North America : Established Market with Growth Potential

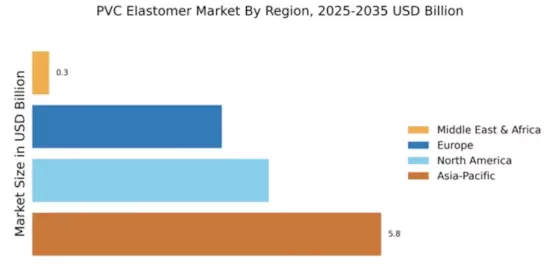

The North American PVC elastomer market, valued at $3.93 billion, is driven by increasing demand in automotive and construction sectors. Regulatory support for sustainable materials and innovations in manufacturing processes are key growth catalysts. The region is witnessing a shift towards eco-friendly alternatives, enhancing market dynamics.

Leading countries like the US and Canada are home to major players such as Dow Inc. and Kraton Corporation. The competitive landscape is characterized by strategic partnerships and technological advancements. The presence of established companies fosters innovation, ensuring a robust market environment.

Europe : Innovation and Sustainability Focus

Europe's PVC elastomer market, valued at $3.15 billion, is characterized by a strong emphasis on sustainability and innovation. Regulatory frameworks, such as the EU's Green Deal, are driving demand for eco-friendly materials. The region is adapting to changing consumer preferences, which favor sustainable products, thus enhancing market growth.

Germany, France, and the UK are leading countries in this sector, with key players like BASF SE and Solvay S.A. dominating the landscape. The competitive environment is marked by continuous R&D efforts and collaborations aimed at developing advanced materials, positioning Europe as a leader in the PVC elastomer market.

Asia-Pacific : Emerging Powerhouse in PVC Elastomers

The Asia-Pacific region, with a market size of $5.8 billion, is the largest player in the PVC elastomer market. Rapid industrialization, urbanization, and increasing automotive production are significant growth drivers. The region's regulatory environment is becoming more supportive of sustainable practices, further boosting demand for PVC elastomers.

Countries like China, Japan, and South Korea are at the forefront, with major companies such as LG Chem and Mitsubishi Chemical Corporation leading the market. The competitive landscape is dynamic, with a focus on innovation and expansion, ensuring the region's dominance in the global market.

Middle East and Africa : Emerging Market with Growth Potential

The Middle East and Africa (MEA) PVC elastomer market, valued at $0.28 billion, is in its nascent stages but shows significant growth potential. Factors such as increasing construction activities and rising demand for automotive components are driving market expansion. Regulatory initiatives aimed at promoting local manufacturing are also contributing to market growth.

Countries like South Africa and the UAE are leading the way, with a growing presence of international players. The competitive landscape is evolving, with local manufacturers increasingly focusing on quality and sustainability to capture market share, indicating a promising future for the region.