Government Regulations and Support

Government regulations and support are pivotal in shaping the US Agricultural Disinfectants Market. The Environmental Protection Agency (EPA) enforces strict guidelines regarding the use of disinfectants in agriculture, ensuring that products are safe for both the environment and human health. Additionally, various federal and state programs provide financial assistance to farmers for implementing biosecurity measures, including the purchase of disinfectants. This regulatory framework not only promotes the use of effective disinfectants but also encourages innovation within the industry. As compliance with these regulations becomes increasingly critical, the market for agricultural disinfectants is expected to grow, driven by both necessity and support.

Global Trade and Export Opportunities

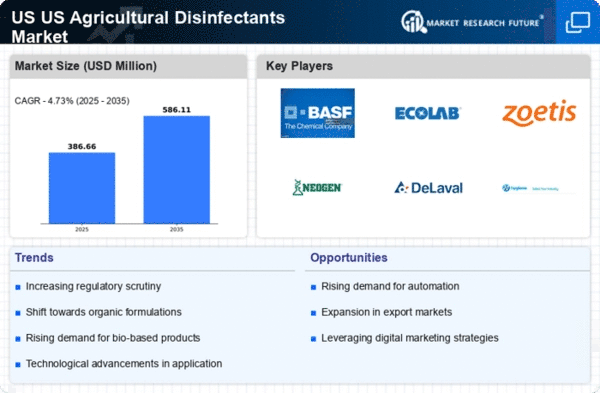

The US Agricultural Disinfectants Market is also influenced by global trade dynamics and export opportunities. As the demand for US agricultural products continues to rise internationally, there is a corresponding need for effective disinfectants to ensure the quality and safety of these products. The USDA has reported that exports of US agricultural goods have reached record levels, prompting manufacturers to enhance their product offerings to meet international standards. This trend not only opens new markets for US disinfectant manufacturers but also drives innovation as they seek to develop products that comply with diverse regulatory requirements. Consequently, the market is poised for growth as companies capitalize on these export opportunities.

Increased Demand for Sustainable Practices

The US Agricultural Disinfectants Market is experiencing a notable shift towards sustainable agricultural practices. Farmers are increasingly adopting eco-friendly disinfectants that align with organic farming principles. This trend is driven by consumer demand for sustainably produced food, which has led to a rise in organic farming. According to the USDA, organic farming has seen a growth rate of approximately 12% annually, indicating a robust market for agricultural disinfectants that meet organic certification standards. As a result, manufacturers are innovating to develop products that are both effective and environmentally friendly, thereby enhancing their market presence in the US Agricultural Disinfectants Market.

Rising Awareness of Animal Health and Biosecurity

The US Agricultural Disinfectants Market is significantly influenced by the rising awareness of animal health and biosecurity measures. Livestock producers are increasingly recognizing the importance of maintaining a clean and disease-free environment to ensure the health of their animals. This awareness has led to a surge in the demand for effective disinfectants that can mitigate the risk of disease outbreaks. The USDA has reported that biosecurity measures are essential in preventing the spread of zoonotic diseases, which further emphasizes the need for reliable disinfectants. Consequently, the market for agricultural disinfectants is likely to expand as producers invest in biosecurity protocols.

Technological Advancements in Disinfectant Formulations

Technological advancements are playing a crucial role in shaping the US Agricultural Disinfectants Market. Innovations in formulation chemistry have led to the development of more effective disinfectants that can target a broader spectrum of pathogens. For instance, the introduction of nanotechnology in disinfectant formulations has shown promise in enhancing efficacy while reducing the volume of chemicals required. This not only meets the stringent regulatory standards set by the EPA but also appeals to farmers seeking efficient solutions. The market is projected to grow as these advanced formulations become more widely adopted, reflecting a shift towards more sophisticated agricultural practices.