Growing Organic Farming Practices

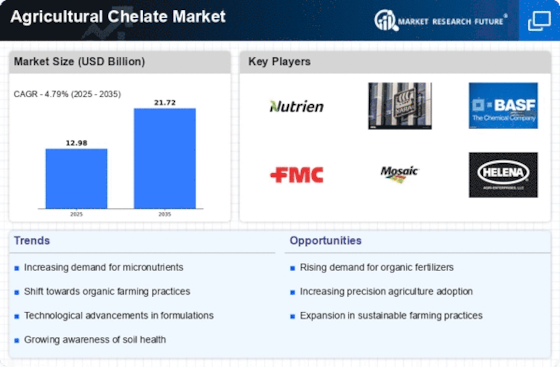

The agricultural chelate Market is experiencing growth due to the rising trend of organic farming practices. As consumers demand organic produce, farmers are seeking natural and effective solutions to enhance soil fertility and crop health. Chelated nutrients, which are often derived from organic sources, are gaining traction in organic farming systems. This shift is supported by data indicating that the organic food market is projected to reach USD 620 billion by 2026. The increasing adoption of organic farming is likely to drive the Agricultural Chelate Market, as these products align with the principles of organic agriculture.

Increased Awareness of Soil Health

The Agricultural Chelate Market is witnessing a surge in awareness regarding soil health and its critical role in sustainable agriculture. Farmers are becoming more educated about the impact of soil quality on crop performance. This awareness is driving the adoption of chelated nutrients, which improve nutrient uptake and soil structure. Research indicates that healthy soils can increase crop yields by up to 30%. As the focus on soil health intensifies, the demand for agricultural chelates is likely to rise, positioning the Agricultural Chelate Market as a key player in enhancing agricultural productivity.

Rising Demand for High-Quality Crops

The Agricultural Chelate Market is experiencing a notable increase in demand for high-quality crops. Farmers are increasingly recognizing the importance of micronutrients in enhancing crop yield and quality. Chelated nutrients, which are more bioavailable, are being adopted to address nutrient deficiencies in soils. This trend is supported by data indicating that the global market for chelated micronutrients is projected to reach approximately USD 2.5 billion by 2026. As agricultural practices evolve, the emphasis on producing high-quality crops is likely to drive the Agricultural Chelate Market further, as these products are essential for achieving optimal growth and maximizing profitability.

Environmental Regulations and Sustainable Practices

The Agricultural Chelate Market is influenced by stringent environmental regulations aimed at promoting sustainable agricultural practices. Governments are increasingly implementing policies that encourage the use of eco-friendly fertilizers and soil amendments. Chelated products, which minimize nutrient runoff and enhance soil health, align with these regulations. The market is projected to grow as farmers seek compliant solutions that not only meet regulatory standards but also improve crop productivity. This shift towards sustainability is expected to propel the Agricultural Chelate Market, as stakeholders prioritize environmentally responsible practices in their operations.

Technological Innovations in Fertilizer Application

The Agricultural Chelate Market is benefiting from technological innovations in fertilizer application methods. Precision agriculture techniques, such as variable rate application and soil mapping, are becoming more prevalent. These technologies allow for the targeted application of chelated nutrients, optimizing their effectiveness and reducing waste. The integration of advanced technologies is expected to enhance the efficiency of nutrient use, thereby driving the Agricultural Chelate Market. As farmers adopt these innovative practices, the demand for chelated products is likely to increase, reflecting a shift towards more efficient agricultural practices.

.png)