Rising Demand for Food Production

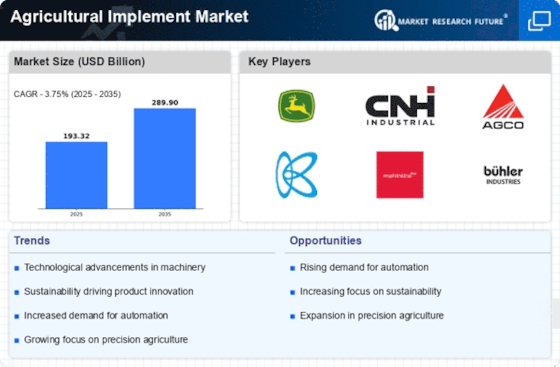

The Agricultural Implement Market is experiencing a notable surge in demand driven by the increasing need for food production. As the global population continues to grow, the pressure on agricultural systems intensifies, necessitating enhanced productivity. According to recent data, food production must increase by approximately 70% by 2050 to meet the needs of the burgeoning population. This demand compels farmers to adopt advanced agricultural implements that improve efficiency and yield. Consequently, manufacturers are innovating to provide equipment that supports precision farming and sustainable practices. The integration of technology in agricultural implements is likely to play a pivotal role in addressing these challenges, thereby propelling the Agricultural Implement Market forward.

Government Initiatives and Support

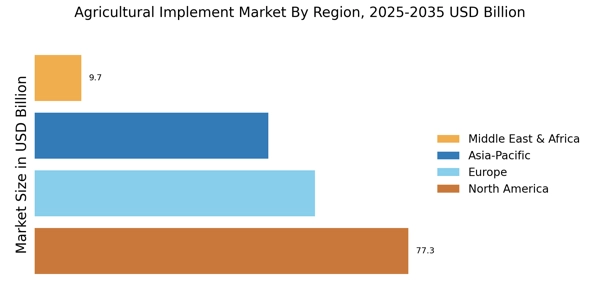

Government initiatives aimed at boosting agricultural productivity significantly influence the Agricultural Implement Market. Various countries are implementing policies that promote the adoption of modern farming techniques and equipment. For instance, subsidies and financial assistance programs are being introduced to encourage farmers to invest in advanced agricultural implements. These initiatives not only enhance productivity but also contribute to rural development and economic growth. Data indicates that regions with strong government support for agriculture witness higher rates of equipment adoption, which in turn stimulates the Agricultural Implement Market. As governments recognize the importance of agriculture in ensuring food security, the trend of supportive policies is expected to continue, further driving market growth.

Increasing Investment in Agriculture

Investment in agriculture is a crucial factor driving the Agricultural Implement Market. As economies recognize the importance of agriculture for economic stability and food security, there is a marked increase in funding directed towards agricultural development. This investment encompasses not only infrastructure but also the procurement of modern agricultural implements. Data shows that regions with higher agricultural investment experience accelerated growth in the adoption of advanced farming equipment. This trend is likely to continue, as stakeholders, including governments and private investors, seek to enhance agricultural productivity. The influx of capital into the sector is expected to stimulate innovation and competition within the Agricultural Implement Market, ultimately benefiting farmers and consumers alike.

Technological Advancements in Equipment

Technological advancements are reshaping the Agricultural Implement Market, leading to the development of more efficient and effective farming tools. Innovations such as GPS-guided tractors, automated planting systems, and drones for crop monitoring are becoming increasingly prevalent. These technologies enhance precision in farming, reduce labor costs, and improve overall productivity. Market data suggests that the adoption of smart agricultural implements is on the rise, with a projected growth rate of over 10% annually in the coming years. This trend indicates a shift towards more data-driven farming practices, which are likely to dominate the Agricultural Implement Market. As farmers seek to optimize their operations, the demand for technologically advanced equipment is expected to escalate.

Sustainability and Environmental Concerns

Sustainability has emerged as a critical driver in the Agricultural Implement Market, as environmental concerns gain prominence. Farmers are increasingly aware of the impact of traditional farming practices on ecosystems and are seeking implements that promote sustainable agriculture. This shift is reflected in the growing demand for equipment that minimizes soil degradation, reduces chemical usage, and conserves water. Market Research Future indicates that sustainable agricultural practices are likely to become mainstream, with a significant portion of the Agricultural Implement Market focusing on eco-friendly solutions. As consumers demand more sustainably produced food, manufacturers are responding by developing implements that align with these values, thereby fostering growth in the market.