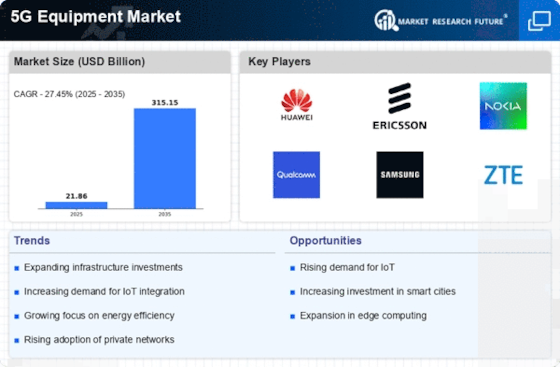

Expansion of Smart Cities Initiatives

The development of smart cities is significantly influencing the 5G Equipment Market. As urban areas evolve to incorporate advanced technologies, the integration of 5G networks becomes essential for supporting various applications, such as smart traffic management, public safety, and energy efficiency. Reports suggest that investments in smart city projects are expected to exceed 1 trillion by 2025, highlighting the potential for 5G technology to facilitate these initiatives. The deployment of 5G infrastructure is crucial for enabling real-time data exchange and connectivity among devices, thereby enhancing the overall quality of urban life. This trend is likely to drive demand for 5G equipment, as municipalities and governments seek to implement innovative solutions.

Rising Demand for High-Speed Internet

The 5G Equipment Market is experiencing a notable surge in demand for high-speed internet connectivity. As consumers and businesses increasingly rely on seamless online experiences, the need for faster data transmission becomes paramount. According to recent data, the number of 5G subscriptions is projected to reach over 1.5 billion by 2025, indicating a robust growth trajectory. This demand is not only driven by individual users but also by enterprises seeking to enhance operational efficiency through advanced connectivity solutions. Consequently, telecommunications companies are investing heavily in 5G infrastructure, which is expected to propel the 5G Equipment Market forward, creating opportunities for equipment manufacturers and service providers alike.

Increased Focus on Remote Work Solutions

The shift towards remote work has created a pressing need for reliable and high-speed internet connectivity, thereby impacting the 5G Equipment Market. As organizations adapt to hybrid work models, the demand for advanced communication tools and technologies has surged. The 5G network's ability to provide enhanced connectivity and support high-definition video conferencing is particularly appealing to businesses. Market analysis indicates that the remote work technology sector is projected to grow significantly, with companies increasingly investing in 5G solutions to ensure seamless collaboration among remote teams. This trend is likely to drive the adoption of 5G equipment, as businesses seek to enhance productivity and maintain operational continuity.

Emergence of Advanced Mobile Applications

The rise of advanced mobile applications is reshaping the 5G Equipment Market. As consumers demand more sophisticated and data-intensive applications, the need for high-speed connectivity becomes critical. The gaming, streaming, and augmented reality sectors are particularly reliant on 5G technology to deliver immersive experiences. Market forecasts suggest that the mobile application market will continue to expand, with revenues projected to reach over 400 billion by 2025. This growth is likely to drive the demand for 5G equipment, as developers and service providers seek to leverage the capabilities of 5G networks to enhance user experiences and meet consumer expectations.

Growth of the Internet of Things (IoT) Ecosystem

The proliferation of the Internet of Things (IoT) is a key driver for the 5G Equipment Market. As more devices become interconnected, the demand for reliable and high-speed connectivity intensifies. It is estimated that by 2025, there will be over 75 billion IoT devices in use, necessitating robust 5G networks to support their functionality. The ability of 5G technology to handle massive data traffic and provide low-latency communication is particularly advantageous for IoT applications, ranging from smart homes to industrial automation. This growth in the IoT ecosystem is likely to stimulate investments in 5G equipment, as companies strive to capitalize on the opportunities presented by this expanding market.