Rising Investment in Aerospace R&D

The Aerospace Thermoplastic Composite Market is witnessing a rise in investment directed towards research and development. As aerospace companies strive to innovate and enhance the performance of their aircraft, there is a growing focus on developing advanced composite materials. This investment is not only aimed at improving the mechanical properties of thermoplastic composites but also at exploring new applications within the aerospace sector. Recent reports indicate that R&D spending in aerospace is projected to grow significantly, which could lead to breakthroughs in thermoplastic composite technologies, further driving their adoption in the industry.

Increasing Focus on Fuel Efficiency

The Aerospace Thermoplastic Composite Market is significantly influenced by the increasing focus on fuel efficiency among airlines and manufacturers. As fuel costs continue to rise, the aerospace sector is compelled to seek solutions that enhance operational efficiency. Thermoplastic composites, with their lightweight characteristics, contribute to reduced fuel consumption and lower operational costs. Studies suggest that the integration of these materials can lead to substantial savings in fuel expenses over the lifespan of an aircraft. Consequently, the emphasis on fuel efficiency is likely to propel the demand for thermoplastic composites, thereby fostering growth within the Aerospace Thermoplastic Composite Market.

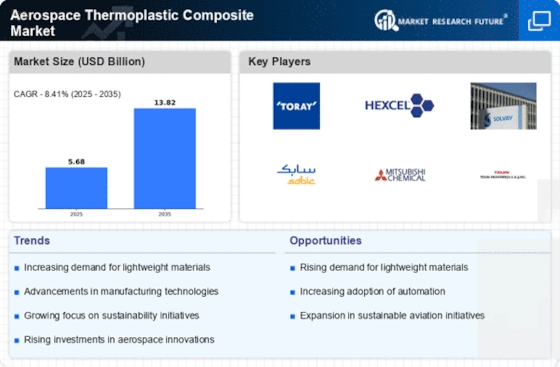

Growing Demand for Lightweight Materials

The Aerospace Thermoplastic Composite Market is experiencing a notable surge in demand for lightweight materials. This trend is primarily driven by the aerospace sector's ongoing efforts to enhance fuel efficiency and reduce emissions. Thermoplastic composites, known for their low density and high strength-to-weight ratio, are increasingly favored in aircraft manufacturing. According to recent data, the use of these materials can lead to weight reductions of up to 30% compared to traditional materials. As airlines and manufacturers prioritize sustainability, the shift towards lightweight solutions is likely to continue, further propelling the growth of the Aerospace Thermoplastic Composite Market.

Advancements in Manufacturing Technologies

Technological innovations in manufacturing processes are significantly influencing the Aerospace Thermoplastic Composite Market. The introduction of automated and advanced manufacturing techniques, such as 3D printing and automated fiber placement, enhances production efficiency and reduces costs. These advancements allow for the creation of complex geometries and tailored properties in thermoplastic composites, which were previously challenging to achieve. As a result, manufacturers can produce components with improved performance characteristics, thereby meeting the stringent requirements of the aerospace sector. The ongoing evolution of these technologies is expected to drive further adoption of thermoplastic composites in aerospace applications.

Regulatory Support for Sustainable Practices

Regulatory frameworks promoting sustainable practices are playing a crucial role in shaping the Aerospace Thermoplastic Composite Market. Governments and international organizations are increasingly implementing stringent regulations aimed at reducing carbon footprints and promoting eco-friendly materials in aviation. These regulations encourage manufacturers to adopt thermoplastic composites, which are often more recyclable and environmentally friendly compared to traditional materials. As a result, the Aerospace Thermoplastic Composite Market is likely to benefit from heightened regulatory support, which may lead to increased investments in research and development of sustainable composite solutions.