Increasing Defense Budgets

Rising Threat of Asymmetric Warfare

The Global active protection system Market Industry is significantly influenced by the rising threat of asymmetric warfare. Non-state actors and insurgent groups are increasingly employing unconventional tactics, necessitating the development of advanced defense technologies. Active protection systems provide a crucial countermeasure against such threats, enhancing the survivability of military assets. As nations recognize the need to adapt to evolving warfare dynamics, investments in these systems are likely to increase. This shift in focus could propel the market towards a projected value of 25 USD Billion by 2035, reflecting a growing recognition of the importance of active protection in modern military strategies.

Market Trends and Growth Projections

The Global Active Protection System Market Industry is characterized by various trends that indicate robust growth potential. The market is projected to reach 12.5 USD Billion in 2024, with expectations of doubling to 25 USD Billion by 2035. The anticipated CAGR of 6.5% from 2025 to 2035 reflects a strong demand for active protection systems driven by increasing defense budgets, technological advancements, and the need for military modernization. These trends suggest a favorable environment for market players, as investments in active protection systems are likely to rise in response to evolving security threats and the imperative for enhanced military capabilities.

Growing Military Modernization Programs

The Global Active Protection System Market Industry is being propelled by ongoing military modernization programs worldwide. Many countries are undertaking comprehensive reviews of their defense strategies, leading to the procurement of advanced military technologies, including active protection systems. Nations such as India and South Korea are investing heavily in modernizing their armed forces, which includes the integration of active protection systems into their existing platforms. This trend not only enhances operational effectiveness but also ensures that military assets remain competitive in a rapidly evolving security environment. The market is poised for substantial growth as these modernization efforts continue.

Technological Advancements in Defense Systems

The Global Active Protection System Market Industry is witnessing rapid technological advancements that enhance the effectiveness of active protection systems. Innovations in sensor technologies, artificial intelligence, and materials science are enabling the development of more sophisticated systems capable of countering a wider range of threats. For example, advancements in radar and electro-optical systems improve target detection and tracking capabilities. These technological improvements are likely to attract investments and drive market growth, with an anticipated CAGR of 6.5% from 2025 to 2035. As defense forces seek to integrate cutting-edge technologies, the demand for advanced active protection systems is expected to rise.

Emerging Markets and Regional Defense Initiatives

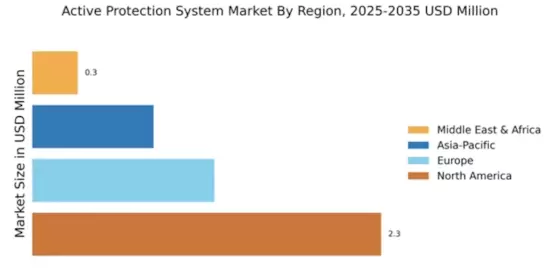

The Global Active Protection System Market Industry is increasingly benefiting from emerging markets and regional defense initiatives. Countries in regions such as Asia-Pacific and the Middle East are ramping up their defense spending, driven by geopolitical tensions and the need for enhanced security. For instance, nations like Saudi Arabia and UAE are investing in advanced military technologies, including active protection systems, to bolster their defense capabilities. This regional focus on strengthening defense infrastructure is likely to contribute to the overall growth of the market, as these countries seek to adopt advanced technologies to address their unique security challenges.