Technological Innovations

Technological advancements play a pivotal role in shaping the aerospace parts manufacturing Market. Innovations such as additive manufacturing, advanced materials, and automation are revolutionizing the production processes. For instance, the adoption of 3D printing technology allows for the creation of complex parts with reduced waste and shorter lead times. Furthermore, the integration of artificial intelligence and machine learning in manufacturing processes enhances efficiency and precision. Data indicates that the aerospace sector is expected to invest over 20 billion dollars in research and development by 2026, focusing on these cutting-edge technologies. As a result, the Aerospace Parts Manufacturing Market is likely to witness a transformation in how parts are designed, produced, and maintained, ultimately leading to improved performance and safety in aviation.

Increased Air Travel Demand

The Aerospace Parts Manufacturing Market is experiencing a surge in demand due to the rising number of air travelers. As more individuals opt for air travel, airlines are compelled to expand their fleets, thereby increasing the need for aircraft parts. According to recent data, the commercial aviation sector anticipates a growth rate of approximately 4.5% annually over the next decade. This growth translates into a heightened demand for various aerospace components, including engines, avionics, and structural parts. Consequently, manufacturers are likely to ramp up production to meet this escalating demand, which could lead to innovations in manufacturing processes and materials. The Aerospace Parts Manufacturing Market must adapt to these trends to remain competitive and responsive to the evolving needs of the aviation sector.

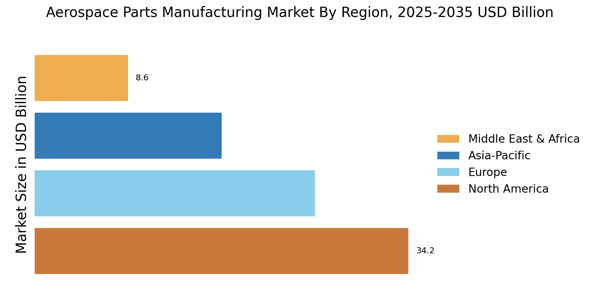

Emerging Markets and Globalization

The Aerospace Parts Manufacturing Market is witnessing a shift as emerging markets become increasingly integral to the global supply chain. Countries such as India, Brazil, and China are investing heavily in their aerospace sectors, leading to a rise in local manufacturing capabilities. This trend is likely to create new opportunities for collaboration and partnerships between established manufacturers and emerging players. Data suggests that the Asia-Pacific region is expected to account for a significant share of the aerospace market, with a projected growth rate of around 5% annually. As these markets develop, the Aerospace Parts Manufacturing Market may experience a diversification of suppliers and a more competitive landscape, prompting innovation and efficiency improvements across the board.

Sustainability and Environmental Concerns

Sustainability has emerged as a critical driver in the Aerospace Parts Manufacturing Market. With increasing awareness of environmental issues, manufacturers are under pressure to adopt sustainable practices. This includes the development of eco-friendly materials and processes that minimize waste and reduce carbon footprints. The aerospace sector is projected to invest approximately 30 billion dollars in sustainable technologies by 2030, reflecting a commitment to environmental stewardship. Additionally, airlines are increasingly seeking suppliers who prioritize sustainability in their operations. As a result, the Aerospace Parts Manufacturing Market is likely to see a shift towards greener manufacturing practices, which could enhance brand reputation and attract environmentally conscious customers.

Regulatory Compliance and Safety Standards

The Aerospace Parts Manufacturing Market is significantly influenced by stringent regulatory compliance and safety standards. Regulatory bodies impose rigorous guidelines to ensure the safety and reliability of aerospace components. Manufacturers must adhere to these standards, which often necessitate substantial investments in quality control and testing processes. The Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA) are among the key organizations that set these regulations. As the industry evolves, there is a growing emphasis on compliance with environmental regulations as well. This focus on safety and sustainability is likely to drive innovation in the Aerospace Parts Manufacturing Market, as companies seek to develop parts that not only meet regulatory requirements but also contribute to a more sustainable aviation future.