Increased Enrollment Rates

The rise in enrollment rates across various educational sectors is significantly influencing the Admission Management Software Market. As more students seek higher education, institutions are challenged to manage larger volumes of applications efficiently. This surge in applications necessitates robust admission management solutions that can handle increased workloads without compromising on quality. Data suggests that institutions with effective admission software can manage up to 50% more applications than those relying on traditional methods. Consequently, the demand for sophisticated admission management systems is likely to grow, as institutions strive to maintain high standards of service while accommodating a diverse applicant pool. This trend underscores the critical role of technology in supporting educational growth and accessibility.

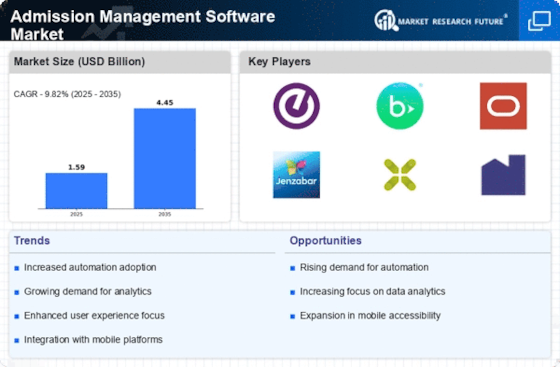

Rising Demand for Automation

The increasing demand for automation in educational institutions is a primary driver of the Admission Management Software Market. Educational institutions are seeking to streamline their admission processes, reduce manual errors, and enhance operational efficiency. Automation allows for quicker processing of applications, which is crucial in a competitive educational landscape. According to recent data, institutions that have adopted automated admission systems report a 30% reduction in processing time. This trend indicates a shift towards more efficient management practices, as schools and universities aim to attract a larger pool of applicants. The Admission Management Software Market is thus experiencing growth as institutions invest in solutions that facilitate automation, ultimately leading to improved student experiences and institutional effectiveness.

Growing Emphasis on Data Analytics

The growing emphasis on data analytics within educational institutions is a significant driver of the Admission Management Software Market. Institutions are increasingly leveraging data to make informed decisions regarding admissions strategies, applicant profiling, and enrollment forecasting. By utilizing advanced analytics, schools can identify trends and patterns that inform their recruitment efforts, ultimately enhancing their competitive edge. Reports indicate that institutions employing data-driven strategies see a 25% increase in successful enrollments. This trend highlights the importance of integrating analytics capabilities into admission management software, as institutions seek to optimize their processes and outcomes. The Admission Management Software Market is thus evolving to incorporate sophisticated analytics tools that empower institutions to harness the power of data.

Shift Towards Cloud-Based Solutions

The transition towards cloud-based solutions is reshaping the Admission Management Software Market. Educational institutions are increasingly adopting cloud technology due to its scalability, cost-effectiveness, and ease of access. Cloud-based admission management systems allow institutions to manage applications from anywhere, facilitating remote work and collaboration among staff. Recent statistics indicate that the adoption of cloud solutions in education has grown by over 40% in the past few years. This shift not only enhances operational flexibility but also ensures that institutions can quickly adapt to changing needs and demands. As more educational entities recognize the benefits of cloud technology, the Admission Management Software Market is poised for continued expansion, driven by the need for modern, adaptable solutions.

Regulatory Compliance and Standardization

Regulatory compliance and standardization requirements are becoming increasingly critical in the Admission Management Software Market. Educational institutions must adhere to various regulations regarding data protection, privacy, and admission practices. As these regulations evolve, institutions are compelled to adopt software solutions that ensure compliance and mitigate risks associated with non-compliance. The demand for admission management systems that incorporate compliance features is on the rise, as institutions seek to protect sensitive applicant information and maintain their reputations. Data indicates that institutions that prioritize compliance are less likely to face legal challenges, which can be detrimental to their operations. Consequently, the Admission Management Software Market is witnessing growth as institutions invest in solutions that not only streamline admissions but also safeguard against regulatory pitfalls.