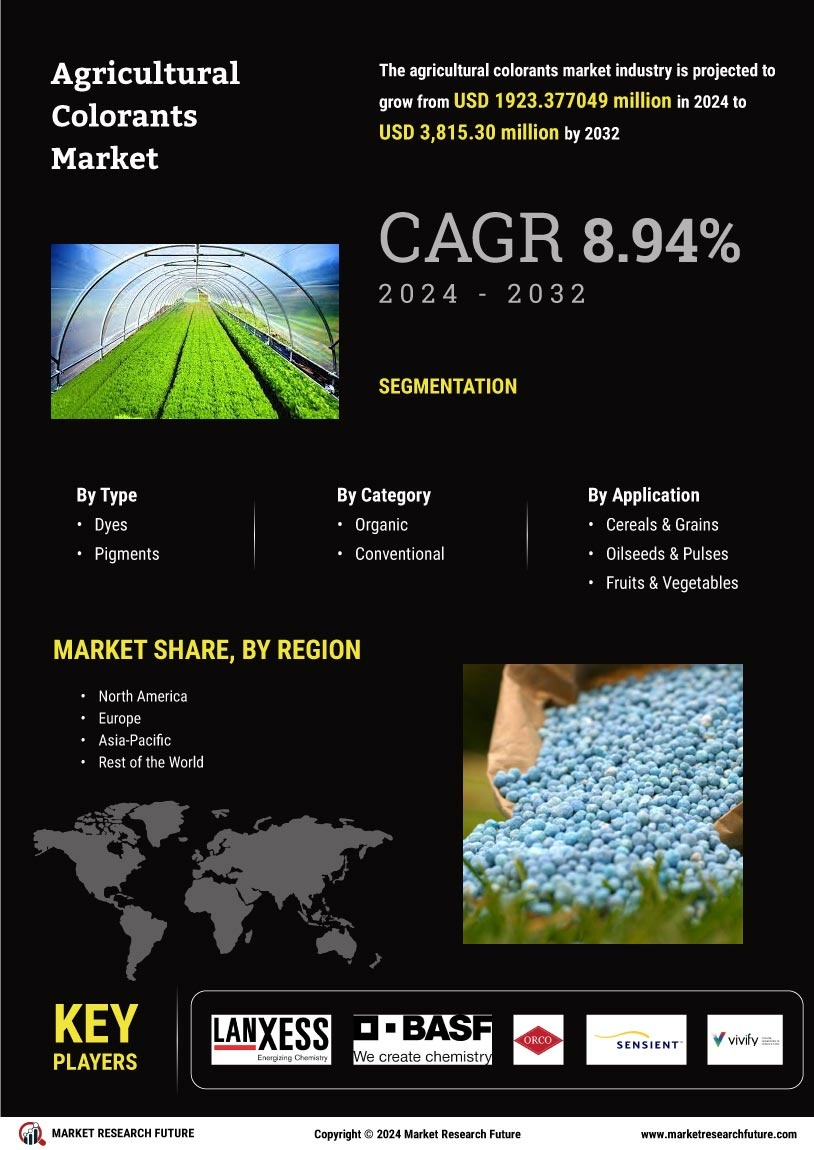

Rising Demand for Organic Produce

The Agricultural Colorants Market is experiencing a notable increase in demand for organic produce. Consumers are becoming more health-conscious and are actively seeking products that are free from synthetic additives. This trend is driving farmers to adopt natural colorants derived from plant sources, which are perceived as safer and more environmentally friendly. According to recent data, the organic food market has been growing at a compound annual growth rate of approximately 10%, which in turn boosts the demand for natural agricultural colorants. As a result, manufacturers in the Agricultural Colorants Market are focusing on developing innovative colorant solutions that align with organic farming practices, thereby enhancing their market presence and catering to the evolving preferences of consumers.

Increased Focus on Aesthetic Appeal

In the Agricultural Colorants Market, the aesthetic appeal of food products is becoming increasingly important. Retailers and consumers alike are drawn to visually appealing fruits and vegetables, which can significantly influence purchasing decisions. This trend is prompting producers to utilize colorants that enhance the visual quality of their products. Research indicates that products with vibrant colors can command higher prices, thus incentivizing farmers to invest in agricultural colorants. The emphasis on aesthetics is not limited to fresh produce; it extends to processed foods as well, where colorants play a crucial role in product differentiation. Consequently, the Agricultural Colorants Market is likely to see sustained growth as producers seek to meet consumer expectations for visually attractive food items.

Regulatory Pressures and Compliance

The Agricultural Colorants Market is increasingly influenced by regulatory pressures aimed at ensuring the safety and efficacy of colorants used in agriculture. Governments and regulatory bodies are implementing stringent guidelines regarding the use of synthetic colorants, which is prompting a shift towards natural alternatives. Compliance with these regulations is becoming essential for manufacturers to maintain market access and consumer trust. Data suggests that regions with stricter regulations are witnessing a faster adoption of natural colorants, as producers seek to align with safety standards. This regulatory landscape is likely to drive innovation within the Agricultural Colorants Market, as companies invest in research and development to create compliant and effective colorant solutions.

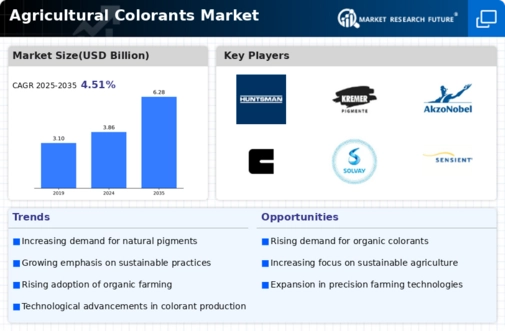

Technological Innovations in Colorant Production

The Agricultural Colorants Market is benefiting from technological innovations that enhance the production and application of colorants. Advances in extraction and formulation techniques are enabling manufacturers to create more effective and sustainable colorants. For instance, the development of microencapsulation technology allows for better stability and controlled release of colorants, which can improve their efficacy in agricultural applications. Furthermore, the integration of biotechnology in colorant production is paving the way for the creation of novel colorants that are both efficient and environmentally friendly. As these technologies continue to evolve, they are likely to reshape the Agricultural Colorants Market, providing new opportunities for growth and differentiation among market players.

Growing Awareness of Environmental Sustainability

The Agricultural Colorants Market is increasingly shaped by the growing awareness of environmental sustainability among consumers and producers. There is a rising concern regarding the ecological impact of synthetic colorants, which has led to a shift towards more sustainable practices. Farmers are now more inclined to use natural colorants that not only meet consumer demands but also minimize environmental harm. This shift is supported by data indicating that sustainable agricultural practices can enhance soil health and biodiversity. As awareness continues to grow, the Agricultural Colorants Market is expected to expand, with a focus on developing eco-friendly colorant solutions that align with sustainable farming practices.