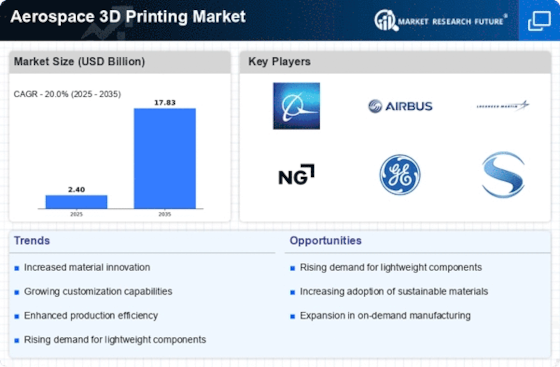

Leading market players are spending a lot of money on R&D to diversify their product offerings, which will drive the aerospace 3D printing market to expand even further. Market participants are also engaging in a range of strategic initiatives to broaden their worldwide reach. Significant market developments include new product launches, contractual agreements, mergers and acquisitions, greater investments, and collaboration with other organizations. Cost-effective products are necessary for the aerospace 3D printing industry to grow and thrive in a more competitive and challenging market environment.

Producing locally to reduce operational costs is one of the most important business strategies utilized by manufacturers in the worldwide aerospace 3D printing industry to benefit customers and expand the market sector. The aerospace 3D printing industry has recently provided some of the most significant benefits to medical. 3D Systems Corporation is a major player in the aerospace 3D printing market (US). Aerojet Rocketdyne (US), Arcam AB (Sweden), Envisiontec GmbH (Germany), EOS GmbH (Germany), Hoganas AB (Sweden), and other firms are expected to let new entrants into the industry in the next years, increasing competition.

The Lockheed Martin Corporation is a multinational aerospace, armaments, military, information security, and technology firm headquartered in the United States.

In March Lockheed Corporation merged with Martin Marietta to become the company. Its headquarters are in North Bethesda, Maryland, near Washington, D.C.

As of January Lockheed Martin employs around 115,000 people worldwide, including approximately 60,000 engineers and scientists.

In September Lockheed Martin announced a partnership with Makerbot to develop 3D printed parts and designs for NASA's AI-assisted Lunar Rover Mission.

In collaboration with General Motors, Lockheed Martin is creating a new completely autonomous lunar rover that might be utilized in NASA's Artemis mission.

An American technology business called Desktop Metal designs and sells 3D printing devices. The Burlington, Massachusetts-based business has received $438 million in venture capital funding since its inception[9][10] from backers including Google Ventures, BMW, and Ford Motor Company.

In April Desktop Metal unveiled its first two products the Production System, a metal 3D printing system geared toward manufacturers and large-scale printing, and the Studio System, a system for engineers and small production runs.

In November 2019, Two new printer systems were introduced by the company the Shop System, which is intended for machine shops, and its Fiber industrial-grade composites printer, which uses automated fiber placement. In 2017, Desktop Metal was recognized as a technology pioneer by the World Economic Forum.