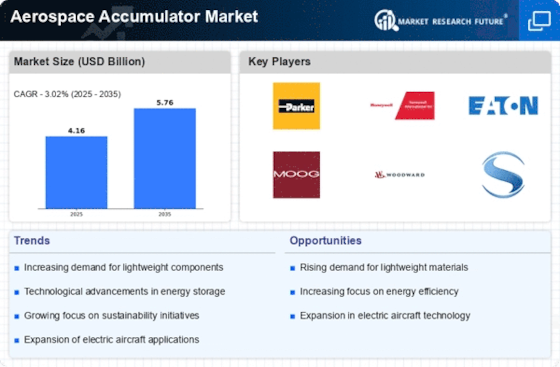

Expansion of Aerospace Applications

The aerospace accumulator Market is benefiting from the expansion of aerospace applications across various segments, including commercial aviation, military, and space exploration. As the aerospace sector diversifies, the demand for specialized accumulators tailored to specific applications is increasing. For instance, military aircraft require accumulators that can withstand extreme conditions, while commercial aviation focuses on reliability and efficiency. This diversification is prompting manufacturers to innovate and develop accumulators that cater to these varied needs. Additionally, the rise of space exploration initiatives is creating new opportunities for accumulator applications in spacecraft and satellites. The market is projected to grow at a rate of 5.8% as these new applications emerge, highlighting the potential for growth driven by the expansion of aerospace applications.

Growing Demand for Lightweight Components

The Aerospace Accumulator Market is witnessing a growing demand for lightweight components, driven by the aerospace sector's emphasis on fuel efficiency and performance. As airlines and manufacturers strive to reduce operational costs, the need for lighter aircraft has become paramount. Accumulators play a critical role in this context, as their weight directly impacts the overall weight of the aircraft. Innovations in materials and design are enabling the production of lighter accumulators without compromising performance. This trend is reflected in the increasing adoption of composite materials and advanced manufacturing techniques. Market analysis indicates that the demand for lightweight accumulators is expected to grow by approximately 6% over the next few years, as manufacturers align their strategies with the industry's focus on reducing weight and enhancing fuel efficiency.

Regulatory Compliance and Safety Standards

The Aerospace Accumulator Market is significantly influenced by stringent regulatory compliance and safety standards. Regulatory bodies are continuously updating guidelines to ensure the safety and reliability of aerospace components, including accumulators. This has led to increased investments in research and development to meet these evolving standards. Manufacturers are compelled to innovate and enhance their products to comply with regulations, which often results in improved performance and safety features. The market is expected to see a rise in demand for accumulators that meet or exceed these safety standards, as airlines and manufacturers prioritize passenger safety. As a result, the focus on compliance is likely to drive growth in the aerospace accumulator sector, with an estimated increase in market size by 4.5% annually.

Increased Investment in Aerospace Infrastructure

The Aerospace Accumulator Market is poised for growth due to increased investment in aerospace infrastructure. Governments and private entities are allocating substantial resources to enhance airport facilities, manufacturing plants, and research centers. This investment is not only aimed at improving operational efficiency but also at fostering innovation within the aerospace sector. As infrastructure improves, the demand for advanced aerospace components, including accumulators, is likely to rise. Enhanced manufacturing capabilities and research initiatives will lead to the development of more efficient and reliable accumulators. Market forecasts suggest that this trend could result in a compound annual growth rate of around 5.5% for the aerospace accumulator market, driven by the ongoing investments in infrastructure and technology.

Technological Innovations in Aerospace Accumulator Market

The Aerospace Accumulator Market is experiencing a surge in technological innovations that enhance performance and reliability. Advanced materials, such as composite structures and lightweight alloys, are being integrated into accumulator designs, leading to improved efficiency and reduced weight. This shift is crucial as aerospace manufacturers seek to optimize fuel consumption and operational costs. Furthermore, the introduction of smart accumulators equipped with sensors for real-time monitoring is gaining traction. These innovations not only improve safety but also facilitate predictive maintenance, thereby reducing downtime. According to recent data, the market for advanced aerospace accumulators is projected to grow at a compound annual growth rate of approximately 5.2% over the next five years, indicating a robust demand driven by these technological advancements.

.png)