Supply Chain Resilience

Supply chain resilience is becoming increasingly vital in the Additive Manufacturing Market. The ability to produce parts on-demand and closer to the point of use can mitigate supply chain disruptions. Traditional manufacturing often relies on complex supply chains that can be vulnerable to delays and shortages. In contrast, additive manufacturing allows for localized production, reducing lead times and transportation costs. Market Research Future suggest that companies leveraging additive manufacturing for supply chain resilience can achieve a 40% reduction in lead times. As businesses seek to enhance their operational agility and responsiveness, the adoption of additive manufacturing technologies will likely become a strategic priority within the Additive Manufacturing Market.

Sustainability Initiatives

The Additive Manufacturing Market is increasingly influenced by sustainability initiatives. Companies are adopting additive manufacturing processes to reduce waste and energy consumption. Traditional manufacturing often results in significant material waste, whereas additive manufacturing allows for precise material usage, potentially reducing waste by up to 90%. Furthermore, the ability to produce parts on-demand minimizes the need for large inventories, which can lead to overproduction and excess waste. As environmental regulations become more stringent, businesses are likely to invest in additive manufacturing technologies that align with their sustainability goals. This shift not only enhances corporate responsibility but also appeals to environmentally conscious consumers, thereby driving demand within the Additive Manufacturing Market.

Cost Reduction and Efficiency

Cost reduction and efficiency are critical factors driving the Additive Manufacturing Market. The ability to produce complex geometries and lightweight structures can lead to significant savings in material costs and production time. For instance, additive manufacturing can reduce the number of parts in an assembly, simplifying the supply chain and lowering labor costs. Market data indicates that companies adopting additive manufacturing technologies have reported up to a 30% reduction in production costs. Furthermore, the flexibility of additive manufacturing allows for rapid prototyping, enabling faster product development cycles. As businesses strive to remain competitive, the emphasis on cost-effective manufacturing solutions will likely propel the growth of the Additive Manufacturing Market.

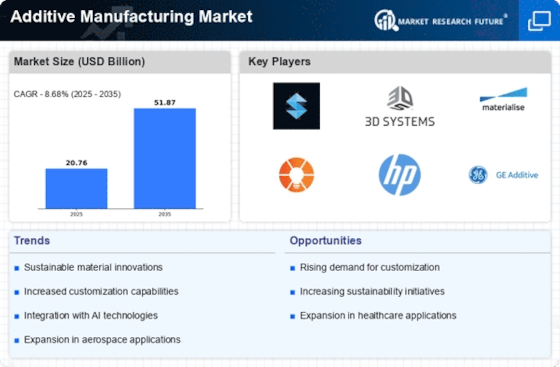

Customization and Personalization

Customization and personalization are pivotal drivers in the Additive Manufacturing Market. The ability to create tailored products that meet specific customer needs is revolutionizing various sectors, including healthcare, automotive, and consumer goods. For instance, in the healthcare sector, additive manufacturing enables the production of bespoke prosthetics and implants, enhancing patient outcomes. Market data indicates that the demand for customized products is expected to grow significantly, with a projected increase in revenue from personalized manufacturing solutions. This trend is further fueled by advancements in design software and 3D printing technologies, allowing manufacturers to efficiently produce unique items. As consumers increasingly seek personalized solutions, the Additive Manufacturing Market is poised for substantial growth.

Integration of Advanced Technologies

The integration of advanced technologies is transforming the Additive Manufacturing Market. Innovations such as artificial intelligence, machine learning, and the Internet of Things are enhancing the efficiency and capabilities of additive manufacturing processes. For example, AI-driven design tools can optimize product designs for 3D printing, reducing material usage and production time. Additionally, IoT-enabled machines can monitor production in real-time, ensuring quality control and minimizing downtime. Market analysis suggests that the adoption of these technologies could lead to a 25% increase in productivity within the additive manufacturing sector. As manufacturers seek to improve operational efficiency and reduce costs, the integration of advanced technologies will likely play a crucial role in shaping the future of the Additive Manufacturing Market.