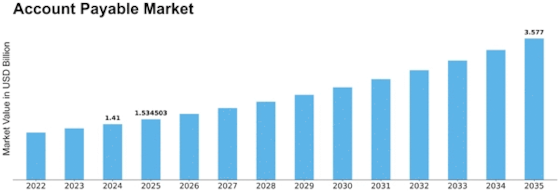

Account Payable Size

Account Payable Market Growth Projections and Opportunities

Accounts Payable (AP) market dynamics involve a complex interaction of elements that affect firm financial management. An organization's financial system relies on Accounts Payable (AP), which represents the money owed to suppliers and creditors for goods and services. Economic conditions, technical advances, regulatory changes, and corporate needs shape this market.

Economic conditions influence AP market change. Inflation, interest rates, and economic growth might affect a company's accounts payable management. Businesses may buy more goods and services during economic expansion, increasing AP volumes. In contrast, economic downturns may force organizations to restrict their finances and optimize their AP procedures to save cash.

Technology shapes the AP market in a mjaor way. Automation, AI, and blockchain have transformed accounts payable management. Automation tools decrease errors, speed up payments, and improve invoice processing. AI improves data analysis, revealing expenditure patterns and vendor relationships. Blockchain technology's decentralization and security reduce fraud and errors by providing transaction transparency and traceability.

Additionally, regulatory changes greatly impact the AP market. Financial fairness and transparency are regulated by governments worldwide. Businesses must change their AP processes to comply with tax legislation and financial reporting standards. The growing attention on environmental, social, and governance (ESG) issues has led firms to assess their supply chains' sustainability, encouraging AP practices to be responsible.

Moreover, changing company needs make the AP market dynamics shift considerably. As firms develop abroad, their AP processes must adapt to foreign trade, currencies, and regulations. Businesses choose advanced AP solutions with analytics, reporting, and forecasting capabilities to gain real-time financial transaction visibility and strategic insights.

AP market dynamics are also shaped by competition. Software, financial institutions, and fintech companies compete for market share by offering new accounts payable solutions to businesses. Companies strive to differentiate themselves by offering innovative features, greater user experiences, and financial ecosystem-aligned integration.

The strategic value of AP in companies emphasizes its dynamic character. Fast vendor payments, better supplier relationships, negotiating leverage, and cash flow optimization are all benefits of efficient AP management. Businesses constantly improve and upgrade AP procedures because of its importance in working capital management and strategic financial decision-making.

Leave a Comment