Evolving Patient Preferences

In the Acetaminophen Opioid Combination Market, patient preferences are shifting towards safer and more effective pain relief options. Patients increasingly seek medications that provide relief without the high risk of addiction associated with traditional opioids. This shift is prompting pharmaceutical companies to innovate and develop formulations that combine acetaminophen with opioids, aiming to balance efficacy and safety. Market data indicates that products with lower abuse potential are gaining traction, reflecting a broader trend towards responsible pain management practices.

Increasing Pain Management Needs

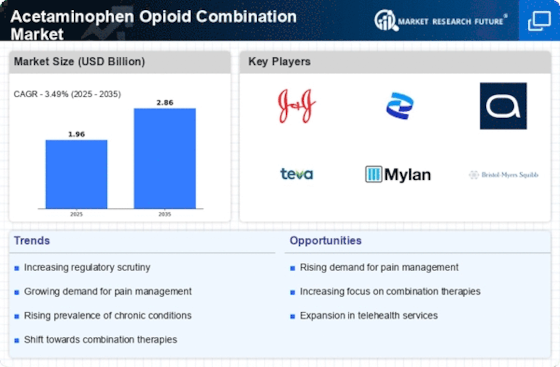

The Acetaminophen Opioid Combination Market is experiencing a surge in demand due to the rising prevalence of chronic pain conditions. As populations age and lifestyle-related ailments become more common, the need for effective pain management solutions intensifies. Reports indicate that nearly 20% of adults suffer from chronic pain, necessitating the use of combination therapies that enhance analgesic efficacy while minimizing opioid-related side effects. This trend suggests a growing acceptance of acetaminophen-opioid combinations as a viable option for managing moderate to severe pain, thereby driving market growth.

Rising Awareness of Pain Management Options

There is a growing awareness among healthcare professionals and patients regarding the importance of effective pain management strategies within the Acetaminophen Opioid Combination Market. Educational initiatives and campaigns are emphasizing the benefits of combination therapies, leading to increased prescriptions and usage. This heightened awareness is crucial, as it encourages patients to discuss pain management options with their healthcare providers, ultimately driving demand for acetaminophen-opioid combinations. As more individuals become informed about their choices, the market is poised for continued expansion.

Regulatory Support for Combination Therapies

The Acetaminophen Opioid Combination Market benefits from favorable regulatory frameworks that encourage the development of combination therapies. Regulatory bodies are increasingly recognizing the need for effective pain management solutions that mitigate the risks associated with opioid use. This support is evident in the expedited approval processes for new formulations that combine acetaminophen with opioids. As a result, pharmaceutical companies are more inclined to invest in research and development, leading to a wider array of products entering the market, which could enhance competition and drive down prices.

Technological Advancements in Drug Formulation

Technological innovations are playing a pivotal role in the Acetaminophen Opioid Combination Market. Advances in drug formulation techniques allow for improved bioavailability and targeted delivery of combination therapies. These innovations not only enhance the therapeutic effects of acetaminophen-opioid combinations but also reduce the incidence of side effects. As companies leverage new technologies to create more effective and patient-friendly formulations, the market is likely to witness an influx of novel products, catering to diverse patient needs and preferences.