Market Growth Projections

The Global Active Calcium Silicate Market Industry is projected to experience substantial growth over the next decade. The market is expected to reach a value of 153.8 USD Million in 2024, with a forecasted increase to 267.6 USD Million by 2035. This growth trajectory indicates a compound annual growth rate of 5.16% from 2025 to 2035. Such projections reflect the increasing adoption of active calcium silicate across various sectors, driven by factors such as technological advancements, rising health and safety standards, and expanding applications in emerging markets. These figures highlight the market's potential and the opportunities it presents for stakeholders.

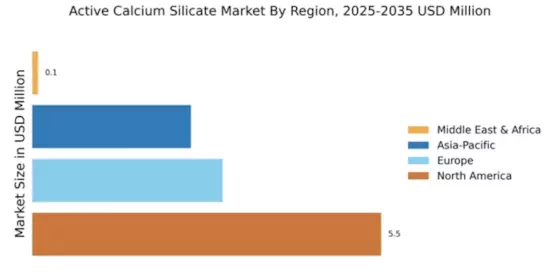

Emerging Markets and Global Expansion

Emerging markets are playing a pivotal role in the growth of the Global Active Calcium Silicate Market Industry. Regions such as Asia-Pacific and Latin America are witnessing rapid industrialization and urbanization, leading to increased demand for active calcium silicate in construction, automotive, and consumer goods. The expansion of manufacturing capabilities in these regions is likely to enhance the availability of active calcium silicate products, catering to local needs. As global players establish a presence in these markets, the competitive landscape is expected to evolve, fostering innovation and driving market growth. This trend underscores the importance of strategic investments in emerging economies.

Increasing Demand in Construction Sector

The Global Active Calcium Silicate Market Industry experiences a surge in demand driven by the construction sector's growth. Active calcium silicate is utilized in various applications, including insulation and fireproofing materials, which are essential for modern construction projects. As urbanization accelerates, particularly in developing regions, the need for sustainable and efficient building materials becomes paramount. This trend is reflected in the market's projected value of 153.8 USD Million in 2024, indicating a robust growth trajectory. The construction industry's focus on energy efficiency and safety standards further propels the adoption of active calcium silicate products.

Technological Advancements in Manufacturing

Technological innovations in the production of active calcium silicate are reshaping the Global Active Calcium Silicate Market Industry. Enhanced manufacturing processes lead to improved product quality and cost-effectiveness, making active calcium silicate more accessible to various industries. For instance, advancements in nanotechnology and material science enable the development of high-performance calcium silicate products with superior properties. These innovations not only cater to the increasing demand for specialized applications but also contribute to the overall market growth. As manufacturers adopt these technologies, the market is poised for substantial expansion, aligning with the projected growth figures for the coming years.

Growing Applications in the Automotive Industry

The automotive sector's evolving landscape presents new opportunities for the Global Active Calcium Silicate Market Industry. Active calcium silicate is increasingly utilized in automotive components for its lightweight and thermal insulation properties. As the automotive industry shifts towards electric vehicles and sustainable practices, the demand for materials that enhance energy efficiency and reduce weight is on the rise. This trend is likely to drive market growth, as manufacturers seek innovative solutions to meet stringent environmental regulations. The integration of active calcium silicate in automotive applications could significantly contribute to the market's projected growth, aligning with broader trends in sustainability and efficiency.

Rising Awareness of Health and Safety Standards

There is a growing emphasis on health and safety standards across industries, which significantly influences the Global Active Calcium Silicate Market Industry. Active calcium silicate is recognized for its non-toxic and environmentally friendly properties, making it a preferred choice in applications such as food packaging and pharmaceuticals. As regulatory bodies enforce stricter safety guidelines, manufacturers are increasingly turning to active calcium silicate to meet compliance requirements. This shift not only enhances product safety but also boosts market growth, as evidenced by the anticipated market expansion towards 267.6 USD Million by 2035, reflecting a compound annual growth rate of 5.16% from 2025 to 2035.