Government Initiatives and Investments

Government initiatives and investments play a crucial role in shaping the 5G Towers and Cable Market. Many governments are actively promoting the rollout of 5G technology through funding and policy support. For instance, various countries have allocated substantial budgets to enhance telecommunications infrastructure, recognizing its importance for economic growth and competitiveness. These initiatives often include grants, subsidies, and tax incentives aimed at encouraging private sector investment in 5G infrastructure. As a result, the 5G Towers and Cable Market is likely to experience accelerated growth due to these supportive measures. Additionally, regulatory frameworks are being established to streamline the deployment of 5G towers, which could further enhance market dynamics and attract new players to the industry.

Emergence of IoT and Smart Technologies

The emergence of Internet of Things (IoT) and smart technologies is significantly influencing the 5G Towers and Cable Market. As more devices become interconnected, the demand for reliable and high-speed connectivity intensifies. The proliferation of smart homes, smart cities, and industrial IoT applications necessitates a robust 5G infrastructure to support the vast amount of data generated by these devices. Market analysts suggest that the number of connected IoT devices could exceed 30 billion by 2025, creating a substantial need for 5G towers and advanced cabling solutions. This trend not only drives the demand for infrastructure but also encourages innovation within the 5G Towers and Cable Market, as companies strive to develop solutions that can handle the increasing data traffic and connectivity requirements.

Growing Focus on Enhanced User Experience

A growing focus on enhanced user experience is emerging as a significant driver in the 5G Towers and Cable Market. As consumers become more accustomed to high-speed internet and seamless connectivity, their expectations continue to rise. This shift is prompting service providers to invest in infrastructure that can deliver superior performance and reliability. Market data indicates that user satisfaction is closely linked to network performance, which in turn drives demand for more 5G towers and advanced cabling solutions. Companies that prioritize user experience are likely to gain a competitive edge, as they can attract and retain customers in an increasingly crowded marketplace. Consequently, the 5G Towers and Cable Market must adapt to these changing consumer preferences to remain relevant and successful.

Rising Demand for High-Speed Connectivity

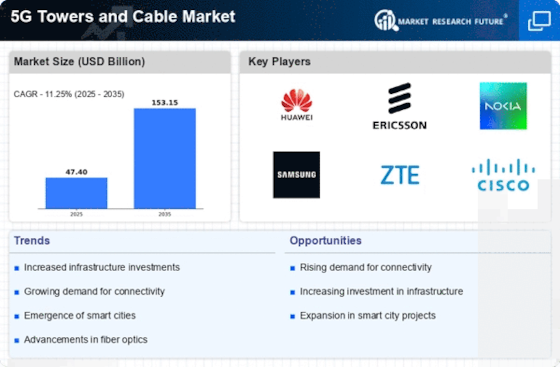

The increasing demand for high-speed connectivity is a primary driver of the 5G Towers and Cable Market. As consumers and businesses alike seek faster internet speeds, the need for robust infrastructure becomes paramount. According to recent data, the number of 5G subscriptions is projected to reach over 1 billion by the end of 2025, indicating a substantial market opportunity. This surge in demand necessitates the deployment of more 5G towers and advanced cabling solutions to support the growing user base. Furthermore, industries such as healthcare, automotive, and entertainment are increasingly reliant on high-speed connectivity, further propelling the need for enhanced infrastructure. The 5G Towers and Cable Market must adapt to these evolving demands to ensure seamless connectivity and support the digital transformation of various sectors.

Competitive Landscape and Technological Advancements

The competitive landscape within the 5G Towers and Cable Market is characterized by rapid technological advancements and innovation. Companies are continuously striving to enhance their offerings, leading to the development of more efficient and cost-effective solutions. The introduction of advanced materials and technologies, such as fiber optics and millimeter-wave technology, is transforming the way 5G infrastructure is deployed. This competitive environment encourages collaboration among industry players, fostering partnerships that can accelerate the deployment of 5G towers and cabling solutions. Furthermore, as companies seek to differentiate themselves, investments in research and development are likely to increase, driving further innovation within the 5G Towers and Cable Market. This dynamic landscape presents both challenges and opportunities for stakeholders as they navigate the evolving market.