Growth in Chemical Manufacturing

The Global Acetonitrile Market Industry is significantly influenced by the expansion of the chemical manufacturing sector. Acetonitrile Market is utilized as a solvent and reagent in various chemical processes, including the production of plastics, agrochemicals, and specialty chemicals. As industrial activities ramp up globally, the demand for acetonitrile is anticipated to rise. This trend is expected to contribute to the market's growth, with projections indicating a compound annual growth rate (CAGR) of 4.01% from 2025 to 2035. The increasing complexity of chemical formulations necessitates the use of acetonitrile, thereby enhancing its importance in the Global Acetonitrile Market Industry.

Rising Demand in Pharmaceuticals

The Global Acetonitrile Market Industry experiences a notable surge in demand from the pharmaceutical sector, where acetonitrile serves as a crucial solvent in drug formulation and synthesis. As the global population ages and healthcare needs evolve, the pharmaceutical industry is projected to expand significantly. This growth is reflected in the market's valuation, which is expected to reach 1.39 USD Billion in 2024. The increasing focus on research and development in pharmaceuticals further drives the need for high-purity acetonitrile, thereby bolstering the Global Acetonitrile Market Industry.

Expanding Applications in Electronics

The Global Acetonitrile Market Industry is witnessing growth due to its expanding applications in the electronics sector. Acetonitrile Market is utilized in the manufacturing of semiconductors and as a solvent in the production of electronic components. As the demand for electronic devices continues to rise, driven by advancements in technology and consumer electronics, the need for high-quality acetonitrile is likely to increase. This trend is indicative of the broader industrial shifts towards more sophisticated electronic products, which in turn supports the growth trajectory of the Global Acetonitrile Market Industry.

Technological Advancements in Production

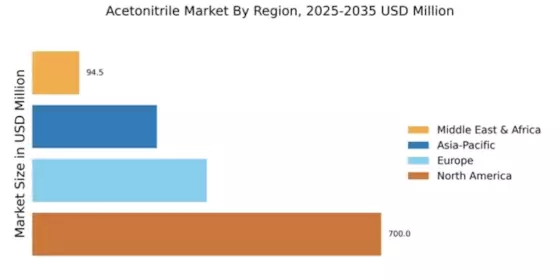

Innovations in acetonitrile production technologies are poised to impact the Global Acetonitrile Market Industry positively. Enhanced production methods, such as more efficient extraction and purification techniques, can lead to reduced costs and improved quality of acetonitrile. These advancements may facilitate a broader application of acetonitrile across various industries, including electronics and biotechnology. As production becomes more sustainable and economically viable, the market is likely to witness increased adoption. This trend aligns with the projected market growth, with estimates suggesting a rise to 2.14 USD Billion by 2035, indicating the potential for technological progress to reshape the Global Acetonitrile Market Industry.

Increasing Use in Environmental Applications

The Global Acetonitrile Market Industry is also driven by its increasing utilization in environmental applications, particularly in analytical chemistry for water quality testing and pollution monitoring. Acetonitrile Market's effectiveness as a solvent in chromatographic techniques makes it a preferred choice for environmental laboratories. As regulatory frameworks tighten globally, the demand for reliable testing methods is expected to rise, thereby boosting the acetonitrile market. This trend underscores the versatility of acetonitrile and its critical role in supporting environmental sustainability efforts, further solidifying its position within the Global Acetonitrile Market Industry.