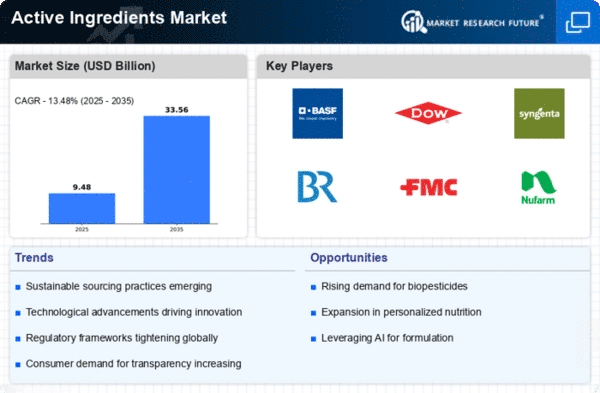

Market Growth Projections

The Global Active Ingredients Market Industry is poised for substantial growth, with projections indicating a market value of 439.2 USD Billion by 2035. This growth trajectory is supported by a compound annual growth rate of 5.7% from 2025 to 2035, reflecting the increasing importance of active ingredients across various sectors. The market's expansion is driven by factors such as rising healthcare expenditures, technological advancements, and growing consumer awareness. As the industry evolves, stakeholders are likely to explore new opportunities and innovations, further enhancing the market's potential.

Regulatory Support and Compliance

Regulatory frameworks play a pivotal role in shaping the Global Active Ingredients Market Industry. Governments worldwide are increasingly emphasizing stringent quality standards and safety regulations for active ingredients used in various applications. This regulatory support not only ensures consumer safety but also fosters innovation within the industry. For instance, the European Medicines Agency and the U.S. Food and Drug Administration have established guidelines that encourage the development of high-quality active ingredients. As companies comply with these regulations, they enhance their market position, potentially leading to increased investment and growth opportunities in the sector.

Growing Demand for Pharmaceuticals

The Global Active Ingredients Market Industry is experiencing a surge in demand for pharmaceuticals, driven by an aging population and increasing prevalence of chronic diseases. In 2024, the market is valued at approximately 238.7 USD Billion, reflecting the critical role of active ingredients in drug formulation. As healthcare systems globally adapt to these challenges, pharmaceutical companies are likely to invest more in research and development of innovative active ingredients. This trend suggests a robust growth trajectory, with projections indicating a market expansion to 439.2 USD Billion by 2035, highlighting a compound annual growth rate of 5.7% from 2025 to 2035.

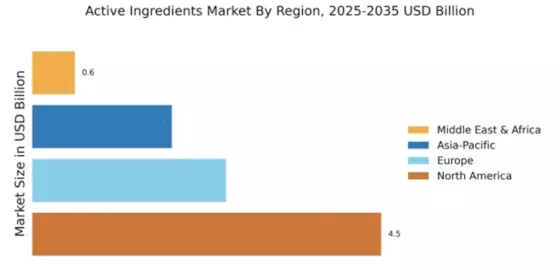

Emerging Markets and Global Expansion

Emerging markets are becoming increasingly important in the Global Active Ingredients Market Industry. Countries in Asia-Pacific and Latin America are witnessing rapid economic growth, leading to higher disposable incomes and increased healthcare spending. This shift is creating new opportunities for active ingredient manufacturers to expand their presence in these regions. For instance, the rising demand for pharmaceuticals and personal care products in these markets is likely to drive significant growth. As companies adapt their strategies to cater to these emerging markets, the overall market is expected to benefit from this diversification.

Technological Advancements in Production

Technological advancements are revolutionizing the Global Active Ingredients Market Industry, enhancing production efficiency and product quality. Innovations such as continuous manufacturing and biotechnological processes enable companies to produce active ingredients more sustainably and at lower costs. For example, the adoption of green chemistry principles is gaining traction, allowing for the development of eco-friendly active ingredients. These advancements not only improve the overall competitiveness of the market but also align with global sustainability goals. As companies leverage these technologies, they are likely to see increased demand for their products, further driving market growth.

Rising Consumer Awareness and Preferences

Consumer awareness regarding health and wellness is significantly influencing the Global Active Ingredients Market Industry. As individuals become more informed about the benefits of active ingredients in personal care and dietary supplements, demand is likely to rise. This trend is evident in the growing popularity of natural and organic products, which often contain active ingredients derived from botanical sources. Companies are responding by reformulating products to meet these consumer preferences, thereby expanding their market reach. The shift towards transparency in ingredient sourcing and formulation is expected to drive further growth in this sector.