Expansion of Application Areas

The expansion of application areas is a significant driver for the Additive Manufacturing and Material Market. Industries such as aerospace, automotive, and healthcare are increasingly recognizing the potential of additive manufacturing for producing complex components and prototypes. For instance, the aerospace sector is projected to account for a substantial share of the additive manufacturing market, with estimates suggesting it could reach 3 billion USD by 2025. This diversification into new applications not only broadens the market scope but also encourages innovation in material development. As more sectors explore the benefits of additive manufacturing, the Additive Manufacturing and Material Market is expected to experience robust growth, fueled by the demand for advanced manufacturing solutions.

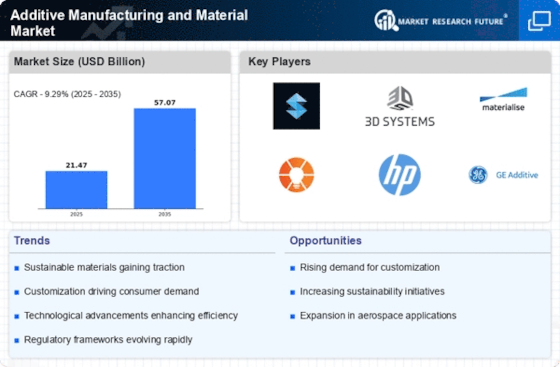

Customization and Personalization Trends

The demand for customization and personalization is reshaping the landscape of the Additive Manufacturing and Material Market. Consumers increasingly seek tailored products that meet their specific needs, which additive manufacturing can readily provide. This capability allows for the production of unique items, from bespoke medical implants to personalized consumer goods. Market analysis suggests that the customization segment is expected to grow significantly, with projections indicating a potential increase in revenue by over 20% annually. As businesses recognize the competitive advantage of offering personalized solutions, the Additive Manufacturing and Material Market is poised for substantial growth, driven by consumer preferences for individualized products.

Sustainability and Eco-Friendly Practices

Sustainability has emerged as a pivotal driver within the Additive Manufacturing and Material Market. The growing emphasis on eco-friendly practices is prompting manufacturers to explore biodegradable and recyclable materials. This shift is not merely a trend; it reflects a broader societal demand for responsible production methods. Recent studies indicate that the adoption of sustainable materials in additive manufacturing could reduce waste by up to 90% compared to traditional manufacturing processes. As companies strive to meet regulatory requirements and consumer expectations for sustainability, the Additive Manufacturing and Material Market is likely to evolve, integrating more environmentally conscious practices into its core operations.

Cost Reduction and Efficiency Improvements

Cost reduction remains a critical driver in the Additive Manufacturing and Material Market. The ability to produce parts on-demand reduces inventory costs and minimizes waste, which is particularly appealing to manufacturers. Recent data indicates that companies utilizing additive manufacturing can achieve cost savings of up to 30% in production processes. Furthermore, the efficiency improvements associated with additive manufacturing, such as reduced material usage and shorter production times, contribute to overall operational cost reductions. As industries continue to seek ways to enhance profitability, the Additive Manufacturing and Material Market is likely to see increased adoption of these technologies, further driving market growth.

Technological Innovations in Additive Manufacturing

The Additive Manufacturing and Material Market is currently experiencing a surge in technological innovations that enhance production capabilities. Advancements in 3D printing technologies, such as multi-material printing and improved software for design optimization, are driving efficiency and reducing lead times. According to recent data, the market for 3D printing materials is projected to reach approximately 10 billion USD by 2026, indicating a robust growth trajectory. These innovations not only streamline manufacturing processes but also enable the production of complex geometries that were previously unattainable. As industries increasingly adopt these technologies, the Additive Manufacturing and Material Market is likely to witness a significant transformation, fostering new applications across sectors such as aerospace, automotive, and healthcare.