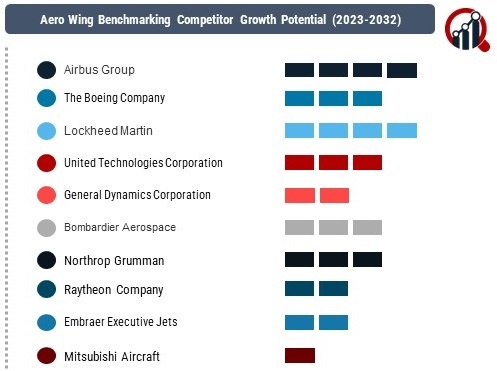

Top Industry Leaders in the Aero Wing Market

Aero Wing Market Outlook

The Competitive Landscape of the Aero Wing Market is vital for understanding the dynamics of the aerospace industry, specifically the segment related to aircraft wings. Examining key players, strategies, and recent developments provides insight into the evolving nature of aero wing technologies.

Key Players:

Airbus Group

The Boeing Company

Lockheed Martin

United Technologies Corporation (UTC)

General Dynamics Corporation

Bombardier Aerospace

Northrop Grumman

Raytheon Company

Embraer Executive Jets

Mitsubishi Aircraft

Strategies Adopted:

The Aero Wing Market deploy various strategies to gain a competitive edge. These strategies include substantial investments in research and development (R&D) to advance wing technologies, strategic collaborations to enhance capabilities, and a focus on innovation. Boeing, for example, emphasizes R&D investments to develop cutting-edge aero wing designs tailored to meet the diverse requirements of modern aircraft. Collaborations between Airbus and key suppliers aim to optimize wing technologies for specific aviation needs, showcasing a collaborative approach to addressing industry demands.

Market Share Analysis:

The Aero Wing Market is influenced by factors such as technological advancement, successful deployment, adaptability to diverse aircraft models, and the ability to provide comprehensive solutions. Companies excelling in delivering high-quality, technologically advanced aero wings, ensuring compliance with aviation standards, and offering solutions adaptable to various aircraft requirements are strategically positioned to capture a larger market share. Establishing strong relationships with aircraft manufacturers, participating in international collaborations, and staying ahead in wing technology development are crucial factors for maintaining a competitive edge.

News & Emerging Companies:

The Aero Wing Market has witnessed the emergence of new companies focused on addressing the demand for innovative and advanced wing technologies. Emerging entrants, such as GKN Aerospace and Spirit AeroSystems, have gained attention for their focus on introducing cutting-edge aero wing solutions. These emerging companies contribute to the market by introducing fresh perspectives and agile approaches to address the evolving demands of aero wing development.

Industry Trends:

The Aero Wing Market underscores ongoing investment trends, with a strong emphasis on improving wing technology, successful deployment, and addressing challenges related to aircraft performance. Companies invest significantly in the development of wing technologies with increased fuel efficiency, aerodynamic enhancements, and advancements in materials and manufacturing processes. Successful deployment milestones, including the integration of aero wings with existing aircraft structures, reflect the industry's response to the need for versatile and effective wing systems. Investments in addressing the challenges of aircraft performance, cost-effectiveness, and sustainability underscore the commitment to improving overall viability in the development and deployment of aero wings.

Competitive Scenario:

The Aero Wing Market is characterized by intense competition among established players and the entry of innovative newcomers. With aircraft manufacturers increasingly prioritizing aerodynamic efficiency and performance, companies aim to differentiate themselves by offering comprehensive solutions that address the challenges of modern aviation requirements. Established players focus on refining their aero wing designs, expanding their market presence through strategic collaborations with aircraft manufacturers, and staying informed about emerging technologies and regulatory requirements. The entry of emerging companies adds dynamism to the market, fostering an environment of continuous improvement and responsiveness to the changing demands of aero wing development.

Recent Development

The Aero Wing Market witnessed a significant development as Lockheed Martin announced the successful testing of its advanced aero wing design for next-generation aircraft. The test marked a crucial milestone in aero wing capabilities, showcasing the design's enhanced features, including improved aerodynamics and fuel efficiency. This development underscores Lockheed Martin's commitment to advancing wing technologies and reinforces its position as a key player in the market. The successful testing is expected to contribute to the overall advancement of aero wing systems, offering improved capabilities for next-generation aircraft. The announcement reflects the industry's continuous efforts to evolve and provide cutting-edge solutions that address the challenges posed by the dynamic aviation landscape, emphasizing the importance of advanced aero wing technologies in shaping the future of aircraft capabilities.