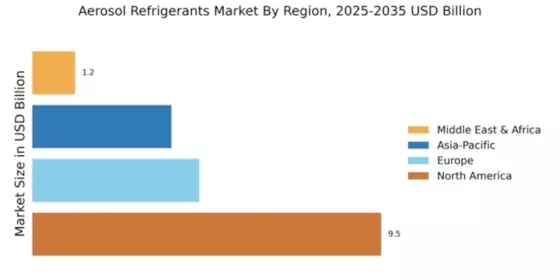

North America : Market Leader in Refrigerants

North America is poised to maintain its leadership in the aerosol refrigerants market, holding a significant share of 9.53 in 2024. The region's growth is driven by increasing demand for eco-friendly refrigerants and stringent regulations aimed at reducing greenhouse gas emissions. The adoption of advanced technologies and rising consumer awareness about sustainable products further bolster market expansion. Regulatory frameworks, such as the Clean Air Act, are pivotal in shaping industry standards and promoting the use of low-GWP refrigerants.

The competitive landscape in North America is characterized by the presence of major players like Honeywell, Chemours, and Air Products and Chemicals. These companies are investing heavily in R&D to innovate and develop new products that meet regulatory requirements. The U.S. and Canada are the leading countries in this region, with a robust distribution network and strong manufacturing capabilities. The market is expected to grow as companies align their strategies with environmental goals and consumer preferences.

Europe : Regulatory-Driven Market Growth

Europe's aerosol refrigerants market is projected to grow significantly, with a market size of 4.56 in 2024. The region's growth is primarily driven by stringent environmental regulations and a strong commitment to sustainability. The European Union's F-Gas Regulation aims to phase down high-GWP refrigerants, creating a favorable environment for low-GWP alternatives. This regulatory push is expected to enhance market dynamics and encourage innovation in eco-friendly refrigerants.

Leading countries in Europe include Germany, France, and the UK, where major players like Arkema and A-Gas are actively involved in developing sustainable solutions. The competitive landscape is marked by collaborations and partnerships aimed at enhancing product offerings. The presence of a well-established manufacturing base and a focus on research and development further strengthen the market position of these companies. As the demand for sustainable refrigerants rises, Europe is set to become a hub for innovation in the aerosol refrigerants sector.

Asia-Pacific : Emerging Market Potential

The Asia-Pacific region is witnessing a burgeoning demand for aerosol refrigerants, with a market size of 3.8 in 2024. This growth is fueled by rapid industrialization, urbanization, and increasing consumer awareness regarding environmental sustainability. Countries like China and India are leading the charge, driven by rising disposable incomes and a growing middle class. Regulatory initiatives aimed at reducing emissions are also contributing to the market's expansion, making it a focal point for investment and innovation.

In this competitive landscape, key players such as Daikin Industries and Mitsubishi Chemical are making significant strides. The presence of these companies, along with local manufacturers, is enhancing the market's competitiveness. As the region continues to develop, the demand for eco-friendly refrigerants is expected to rise, prompting companies to innovate and adapt to changing consumer preferences. The Asia-Pacific market is set to play a crucial role in the global aerosol refrigerants landscape.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa region presents a unique opportunity in the aerosol refrigerants market, with a market size of 1.17 in 2024. The growth in this region is driven by increasing industrial activities and a rising demand for refrigeration in sectors such as food and beverage, healthcare, and automotive. Additionally, the region's commitment to sustainable practices is gradually shaping the market landscape, encouraging the adoption of eco-friendly refrigerants.

Countries like South Africa and the UAE are at the forefront of this market, with local players and international companies exploring opportunities. The competitive landscape is evolving, with investments in infrastructure and technology aimed at enhancing product offerings. As awareness of environmental issues grows, the demand for sustainable refrigerants is expected to increase, positioning the Middle East and Africa as a potential growth hub in the global market.