-

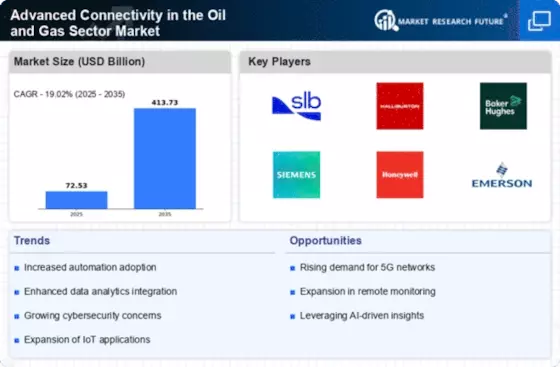

EXECUTIVE SUMMARY

-

Market Attractiveness Analysis

- Global Advanced Connectivity in the Oil & Gas Sector Market, by Assets Type

- Global Advanced Connectivity in the Oil & Gas Sector Market, by Connectivity

- Global Advanced Connectivity in the Oil & Gas Sector Market, by Application

- Global Advanced Connectivity in the Oil & Gas Sector Market, by Region

-

MARKET INTRODUCTION

-

Definition

-

Scope of the Study

-

Market Structure

-

Key Buying Criteria

-

Macro Factor Indicator Analysis

-

RESEARCH METHODOLOGY

-

Research Process

-

Primary Research

-

Secondary Research

-

Market Size Estimation

-

Forecast Model

-

List of Assumptions

-

MARKET DYNAMICS

-

Introduction

-

Drivers

- Governments are increasingly requiring oil and gas companies to collect and store data to comply with regulations

- Growing demand for crude oil & gas

- Driver impact analysis

-

Restraints

- Advanced Connectivity in the Oil & Gas Sector can increase the risk of cyberattacks

- Expensive to deploy and maintain

- Restraint impact analysis

-

Opportunities

- Increase in the investment towards connectivity technology in oil & gas industry.

- Advanced Connectivity in the Oil & Gas Sector can be used to improve the efficiency of operations

-

Covid-19 Impact Analysis

- Impact on surge in economies

- Impact on Advanced Connectivity in the Oil & Gas Sector

- YOY growth 2020-202

-

COVID-19 IMPACT ON SUPPLY CHAIN MARKET FACTOR ANALYSIS

-

Value Chain Analysis/Supply Chain Analysis

-

Porter’s Five Forces Model

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of New Entrants

- Threat of Substitutes

- Intensity of Rivalry

-

GLOBAL ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY ASSETS TYPE

-

Introduction

-

Onshore

-

Offshore

-

GLOBAL ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY CONNECTIVITY

-

Introduction

-

Cellular

-

Low-Earth orbit (LEO) satellites

-

Wireline/Fixed

-

Shortrange

-

LPWAN

-

Wireless Low-Power Networks

-

Optical fiber

-

Others

-

GLOBAL ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY APPLICATION

-

Introduction

-

Remote monitoring and control

-

Real-time data analytics

-

Virtual reality (VR) and augmented reality (AR)

-

Others

-

GLOBAL ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET SIZE ESTIMATION & FORECAST, BY REGION

-

Introduction

-

North America

- Market Estimates & Forecast, by Country, 2018-2032

- Market Estimates & Forecast, by Assets Type, 2018-2032

- Market Estimates & Forecast, by Connectivity, 2018-2032

- Market Estimates & Forecast, by Application, 2018-2032

- US

- Canada

- Mexico

-

Europe

- Market Estimates & Forecast, by Country, 2018-2032

- Market Estimates & Forecast, by Assets Type, 2018-2032

- Market Estimates & Forecast, by Connectivity, 2018-2032

- Market Estimates & Forecast, by Application, 2018-2032

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

-

Asia-Pacific

- Market Estimates & Forecast, by Country, 2018-2032

- Market Estimates & Forecast, by Assets Type, 2018-2032

- Market Estimates & Forecast, by Connectivity, 2018-2032

- Market Estimates & Forecast, by Application, 2018-2032

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

-

Middle East & Africa

- Market Estimates & Forecast, by Country, 2018-2032

- Market Estimates & Forecast, by Assets Type, 2018-2032

- Market Estimates & Forecast, by Connectivity, 2018-2032

- Market Estimates & Forecast, by Application, 2018-2032

- Saudi Arabia

- UAE

- South Africa

- Rest of the Middle East & Africa

-

South America

- Market Estimates & Forecast, by Country, 2018-2032

- Market Estimates & Forecast, by Assets Type, 2018-2032

- Market Estimates & Forecast, by Connectivity, 2018-2032

- Market Estimates & Forecast, by Application, 2018-2032

- Brazil

- Argentina

- Chile

- Rest of South America

-

COMPETITIVE LANDSCAPE

-

Introduction

-

Key Developments & Growth Strategies

-

Competitor Benchmarking

-

Vendor Share Analysis, 2022(% Share)

-

COMPANY PROFILES

-

ABB

- Company Overview

- Financial Overview

- Solution/Services Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Air Liquide Engineering & Construction

-

AspenTech

-

Aveva

-

BASF

-

BD Energy

-

Chevron Lummus Global

-

DuPont

-

ExxonMobil

-

Evonik

-

Fluor

-

Grace

-

Honeywell

-

Huawei

-

KBR

-

Kinetics Technology

-

Linde

-

Lummus Technology

-

-

LIST OF TABLES

-

MARKET SYNOPSIS

-

GLOBAL ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY ASSETS TYPE, 2018–2032 (USD BILLION)

-

GLOBAL ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY CONNECTIVITY, 2018–2032 (USD BILLION)

-

GLOBAL ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY APPLICATION, 2018–2032 (USD BILLION)

-

GLOBAL ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY REGION, 2018–2032 (USD BILLION)

-

NORTH AMERICA ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY COUNTRY, 2018–2032 (USD BILLION)

-

NORTH AMERICA ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY ASSETS TYPE, 2018–2032 (USD BILLION)

-

NORTH AMERICA ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY CONNECTIVITY, 2018–2032 (USD BILLION)

-

NORTH AMERICA ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY APPLICATION, 2018–2032 (USD BILLION)

-

US ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY ASSETS TYPE, 2018–2032 (USD BILLION)

-

US ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY CONNECTIVITY, 2018–2032 (USD BILLION)

-

US ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY APPLICATION, 2018–2032 (USD BILLION)

-

CANADA ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY ASSETS TYPE, 2018–2032 (USD BILLION)

-

CANADA ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY CONNECTIVITY, 2018–2032 (USD BILLION)

-

CANADA ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY APPLICATION, 2018–2032 (USD BILLION)

-

MEXICO ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY ASSETS TYPE, 2018–2032 (USD BILLION)

-

MEXICO ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY CONNECTIVITY, 2018–2032 (USD BILLION)

-

MEXICO ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY APPLICATION, 2018–2032 (USD BILLION)

-

EUROPE ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY COUNTRY, 2018–2032 (USD BILLION)

-

EUROPE ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY ASSETS TYPE, 2018–2032 (USD BILLION)

-

EUROPE ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY CONNECTIVITY, 2018–2032 (USD BILLION)

-

EUROPE ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY APPLICATION, 2018–2032 (USD BILLION)

-

UK ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY ASSETS TYPE, 2018–2032 (USD BILLION)

-

UK ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY CONNECTIVITY, 2018–2032 (USD BILLION)

-

UK ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY APPLICATION, 2018–2032 (USD BILLION)

-

GERMANY ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY ASSETS TYPE, 2018–2032 (USD BILLION)

-

GERMANY ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY CONNECTIVITY, 2018–2032 (USD BILLION)

-

GERMANY ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY APPLICATION, 2018–2032 (USD BILLION)

-

FRANCE ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY ASSETS TYPE, 2018–2032 (USD BILLION)

-

FRANCE ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY CONNECTIVITY, 2018–2032 (USD BILLION)

-

FRANCE ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY APPLICATION, 2018–2032 (USD BILLION)

-

SPAIN ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY ASSETS TYPE, 2018–2032 (USD BILLION)

-

SPAIN ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY CONNECTIVITY, 2018–2032 (USD BILLION)

-

SPAIN ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY APPLICATION, 2018–2032 (USD BILLION)

-

ITALY ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY ASSETS TYPE, 2018–2032 (USD BILLION)

-

ITALY ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY CONNECTIVITY, 2018–2032 (USD BILLION)

-

ITALY ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY APPLICATION, 2018–2032 (USD BILLION)

-

REST OF EUROPE ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY ASSETS TYPE, 2018–2032 (USD BILLION)

-

REST OF EUROPE ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY CONNECTIVITY, 2018–2032 (USD BILLION)

-

REST OF EUROPE ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY APPLICATION, 2018–2032 (USD BILLION)

-

ASIA-PACIFIC ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY COUNTRY, 2018–2032 (USD BILLION)

-

ASIA-PACIFIC ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY ASSETS TYPE, 2018–2032 (USD BILLION)

-

ASIA-PACIFIC ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY CONNECTIVITY, 2018–2032 (USD BILLION)

-

ASIA-PACIFIC ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY APPLICATION, 2018–2032 (USD BILLION)

-

CHINA ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY ASSETS TYPE, 2018–2032 (USD BILLION)

-

CHINA ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY CONNECTIVITY, 2018–2032 (USD BILLION)

-

CHINA ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY APPLICATION, 2018–2032 (USD BILLION)

-

JAPAN ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY ASSETS TYPE, 2018–2032 (USD BILLION)

-

JAPAN ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY CONNECTIVITY, 2018–2032 (USD BILLION)

-

JAPAN ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY APPLICATION, 2018–2032 (USD BILLION)

-

INDIA ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY ASSETS TYPE, 2018–2032 (USD BILLION)

-

INDIA ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY CONNECTIVITY, 2018–2032 (USD BILLION)

-

INDIA ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY APPLICATION, 2018–2032 (USD BILLION)

-

SOUTH KOREA ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY ASSETS TYPE, 2018–2032 (USD BILLION)

-

SOUTH KOREA ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY CONNECTIVITY, 2018–2032 (USD BILLION)

-

SOUTH KOREA ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY APPLICATION, 2018–2032 (USD BILLION)

-

REST OF ASIA-PACIFIC ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY ASSETS TYPE, 2018–2032 (USD BILLION)

-

REST OF ASIA-PACIFIC ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY CONNECTIVITY, 2018–2032 (USD BILLION)

-

REST OF ASIA-PACIFIC ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY APPLICATION, 2018–2032 (USD BILLION)

-

MIDDLE EAST & AFRICA ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY COUNTRY, 2018–2032 (USD BILLION)

-

MIDDLE EAST & AFRICA ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY ASSETS TYPE, 2018–2032 (USD BILLION)

-

MIDDLE EAST & AFRICA ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY CONNECTIVITY, 2018–2032 (USD BILLION)

-

MIDDLE EAST & AFRICA ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY APPLICATION, 2018–2032 (USD BILLION)

-

SAUDI ARABIA ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY ASSETS TYPE, 2018–2032 (USD BILLION)

-

SAUDI ARABIA ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY CONNECTIVITY, 2018–2032 (USD BILLION)

-

SAUDI ARABIA ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY APPLICATION, 2018–2032 (USD BILLION)

-

UAE ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY ASSETS TYPE, 2018–2032 (USD BILLION)

-

UAE ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY CONNECTIVITY, 2018–2032 (USD BILLION)

-

UAE ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY APPLICATION, 2018–2032 (USD BILLION)

-

SOUTH AFRICA ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY ASSETS TYPE, 2018–2032 (USD BILLION)

-

SOUTH AFRICA ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY CONNECTIVITY, 2018–2032 (USD BILLION)

-

SOUTH AFRICA ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY APPLICATION, 2018–2032 (USD BILLION)

-

REST OF THE MIDDLE EAST & AFRICA ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY ASSETS TYPE, 2018–2032 (USD BILLION)

-

REST OF THE MIDDLE EAST & AFRICA ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY CONNECTIVITY, 2018–2032 (USD BILLION)

-

REST OF THE MIDDLE EAST & AFRICA ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY APPLICATION, 2018–2032 (USD BILLION)

-

SOUTH AMERICA ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY COUNTRY, 2018–2032 (USD BILLION)

-

SOUTH AMERICA ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY ASSETS TYPE, 2018–2032 (USD BILLION)

-

SOUTH AMERICA ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY CONNECTIVITY, 2018–2032 (USD BILLION)

-

SOUTH AMERICA ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY APPLICATION, 2018–2032 (USD BILLION)

-

BRAZIL ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY ASSETS TYPE, 2018–2032 (USD BILLION)

-

BRAZIL ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY CONNECTIVITY, 2018–2032 (USD BILLION)

-

BRAZIL ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY APPLICATION, 2018–2032 (USD BILLION)

-

ARGENTINA ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY ASSETS TYPE, 2018–2032 (USD BILLION)

-

ARGENTINA ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY CONNECTIVITY, 2018–2032 (USD BILLION)

-

ARGENTINA ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY APPLICATION, 2018–2032 (USD BILLION)

-

CHILE ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY ASSETS TYPE, 2018–2032 (USD BILLION)

-

CHILE ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY CONNECTIVITY, 2018–2032 (USD BILLION)

-

CHILE ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY APPLICATION, 2018–2032 (USD BILLION)

-

REST OF THE SOUTH AMERICA ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY ASSETS TYPE, 2018–2032 (USD BILLION)

-

REST OF THE SOUTH AMERICA ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY CONNECTIVITY, 2018–2032 (USD BILLION)

-

REST OF THE SOUTH AMERICA ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY APPLICATION, 2018–2032 (USD BILLION)

-

BUSINESS EXPANSIONS/PRODUCT LAUNCHES

-

PARTNERSHIPS/AGREEMENTS/CONTRACTS/COLLABORATIONS

-

ACQUISITIONS/MERGERS

-

ABB : PRODUCTS OFFERED

-

ABB : KEY DEVELOPMENT

-

AIR LIQUIDE ENGINEERING & CONSTRUCTION : PRODUCTS OFFERED

-

AIR LIQUIDE ENGINEERING & CONSTRUCTION : KEY DEVELOPMENT

-

ASPENTECH : PRODUCTS OFFERED

-

ASPENTECH : KEY DEVELOPMENT

-

AVEVA : PRODUCTS OFFERED

-

AVEVA : KEY DEVELOPMENT

-

BASF : PRODUCTS OFFERED

-

BASF : KEY DEVELOPMENT

-

BD ENERGY : PRODUCTS OFFERED

-

BD ENERGY : KEY DEVELOPMENT

-

CHEVRON LUMMUS GLOBAL : PRODUCTS OFFERED

-

CHEVRON LUMMUS GLOBAL : KEY DEVELOPMENT

-

DUPONT : PRODUCTS OFFERED

-

DUPONT : KEY DEVELOPMENT

-

EXXONMOBIL : PRODUCTS OFFERED

-

EXXONMOBIL : KEY DEVELOPMENT

-

EVONIK : PRODUCTS OFFERED

-

EVONIK : KEY DEVELOPMENT

-

FLUOR : PRODUCTS OFFERED

-

FLUOR : KEY DEVELOPMENT

-

GRACE : PRODUCTS OFFERED

-

GRACE : KEY DEVELOPMENT

-

HONEYWELL : PRODUCTS OFFERED

-

HONEYWELL : KEY DEVELOPMENT

-

HUAWEI : PRODUCTS OFFERED

-

HUAWEI : KEY DEVELOPMENT

-

KBR : PRODUCTS OFFERED

-

KBR : KEY DEVELOPMENT

-

KINETICS TECHNOLOGY : PRODUCTS OFFERED

-

KINETICS TECHNOLOGY : KEY DEVELOPMENT

-

LINDE : PRODUCTS OFFERED

-

LINDE : KEY DEVELOPMENT

-

LUMMUS TECHNOLOGY : PRODUCTS OFFERED

-

LUMMUS TECHNOLOGY : KEY DEVELOPMENT

-

-

LIST OF FIGURES

-

MARKET ATTRACTIVENESS ANALYSIS: GLOBAL ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET

-

GLOBAL ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET: MARKET STRUCTURE

-

BOTTOM-UP AND TOP-DOWN APPROACHES

-

NORTH AMERICA: ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET SIZE (USD BILLION) & MARKET SHARE (%), BY COUNTRY (2022 VS 2032)

-

EUROPE: ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET SIZE (USD BILLION) & MARKET SHARE (%), BY COUNTRY (2022 VS 2032)

-

ASIA–PACIFIC: ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET SIZE (USD BILLION) & MARKET SHARE (%), BY COUNTRY (2022 VS 2032)

-

MIDDLE EAST & AFRICA: ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET SIZE (USD BILLION) & MARKET SHARE (%), BY COUNTRY (2022 VS 2032)

-

SOUTH AMERICA: ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET SIZE (USD BILLION) & MARKET SHARE (%), BY COUNTRY (2022 VS 2032)

-

GLOBAL ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET SIZE (USD BILLION) & MARKET SHARE (%), BY ASSETS TYPE (2022 VS 2032)

-

GLOBAL ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET SIZE (USD BILLION) & MARKET SHARE (%), BY CONNECTIVITY (2022 VS 2032)

-

GLOBAL ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET SIZE (USD BILLION) & MARKET SHARE (%), BY APPLICATION (2022 VS 2032)

-

MARKET DYNAMIC ANALYSIS OF THE GLOBAL ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET

-

DRIVER IMPACT ANALYSIS

-

RESTRAINT IMPACT ANALYSIS

-

VALUE CHAIN: GLOBAL ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET

-

PORTER''S FIVE FORCES ANALYSIS OF THE GLOBAL ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET

-

GLOBAL ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY ASSETS TYPE, 2022 (% SHARE)

-

GLOBAL ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY ASSETS TYPE, 2022 VS 2032 (USD BILLION)

-

GLOBAL ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY CONNECTIVITY, 2022 (% SHARE)

-

GLOBAL ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY CONNECTIVITY, 2022 VS 2032 (USD BILLION)

-

GLOBAL ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY APPLICATION, 2022 (% SHARE)

-

GLOBAL ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY APPLICATION, 2022 VS 2032 (USD BILLION)

-

GLOBAL ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY REGION, 2022 (% SHARE)

-

GLOBAL ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY REGION, 2022 VS 2032 (USD BILLION)

-

NORTH AMERICA ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY COUNTRY, 2022 (% SHARE)

-

NORTH AMERICA ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY COUNTRY, 2022 VS 2032 (USD BILLION)

-

NORTH AMERICA ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY ASSETS TYPE, 2022-2032 (USD BILLION)

-

NORTH AMERICA ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY CONNECTIVITY, 2022-2032 (USD BILLION)

-

NORTH AMERICA ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY APPLICATION, 2022-2032 (USD BILLION)

-

EUROPE ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY COUNTRY, 2022 (% SHARE)

-

EUROPE ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY COUNTRY, 2022 VS 2032 (USD BILLION)

-

EUROPE ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY ASSETS TYPE, 2022-2032 (USD BILLION)

-

EUROPE ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY CONNECTIVITY, 2022-2032 (USD BILLION)

-

EUROPE ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY APPLICATION, 2022-2032 (USD BILLION)

-

ASIA-PACIFIC ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY COUNTRY, 2022 (% SHARE)

-

ASIA-PACIFIC ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY COUNTRY, 2022 VS 2032 (USD BILLION)

-

ASIA-PACIFIC ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY ASSETS TYPE, 2022-2032 (USD BILLION)

-

ASIA-PACIFIC ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY CONNECTIVITY, 2022-2032 (USD BILLION)

-

ASIA-PACIFIC ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY APPLICATION, 2022-2032 (USD BILLION)

-

MIDDLE EAST & AFRICA ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY COUNTRY, 2022 (% SHARE)

-

MIDDLE EAST & AFRICA ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY COUNTRY, 2022 VS 2032 (USD BILLION)

-

MIDDLE EAST & AFRICA ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY ASSETS TYPE, 2022-2032 (USD BILLION)

-

MIDDLE EAST & AFRICA ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY CONNECTIVITY, 2022-2032 (USD BILLION)

-

MIDDLE EAST & AFRICA ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY APPLICATION, 2022-2032 (USD BILLION)

-

SOUTH AMERICA ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY COUNTRY, 2022 (% SHARE)

-

SOUTH AMERICA ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY COUNTRY, 2022 VS 2032 (USD BILLION)

-

SOUTH AMERICA ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY ASSETS TYPE, 2022-2032 (USD BILLION)

-

SOUTH AMERICA ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY CONNECTIVITY, 2022-2032 (USD BILLION)

-

SOUTH AMERICA ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET, BY APPLICATION, 2022-2032 (USD BILLION)

-

GLOBAL ADVANCED CONNECTIVITY IN THE OIL & GAS SECTOR MARKET: COMPETITIVE BENCHMARKING

-

VENDOR SHARE ANALYSIS (2022) (%)

-

ABB : FINANCIAL OVERVIEW SNAPSHOT

-

ABB : SWOT ANALYSIS

-

AIR LIQUIDE ENGINEERING & CONSTRUCTION : FINANCIAL OVERVIEW SNAPSHOT

-

AIR LIQUIDE ENGINEERING & CONSTRUCTION : SWOT ANALYSIS

-

ASPENTECH : FINANCIAL OVERVIEW SNAPSHOT

-

ASPENTECH : SWOT ANALYSIS

-

AVEVA : FINANCIAL OVERVIEW SNAPSHOT

-

AVEVA : SWOT ANALYSIS

-

BASF : FINANCIAL OVERVIEW SNAPSHOT

-

BASF : SWOT ANALYSIS

-

BD ENERGY : FINANCIAL OVERVIEW SNAPSHOT

-

BD ENERGY : SWOT ANALYSIS

-

CHEVRON LUMMUS GLOBAL : FINANCIAL OVERVIEW SNAPSHOT

-

CHEVRON LUMMUS GLOBAL : SWOT ANALYSIS

-

DUPONT : FINANCIAL OVERVIEW SNAPSHOT

-

DUPONT : SWOT ANALYSIS

-

EXXONMOBIL : FINANCIAL OVERVIEW SNAPSHOT

-

EXXONMOBIL : SWOT ANALYSIS

-

EVONIK : FINANCIAL OVERVIEW SNAPSHOT

-

EVONIK : SWOT ANALYSIS

-

FLUOR : FINANCIAL OVERVIEW SNAPSHOT

-

FLUOR : SWOT ANALYSIS

-

GRACE : FINANCIAL OVERVIEW SNAPSHOT

-

GRACE : SWOT ANALYSIS

-

HONEYWELL : FINANCIAL OVERVIEW SNAPSHOT

-

HONEYWELL : SWOT ANALYSIS

-

HUAWEI : FINANCIAL OVERVIEW SNAPSHOT

-

HUAWEI : SWOT ANALYSIS

-

KBR : FINANCIAL OVERVIEW SNAPSHOT

-

KBR : SWOT ANALYSIS

-

KINETICS TECHNOLOGY : FINANCIAL OVERVIEW SNAPSHOT

-

KINETICS TECHNOLOGY : SWOT ANALYSIS

-

LINDE : FINANCIAL OVERVIEW SNAPSHOT

-

LINDE : SWOT ANALYSIS

-

LUMMUS TECHNOLOGY : FINANCIAL OVERVIEW SNAPSHOT

-

LUMMUS TECHNOLOGY : SWOT ANALYSIS

Leave a Comment