Active And Intelligent Packaging Size

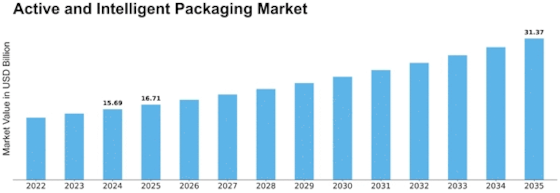

Active and Intelligent Packaging Market Growth Projections and Opportunities

Several factors that influence the Active & Intelligent Packaging Market growth and trajectory. One of them is consumer behavior as emphasized by their changing tastes and emphasis towards personal care leading to cosmetics demand. The active and intelligent packaging industry has also been influenced greatly by technological advancements. This includes developments such as QR codes, RFID tags or sensors on products among others which have positive impacts on consumers’ experience ensuring safe products.

Such conditions are economic including disposable incomes tend to shape the Active & Intelligent Packaging Market. Customers when the times are good tend to buy more costly beauty merchandise so it is expanding faster than ever before. However, because of difficult economical situations, purchasers may prefer low-cost substitutes provoking market transformations. Besides, this sector is closely tied to global trade with geopolitical concerns determining availability and cost of raw materials thus affecting shifts in markets.

In the Active & Intelligent Packaging Market Regulatory frameworks and sustainability considerations are emerging as increasingly influential factors. Because of generally strict regulations implemented by governments concerning safety of products, many manufacturers now resort to using advanced packages due to reasons related to ingredient transparency for purposes of product safety . Also, there has been increased awareness on environmental matters that in turn led into more demand for sustainable packing materials consequently altering ways things should be done in this marketplace.

Advertising through product use augmented reality (AR) or virtual reality (VR) in connection with marketing technologies supports this moving forward On these two techniques a client sees itself within adverting initiatives shaping his/her purchase plans .Additionally ,the active intelligent packaging domain is rapidly making headways through inventions like time-temperature indicator, freshness sensor ,antimicrobial coating etc…that improve both product performance while answering customer needs concerning safety plus quality aspect of it .

Leave a Comment