Research Methodology on Agriculture Disinfectants Market

The research methodology adopted in this report is an analytical technique based on primary and secondary research whose purpose is to provide a comprehensive analysis of the global Agricultural Disinfectants Market. Primary research involved in-depth interviews and questionnaires with various leading industry experts such as agricultural technicians, Chief Executive Officers (CEOs), Vice Presidents (VPs), and field marketing personnel who have useful insights into the market. They help in understanding the trends and developments witnessed in the market and reaching a general consensus on future market growth.

Secondary research sources such as business journals and other internet sources, have been used to identify and assemble data, potential products and service providers in particular markets and gather information and strategic decisions taken recently by the top players in the Agricultural Disinfectants Market.

Research Objectives

- To understand the scope and the in-depth analysis of the market.

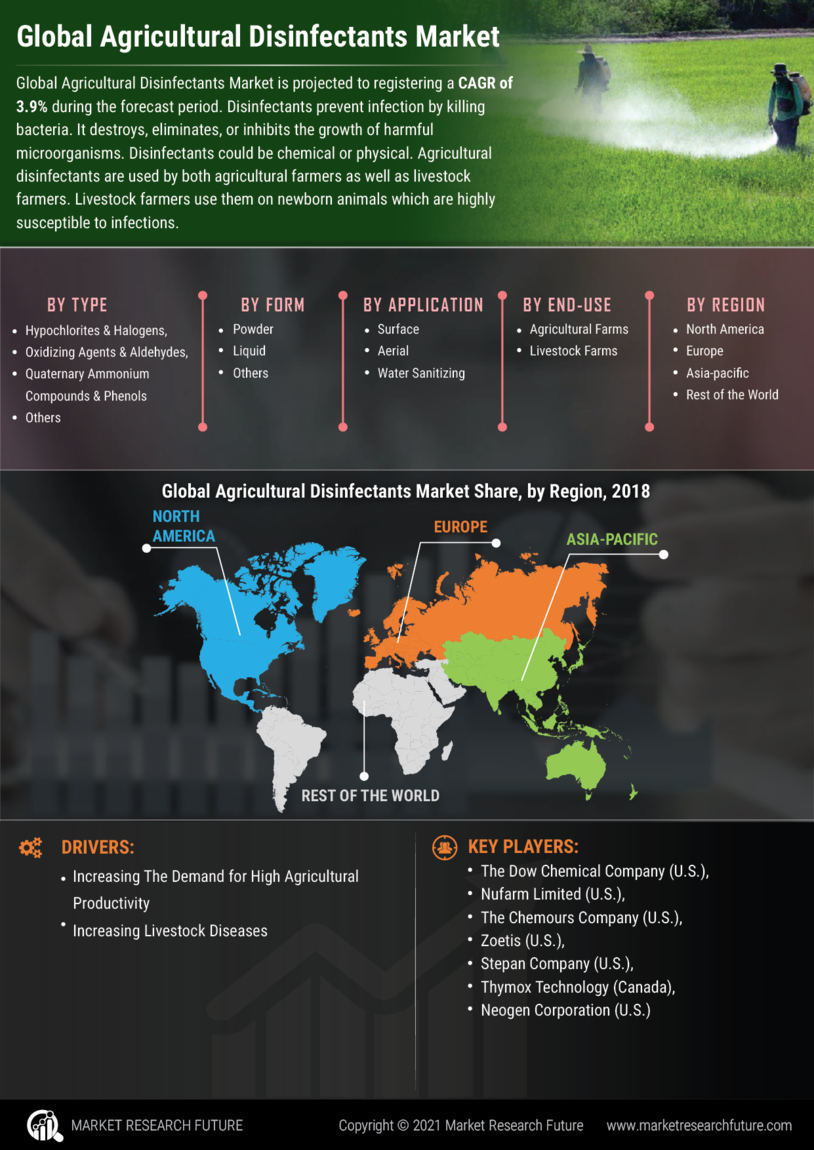

- To analyze the market structure in terms of segmentation, applications, and regions.

- To study and forecast the market size in terms of value for 2023 to 2030.

- To understand the demand and supply trends in the market and to identify the driving and restraining factors for the same.

- To study the competitive landscape in the market to identify the key players and their strategies.

- To identify and analyze the macro and micro economic factors that are impacting the market.

- To identify the attractive investment pockets in the market and gain in-depth knowledge about the same.

- To list the major strategic initiatives taken by the industry players in recent years.

- To analyze the key sources of primary and secondary data employed in this report.

Data Collection

Data was collected from various primary and secondary research sources including the World Bank, industry-specific journals, online databases, and other statistical sources. Secondary sources of data collection included in this report are the company websites, press releases, company annual reports, promotional materials, and other external databases.

Market Estimation

Market share and size were estimated using data obtained from primary sources such as company reports and public databases, as well as multiple secondary research methods such as databases, directories, books, and various other relevant sources. The market was segmented based on various factors such as product type, application, and region. Market estimates were then obtained by triangulating the data collected from different sources. In addition, market shares of the leading players in the market were also studied.

Data Validation

The data obtained from primary and secondary sources is validated using a third-party expert opinion. A separate team of experts was employed by the research firm to conduct data validation using interviews and questionnaires. Expert opinions were used to cross-check the data obtained from both primary and secondary research sources. The two important aspects of data validation include data correction and data triangulation.

Data Triangulation

Data triangulation was done by the research firm to verify the data obtained from both primary and secondary research sources. Data triangulation was done using statistical and graphical techniques such as data correlation and regression analysis. The results obtained after this triangulation process were then used to draw a final conclusion.

Pricing Analysis

The pricing strategy of various companies in the Agricultural Disinfectants Market was based on various factors such as the cost of production, current market trends, and the competitive environment. Data on pricing analyses was obtained after conducting in-depth interviews and discussions with leading industry experts.

Econometric Forecasting Modelling

This report employed econometric forecasting modelling to project various factors of the market. The econometric forecasting modelling was done using historical data collected from both primary and secondary sources and the findings of econometric models were further verified using data gathered from industry experts.

Industry Analysis

This report included a detailed industry analysis which focused on the industry's present and future growth prospects, along with the current trends and strategies adopted by the leading players in the market. Industry analysis was done by performing Porter's Five Forces Analysis, which focused on the bargaining power of suppliers and buyers, the threat of new entrants, the intensity of competition, and the threat of substitutes.

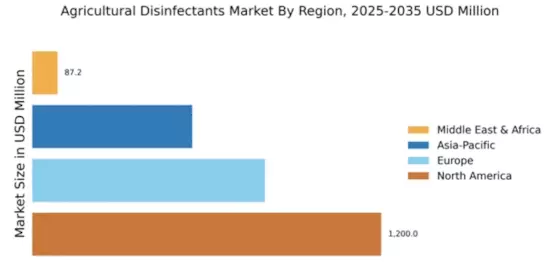

Regional Analysis

This report included a detailed regional analysis which encompassed the current and future trends of the market in various regions. Regional analysis was done by conducting interviews, surveys, and various other activities. The estimated market value of the Agricultural Disinfectants Market was used to further draw the conclusion and validate the findings of the report with the market forecast from 2023 to 2030.