Increasing Air Travel Demand

The aerospace landing gear Market is experiencing a surge in demand due to the increasing number of air travelers. As more individuals opt for air travel, airlines are expanding their fleets to accommodate this growth. According to recent data, the number of air passengers is projected to reach 8.2 billion by 2037, which necessitates the production of more aircraft and, consequently, landing gear systems. This trend indicates a robust growth trajectory for the Aerospace Landing Gear Market, as manufacturers strive to meet the rising demand for efficient and reliable landing gear solutions. Furthermore, the expansion of low-cost carriers is likely to contribute to this demand, as they continue to penetrate new markets and increase flight frequencies. Thus, the interplay between rising air travel and the need for advanced landing gear systems is a key driver in the Aerospace Landing Gear Market.

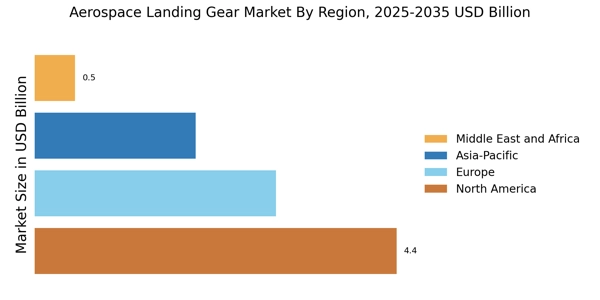

Emerging Markets and Regional Growth

The Aerospace Landing Gear Market is poised for growth in emerging markets, where increasing economic development is leading to a rise in air travel and aircraft manufacturing. Countries in Asia-Pacific and Latin America are witnessing a burgeoning middle class, which is driving demand for air travel. For instance, the Asia-Pacific region is expected to account for a significant share of new aircraft deliveries in the coming years, with estimates suggesting that over 17,000 new aircraft will be needed by 2038. This growth in aircraft production directly correlates with the demand for landing gear systems, as each new aircraft requires a complete landing gear assembly. Consequently, manufacturers are likely to focus on these emerging markets to capitalize on the growth potential, thereby enhancing the Aerospace Landing Gear Market's overall landscape.

Technological Innovations in Materials

The Aerospace Landing Gear Market is being transformed by technological innovations in materials used for landing gear systems. The introduction of lightweight and high-strength materials, such as carbon fiber composites and advanced alloys, is enhancing the performance and efficiency of landing gear. These materials not only reduce the overall weight of the landing gear but also improve its durability and resistance to wear and tear. As manufacturers seek to optimize fuel efficiency and reduce operational costs, the adoption of these advanced materials is becoming increasingly prevalent. Furthermore, the integration of additive manufacturing techniques is enabling the production of complex geometries that were previously unattainable. This shift towards innovative materials and manufacturing processes is likely to drive the Aerospace Landing Gear Market forward, as companies strive to develop more efficient and reliable landing gear solutions.

Regulatory Compliance and Safety Standards

The Aerospace Landing Gear Market is significantly influenced by stringent regulatory compliance and safety standards imposed by aviation authorities. These regulations are designed to ensure the safety and reliability of landing gear systems, which are critical components of aircraft. Compliance with these standards often necessitates the adoption of advanced materials and technologies, thereby driving innovation within the Aerospace Landing Gear Market. For instance, the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA) have established rigorous testing and certification processes for landing gear systems. As a result, manufacturers are compelled to invest in research and development to enhance the performance and safety of their products. This focus on compliance not only fosters technological advancements but also creates a competitive landscape where companies strive to exceed regulatory expectations, further propelling the Aerospace Landing Gear Market.

Focus on Sustainability and Environmental Impact

The Aerospace Landing Gear Market is increasingly influenced by a focus on sustainability and reducing environmental impact. As the aviation sector faces pressure to minimize its carbon footprint, manufacturers are exploring eco-friendly materials and production processes for landing gear systems. This shift towards sustainability is not only a response to regulatory pressures but also aligns with the growing consumer demand for environmentally responsible practices. For instance, the use of recyclable materials in landing gear production can significantly reduce waste and energy consumption. Additionally, companies are investing in research to develop landing gear systems that enhance fuel efficiency, thereby contributing to lower emissions during flight. This emphasis on sustainability is likely to shape the future of the Aerospace Landing Gear Market, as stakeholders prioritize environmentally friendly solutions in their operations.