Aging Population

The aging population is a primary driver of the adult incontinence products Market. As life expectancy increases, a larger segment of the population experiences age-related health issues, including incontinence. It is estimated that by 2030, the number of individuals aged 60 and above will reach 1.4 billion, significantly impacting the demand for adult incontinence products. This demographic shift necessitates innovative solutions to cater to the needs of older adults, thereby propelling market growth. Furthermore, the prevalence of chronic conditions associated with aging, such as diabetes and neurological disorders, further contributes to the rising demand for these products. Consequently, manufacturers are focusing on developing specialized products that address the unique requirements of this demographic, enhancing comfort and usability.

E-commerce Expansion

E-commerce expansion is transforming the Adult Incontinence Products Market by providing consumers with convenient access to a wide range of products. The rise of online shopping platforms has made it easier for individuals to purchase incontinence products discreetly and efficiently. This trend is particularly beneficial for those who may feel embarrassed about buying these products in physical stores. E-commerce platforms often offer competitive pricing and a broader selection, catering to diverse consumer needs. Additionally, the COVID-19 pandemic has accelerated the shift towards online shopping, with many consumers now preferring the convenience of home delivery. As e-commerce continues to grow, it is expected to play a significant role in shaping the future of the adult incontinence products market.

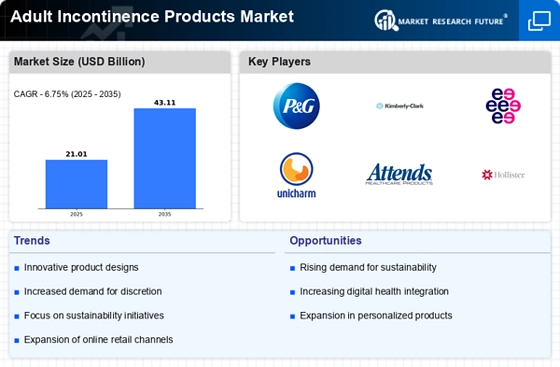

Innovative Product Development

Innovative product development plays a pivotal role in shaping the Adult Incontinence Products Market. Manufacturers are increasingly investing in research and development to create advanced products that offer enhanced comfort, discretion, and absorbency. Recent innovations include the introduction of breathable materials, odor control technologies, and customizable sizing options. These advancements not only improve user experience but also attract a broader consumer base. The market is witnessing a shift towards eco-friendly products, with companies exploring sustainable materials to appeal to environmentally conscious consumers. As a result, the introduction of innovative products is expected to drive market growth, as consumers seek solutions that align with their lifestyle preferences and values.

Rising Awareness and Education

Rising awareness and education regarding incontinence issues significantly contribute to the growth of the Adult Incontinence Products Market. Increased public discourse and educational campaigns have helped destigmatize incontinence, encouraging individuals to seek solutions. Healthcare professionals are also playing a vital role in educating patients about available products and management options. This heightened awareness is leading to increased product adoption, as individuals become more informed about the benefits of using incontinence products. Furthermore, the availability of information through various channels, including online platforms, has empowered consumers to make informed choices. As awareness continues to grow, the market is likely to expand, driven by a more educated consumer base.

Increased Healthcare Expenditure

Increased healthcare expenditure is another crucial driver influencing the Adult Incontinence Products Market. As countries allocate more resources to healthcare, there is a corresponding rise in the availability and accessibility of incontinence products. For instance, healthcare spending has been on an upward trajectory, with many nations investing in preventive care and management of chronic conditions. This trend is likely to enhance the distribution and affordability of adult incontinence products, making them more accessible to those in need. Additionally, healthcare policies that promote the use of incontinence products as part of comprehensive care plans further stimulate market growth. The integration of these products into healthcare systems underscores their importance in improving the quality of life for individuals suffering from incontinence.