Increasing Cybersecurity Threats

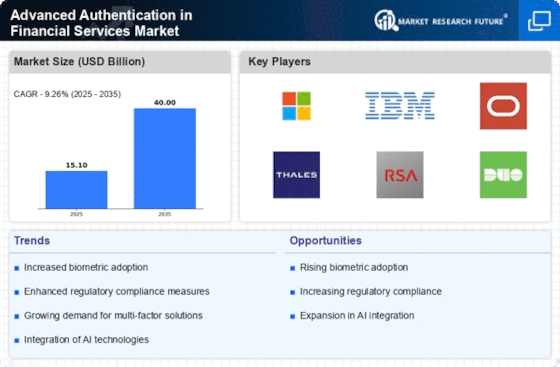

The Advanced Authentication in Financial Services Market is experiencing a surge in demand due to the escalating frequency and sophistication of cyber threats. Financial institutions are increasingly targeted by cybercriminals, leading to substantial financial losses and reputational damage. In response, organizations are investing heavily in advanced authentication solutions to safeguard sensitive customer data and transactions. According to recent data, the financial sector has reported a 30% increase in cyberattacks over the past year, prompting a shift towards more robust authentication methods. This trend indicates a growing recognition of the need for enhanced security measures, thereby driving the adoption of advanced authentication technologies.

Regulatory Pressures and Compliance

The Advanced Authentication in Financial Services Market is significantly influenced by regulatory pressures aimed at enhancing security protocols within the financial sector. Governments and regulatory bodies are increasingly mandating stringent compliance measures to protect consumer data and prevent fraud. For instance, regulations such as the General Data Protection Regulation (GDPR) and the Payment Services Directive 2 (PSD2) have set high standards for authentication processes. Financial institutions are compelled to invest in advanced authentication technologies to ensure compliance, thereby driving market growth. The need to avoid hefty fines and maintain customer trust is propelling organizations to adopt innovative authentication solutions that align with these regulatory frameworks.

Consumer Demand for Enhanced Security

Consumer expectations regarding security in financial transactions are evolving, significantly influencing the Advanced Authentication in Financial Services Market. As individuals become more aware of the risks associated with online banking and digital payments, they are demanding stronger authentication measures. Surveys indicate that over 70% of consumers express a preference for biometric authentication methods, such as fingerprint or facial recognition, over traditional passwords. This shift in consumer behavior is compelling financial institutions to adopt advanced authentication solutions that not only meet regulatory requirements but also enhance user experience. Consequently, the market is witnessing a robust growth trajectory as organizations strive to align their security offerings with consumer expectations.

Technological Advancements in Authentication

Technological innovations are playing a pivotal role in shaping the Advanced Authentication in Financial Services Market. The integration of cutting-edge technologies such as artificial intelligence, machine learning, and blockchain is revolutionizing authentication processes. These advancements enable financial institutions to implement more secure and efficient authentication methods, reducing the risk of fraud. For example, AI-driven analytics can identify unusual transaction patterns, prompting additional authentication measures when necessary. As these technologies continue to evolve, they are likely to enhance the effectiveness of authentication solutions, thereby driving their adoption across the financial sector. This trend suggests a promising future for the market as organizations seek to leverage technology for improved security.

Rise of Digital Banking and Fintech Solutions

The proliferation of digital banking and fintech solutions is significantly impacting the Advanced Authentication in Financial Services Market. As more consumers shift towards online banking and mobile payment platforms, the demand for secure authentication methods has intensified. Fintech companies, in particular, are at the forefront of adopting advanced authentication technologies to differentiate themselves in a competitive landscape. Data indicates that the digital banking sector is expected to grow by over 20% annually, further emphasizing the need for robust authentication solutions. This growth trajectory is likely to drive innovation and investment in advanced authentication technologies, as financial institutions strive to enhance security while providing seamless user experiences.