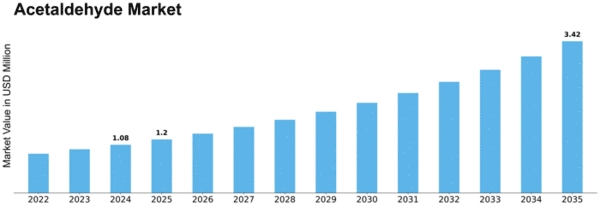

Acetaldehyde Size

Acetaldehyde Market Growth Projections and Opportunities

The Acetaldehyde market is influenced by various market factors that play a crucial role in shaping its dynamics. One of the primary drivers is the growing demand from the chemical industry. Acetaldehyde serves as a key intermediate in the production of various chemicals, including acetic acid, pyridine, and pentaerythritol. As the chemical industry expands globally, especially in regions like Asia-Pacific, the demand for acetaldehyde is expected to witness a substantial increase.

Additionally, the rise in the automotive sector contributes significantly to the acetaldehyde market. Acetaldehyde is utilized in the production of pyridine bases, which find applications in rubber and tire manufacturing. With the automotive industry experiencing steady growth, particularly in emerging economies, the demand for acetaldehyde in this sector is anticipated to rise.

Market factors are also influenced by the changing consumer preferences and the rise in disposable income. The increasing urbanization and changing lifestyles have led to a surge in the consumption of packaged food and beverages. Acetaldehyde is used in the production of flavor and fragrance agents for food and beverages. As the demand for packaged and processed food continues to grow, the acetaldehyde market is likely to benefit from this trend.

Moreover, government regulations and environmental concerns are pivotal market factors for acetaldehyde. Stringent regulations regarding emissions and environmental impact drive industries to adopt greener practices. Acetaldehyde is used in the production of biodegradable plastics, and as the focus on sustainable materials increases, the demand for acetaldehyde in this application is expected to rise.

Global economic conditions also play a crucial role in shaping the acetaldehyde market. Economic growth, inflation rates, and currency exchange rates impact the overall production and consumption patterns. Fluctuations in these factors can influence the cost of raw materials and transportation, thereby affecting the pricing and profitability of acetaldehyde.

Competitive factors are another key element influencing the acetaldehyde market. The presence of established players, their market share, and strategic alliances impact the overall competitiveness of the market. Innovation and research and development activities by key market players contribute to the growth and evolution of the acetaldehyde market.

Furthermore, the availability of raw materials is a significant market factor. Acetaldehyde is primarily produced from petrochemical feedstocks, and any fluctuations in the supply and prices of these feedstocks can directly impact the acetaldehyde market. Additionally, technological advancements in production processes, such as bio-based production methods, can influence the market dynamics by providing alternative and more sustainable sources for acetaldehyde.

The acetaldehyde market is shaped by a combination of factors, including demand from the chemical and automotive industries, changing consumer preferences, government regulations, economic conditions, competitive landscape, and the availability of raw materials. Understanding and monitoring these market factors are essential for stakeholders in the acetaldehyde industry to make informed decisions and adapt to the evolving market dynamics.

Leave a Comment