Market Analysis

In-depth Analysis of Active Ingredients Market Industry Landscape

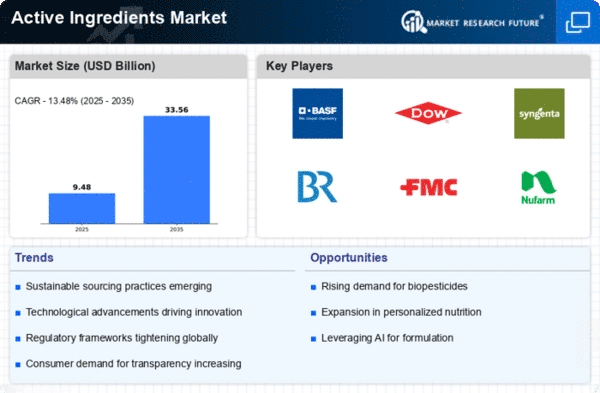

The global demand for inventive and viable compounds in pharmaceuticals, agrochemicals, and personal care is changing the active ingredients business. Products that promote health, horticulture, and personal well-being contain active substances, sometimes bioactive combinations with healing or beneficial effects. The constant pursuit of medication innovation shapes the market. Active ingredients for drugs, antibodies, and restorative arrangements are used in the pharma industry, which advances medical services and disease.

Agrochemicals, which are crucial to crop security, pest control, and plant nutrition, influence the active ingredients industry. Creative active chemicals in pesticides, herbicides, and manures are needed for better performance and sustainable farming. The demand for active ingredients grows as farmers face challenges including changing weather, bugs, and diseases, helping to produce sustainable and eco-friendly agrochemicals.

Individual makeup and consideration also contribute to the active components market. Active chemicals like cancer prevention agents, nutrients, and peptides are added to skincare, haircare, and restorative products to provide anti-aging, moisturization, and UV protection. Consumer preferences for ordinary and bioactive components drive individual consideration, with active substances playing a crucial role in creating products that meet the growing demand for viability and security.

Administrative practices and consumer awareness also affect the active ingredients industry. Drug, agrochemical, and personal care product active ingredient safety regulations affect the market. Manufacturers should research consistency requirements to meet administrative requirements. Rising awareness among buyers about the impact of products on health and the environment increases demand for active substances with proven benefits and sustainable characteristics.

However, the active ingredients industry faces new work costs, administrative issues, and the need for ongoing development. Research and clinical preliminaries often focus on discovering and improving potent active components. The company' challenges include exploring administrative paths and securing approvals for novel active components, which need complex cycles and norms. The market needs inventive, eco-friendly active ingredients to address natural issues and satisfy supportability goals.

Innovative work practices drive active ingredient market growth. Discovery of new bioactive mixes, simplifying extraction and blend methods, and development of eco-friendly alternatives are ongoing. Nanoparticles and embodiment advancements improve active ingredient strength and adequacy in many applications. Plant-based and regular active components are being studied as pharmaceuticals, agribusiness, and personal care increasingly seek greener solutions.

Leave a Comment