture, such as soil testing and nutrient mapping, enable farmers to apply micronutrients more effectively and efficiently. These technologies allow for targeted application, reducing waste and enhancing crop uptake. Furthermore, the development of slow-release and controlled-release formulations is improving the efficacy of micronutrient delivery. As a result, farmers are increasingly adopting these innovative solutions to optimize their yields and reduce input costs. The Agricultural Micronutrients Market is expected to expand as these technologies become more accessible and affordable, facilitating broader adoption among farmers.