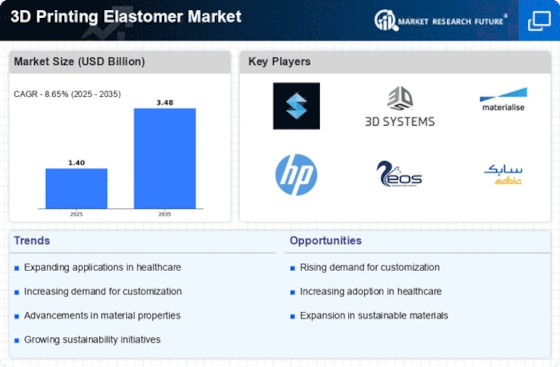

Growing Applications in Healthcare

The healthcare sector is increasingly adopting 3D printing technologies, which is a significant driver for the 3D Printing Elastomer Market. Elastomers are being utilized in the production of medical devices, prosthetics, and implants due to their biocompatibility and flexibility. The ability to customize these products to meet individual patient needs is particularly appealing, as it enhances patient outcomes and satisfaction. Market data indicates that the 3D printing in healthcare is expected to witness substantial growth, with elastomers playing a crucial role in this transformation. As regulatory bodies continue to approve more 3D printed medical devices, the demand for elastomer-based solutions is likely to rise, further solidifying their position in the healthcare market.

Advancements in 3D Printing Technology

Technological advancements in 3D printing are propelling the growth of the 3D Printing Elastomer Market. Innovations such as improved printing speeds, enhanced material properties, and the development of new printing techniques are making elastomers more accessible and versatile. For instance, advancements in multi-material printing allow for the combination of elastomers with other materials, leading to the creation of complex geometries and tailored properties. This evolution in technology is reflected in the increasing number of patents filed in the 3D printing sector, suggesting a robust pipeline of innovations that could further enhance the capabilities of elastomers. As these technologies mature, they are likely to expand the applications of elastomers in industries such as healthcare, where customized medical devices are in demand.

Rising Demand for Lightweight Materials

The increasing demand for lightweight materials across various industries is a notable driver for the 3D Printing Elastomer Market. As manufacturers seek to enhance fuel efficiency and reduce emissions, elastomers offer a viable solution due to their lightweight properties. The automotive sector, in particular, is experiencing a shift towards lighter components, with elastomers being utilized in applications such as seals, gaskets, and flexible parts. According to recent data, the automotive elastomer market is projected to grow significantly, which in turn bolsters the 3D Printing Elastomer Market. This trend is not limited to automotive; aerospace and consumer goods are also adopting lightweight elastomer solutions, indicating a broader acceptance of these materials in various applications.

Customization and Personalization Trends

The trend towards customization and personalization is a key driver for the 3D Printing Elastomer Market. As consumers increasingly seek products tailored to their specific needs, elastomers offer the flexibility required for such applications. Industries such as footwear, automotive, and consumer electronics are leveraging 3D printing to create customized components that enhance user experience. Market analysis suggests that the demand for personalized products is on the rise, with elastomers being a preferred choice due to their adaptability and performance characteristics. This trend is likely to continue, as advancements in 3D printing technology make it easier and more cost-effective to produce customized elastomer products, thereby expanding their market reach.

Sustainability and Eco-Friendly Practices

Sustainability is becoming a central theme in manufacturing, and the 3D Printing Elastomer Market is no exception. The shift towards eco-friendly practices is driving the demand for elastomers that are recyclable and produced with minimal environmental impact. Manufacturers are increasingly focusing on developing bio-based elastomers that align with sustainability goals. This trend is supported by various initiatives aimed at reducing plastic waste and promoting circular economy principles. As consumers and businesses alike prioritize sustainability, the demand for eco-friendly elastomer solutions is expected to grow. This shift not only enhances the market appeal of elastomers but also encourages innovation in material development, potentially leading to new formulations that meet both performance and environmental standards.