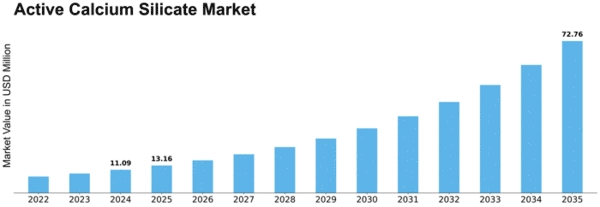

Active Calcium Silicate Size

Active Calcium Silicate Market Growth Projections and Opportunities

Numerous variables affect the dynamics of the active calcium silicate market, which in turn affects the material's production, demand, and uses. To effectively traverse this expanding category and make educated decisions, industry stakeholders must be aware of several critical market aspects. The following are some important factors influencing the market for active calcium silicate: Demand for Industrial Insulation: The growing need for industrial insulating materials is the main factor propelling the Active Calcium Silicate Market. Active calcium silicate is widely utilized in the metallurgy, power generation, and petrochemical sectors because of its exceptional thermal insulation qualities. Booming building Sector: The need for active calcium silicate is mostly driven by the building sector, particularly for uses like fire safety and insulation. The need for high-performance, fire-resistant materials like active calcium silicate is increasing as building activities expand internationally. Strict Rules for Fire Safety: The need for fire-resistant materials, such as active calcium silicate, is driven by the strict implementation of fire safety laws across several sectors. Adoption of active calcium silicate in many applications to improve fire safety measures is encouraged by compliance with safety regulations. Industrial Manufacturing Growth: In industrial production, active calcium silicate is widely used for purposes such as strengthening ceramics and insulating molten metal. The growing use of active calcium silicate is partly due to the rise of industry, especially in emerging nations. Initiatives for Research and Development: Continuous research and development endeavors focused on enhancing the characteristics and functionality of active calcium silicate augment the market. Innovations in applications, production methods, and formulations increase market potential and create new growth opportunities. Health and Environmental Issues: Active calcium silicate is non-toxic and ecologically benign, which is in line with the growing focus on safe and sustainable materials. Active calcium silicate has an advantage over other materials because end customers across a range of sectors favor products with low environmental effect.

Leave a Comment