Market Growth Projections

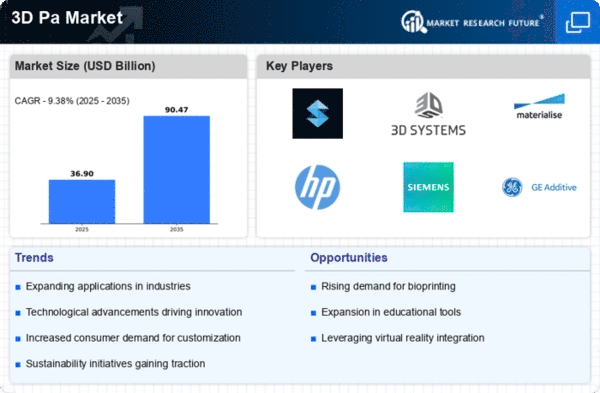

The Global 3D Pa Market Industry is projected to experience substantial growth, with estimates indicating a market value of 33.7 USD Billion in 2024 and a remarkable increase to 90.5 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 9.38% from 2025 to 2035, driven by various factors such as technological advancements, rising demand in healthcare, and sustainability initiatives. The expansion of end-use industries and government support further contribute to this optimistic outlook. These projections highlight the potential for innovation and investment within the 3D printing sector, positioning it as a key player in the future of manufacturing.

Sustainability Initiatives

Sustainability is becoming a crucial driver in the Global 3D Pa Market Industry, as companies increasingly focus on reducing waste and energy consumption. 3D printing technologies allow for additive manufacturing, which minimizes material waste compared to traditional subtractive methods. Furthermore, the use of recycled materials in 3D printing processes is gaining traction, aligning with global sustainability goals. This trend not only appeals to environmentally conscious consumers but also positions companies favorably in a competitive market. As sustainability initiatives continue to shape industry practices, the market is poised for growth, reflecting a broader commitment to eco-friendly manufacturing.

Technological Advancements

The Global 3D Pa Market Industry is witnessing rapid technological advancements that enhance the capabilities of 3D printing and additive manufacturing. Innovations in materials, such as biocompatible polymers and metals, are expanding the applications of 3D printing in sectors like healthcare and aerospace. For instance, the development of 3D-printed prosthetics has revolutionized patient care, providing customized solutions at a lower cost. As these technologies evolve, they are expected to drive market growth, contributing to the projected market value of 33.7 USD Billion in 2024 and a remarkable 90.5 USD Billion by 2035.

Rising Demand in Healthcare

The Global 3D Pa Market Industry is significantly influenced by the increasing demand for personalized healthcare solutions. 3D printing enables the production of patient-specific implants, surgical models, and even bioprinted tissues, which enhance surgical precision and patient outcomes. The healthcare sector's investment in 3D printing technologies is expected to grow, reflecting a broader trend towards customization in medical treatments. This shift is likely to contribute to the market's projected compound annual growth rate of 9.38% from 2025 to 2035, as healthcare providers seek innovative solutions to improve patient care.

Government Support and Funding

Government support and funding play a pivotal role in the growth of the Global 3D Pa Market Industry. Various governments are recognizing the potential of 3D printing technologies to drive innovation and economic development. Initiatives such as grants, subsidies, and research funding are being implemented to encourage the adoption of 3D printing across different sectors. This support not only fosters research and development but also helps small and medium-sized enterprises access advanced manufacturing technologies. As government backing continues to strengthen, it is likely to propel the market forward, contributing to its anticipated growth trajectory.

Expansion of End-Use Industries

The Global 3D Pa Market Industry is experiencing growth due to the expansion of various end-use industries, including automotive, aerospace, and consumer goods. These sectors are increasingly adopting 3D printing technologies for prototyping, tooling, and production, leading to enhanced efficiency and reduced lead times. For example, automotive manufacturers are utilizing 3D printing for lightweight components, which improves fuel efficiency and performance. As these industries continue to integrate 3D printing into their operations, the market is expected to flourish, aligning with the projected increase in market value to 90.5 USD Billion by 2035.