Growth of the Automotive Sector

The automotive sector significantly influences the Global Additive Masterbatch Market Industry, as manufacturers increasingly utilize additive masterbatches to enhance the performance and aesthetics of automotive components. Additives such as UV stabilizers and colorants are essential for improving the durability and visual appeal of automotive parts. With the automotive industry projected to expand, the demand for high-performance materials is likely to rise. This trend is further supported by the increasing production of electric vehicles, which often require specialized materials for lightweight and energy-efficient designs. The market's growth trajectory aligns with the overall expansion of the automotive sector, contributing to the anticipated market value of 5.16 USD Billion by 2035.

Expansion of the Construction Industry

The construction industry serves as a critical driver for the Global Additive Masterbatch Market Industry, as the demand for high-performance building materials continues to rise. Additive masterbatches are increasingly employed in the production of construction materials to enhance properties such as fire resistance, UV stability, and impact resistance. As urbanization accelerates globally, the need for innovative construction solutions becomes paramount. For example, the incorporation of additives in PVC and other polymers used in construction applications can significantly improve their longevity and performance. This trend is expected to bolster the market, as construction activities expand in emerging economies.

Rising Demand for Sustainable Packaging

The Global Additive Masterbatch Market Industry experiences a notable increase in demand for sustainable packaging solutions. As environmental concerns escalate, manufacturers are increasingly adopting biodegradable and recyclable materials. This shift is driven by consumer preferences for eco-friendly products, prompting companies to innovate with additive masterbatches that enhance the properties of sustainable polymers. For instance, the incorporation of additives can improve the mechanical strength and barrier properties of biodegradable plastics, making them more viable for packaging applications. The market is projected to reach 2.5 USD Billion in 2024, reflecting a growing commitment to sustainability in the packaging sector.

Increased Focus on Product Customization

The Global Additive Masterbatch Market Industry is witnessing a surge in demand for customized solutions tailored to specific applications. Manufacturers are increasingly seeking additive masterbatches that can meet unique performance criteria, such as specific color matching or enhanced functional properties. This trend is particularly evident in sectors like consumer goods and packaging, where differentiation is crucial. Companies are investing in research and development to create bespoke formulations that cater to diverse customer needs. As a result, the market is likely to experience robust growth, driven by the increasing emphasis on product customization across various industries.

Technological Advancements in Masterbatch Production

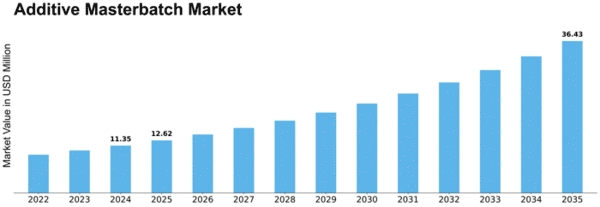

Technological advancements play a pivotal role in shaping the Global Additive Masterbatch Market Industry. Innovations in production techniques, such as the development of more efficient extrusion processes and the use of advanced compounding technologies, enhance the quality and performance of additive masterbatches. These advancements allow for better dispersion of additives within the polymer matrix, resulting in improved product characteristics. Furthermore, the introduction of smart additives that respond to environmental stimuli is gaining traction. As a result, the market is expected to witness a compound annual growth rate of 6.81% from 2025 to 2035, driven by these technological improvements.

Leave a Comment